For some Americans, low airfare carriers such as Spirit Airlines is the difference between reuniting with loved ones for the holidays and sacrificing family to save a few bucks. The inevitable scramble for airline tickets is upon us, which forces us to evaluate our options. The appeal of Spirit Airlines is obvious: how can you say no to a cheap flight when life in America becomes increasingly unaffordable? However, the unfortunate reality is Spirit Airlines completely takes advantage of their promise to provide low airfare costs.

According to Andrew Schmertz from the Huffington Post, Spirit has some of the worst customer service reviews out there. Small, uncomfortable seating along with a barrage of baggage fees. Free carry on? No such thing. Any bag over 40lbs will cost you $30, up to $100 for larger bags. Free drinks or peanuts are nonexistent, and delays are commonplace. Nonetheless, the worst offense of all is the treatment of their workers. Back in 2015, there were reports of a multitude of delayed flights due to “bad weather” reports that did not even exist. The theory was that pilot and crew strikes were the real reason for the delays, but this was never confirmed. This is not surprising as the employee reviews are far from flattering. Low wages and poor management are common complaints, as Spirit has the worst customer service known to mankind.

Despite all this, Spirit Airlines still remains a go to low airfare carrier. At the end of the day, Schmertz believes “economy over convenience” is the driving force of Spirit’s success.

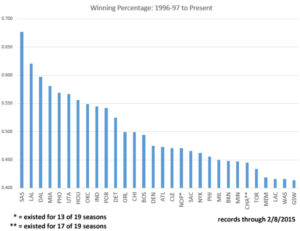

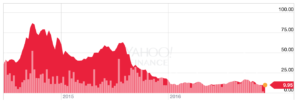

The real question is, are they making as much money as they could be? With all those extra charges, is their net income any better? According to Yahoo Finance, the share price is at a stable $53.11. Compared to other airlines like Southwest with a market cap of $29.5 billion, their market cap is quite small at $3.68 billion. Spirit’s quarterly report revealed their net income was $61.9 million in the first quarter of this year, $73.1 million in the second quarter, and $81.4 million by the third quarter. Overall, they seem to be doing pretty well. Their expenses are not as high as other airlines as they do not fly to as many locations. It seems that Spirit Airlines, which puts pressure on other airlines to lower airfares. However, this will lead to lower profits overall for airlines like Southwest or United as they spend more on their flights than Spirit does. Time will tell how long Spirit will remain a competitor in the airline industry, but for now, terrible customer service and endless fees are worth it to hard working Americans.

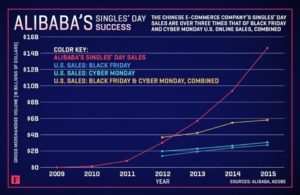

Black Friday because many retailers usually make enough sales on that day to put them in the black for the year, meaning that they will begin to turn a profit. In 2015, 74.2 million people shopped on Black Friday alone, which is lower than the number in past years ranging anywhere from 85 million in 2011 to 92 million in 2013. Although the number of consumers have decreased in recent years, 74.2 million shoppers still means large profits for these corporations.

Black Friday because many retailers usually make enough sales on that day to put them in the black for the year, meaning that they will begin to turn a profit. In 2015, 74.2 million people shopped on Black Friday alone, which is lower than the number in past years ranging anywhere from 85 million in 2011 to 92 million in 2013. Although the number of consumers have decreased in recent years, 74.2 million shoppers still means large profits for these corporations.

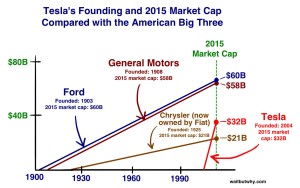

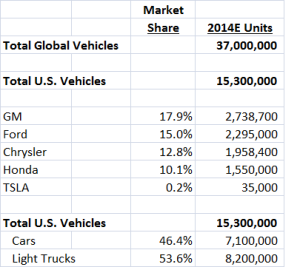

It’s imperative to get back to Tesla’s roots and the man behind the magic. Elon Musk is running the show of this technologic

It’s imperative to get back to Tesla’s roots and the man behind the magic. Elon Musk is running the show of this technologic s the development of sustainable cars, and shifts in customer demand will drive production in the future.”

s the development of sustainable cars, and shifts in customer demand will drive production in the future.”