The United States’ economy continues to grow, and the possibility of a recession in the near future looks very slim. That’s a promising forecast for a country that had been rocked by economic collapse about a decade ago.

The question still remains; when the economy is booming, how do you prevent too much inflation that can stir markets for the worse?

The Federal Reserve aims to address this issue, keeping the booming economy in check by enlarging interest rates, as Goldman Sachs projected massive market swells and a strikingly low unemployment rate in 2018. Economists of Goldman Sachs also noted that there could be four Federal Reserve interest rates hikes in the next year, and that the United States unemployment rate, which hit 4.1 percent in October, could reach its lowest point since the 1960’s by the end of 2019.

“With robust growth momentum and no striking imbalances in the economy, near-term recession risk still looks fairly limited,” said Goldman’s chief economist Jan Hatzius, via CNBC. “But the strength is becoming ‘too much of a good thing’ and containing further overheating will become a more urgent priority in 2018 and beyond.”

The overall upswing of the United States economy is accompanied by a similar trend in overall global economic health, when viewed in terms of GDP growth. Germany, for example, displayed GDP growth of 3.3 percent in the third quarter, while the UK’s GDP grew 1.6 percent. Germany’s stock market index, Dax, is up 13 percent, per Express.

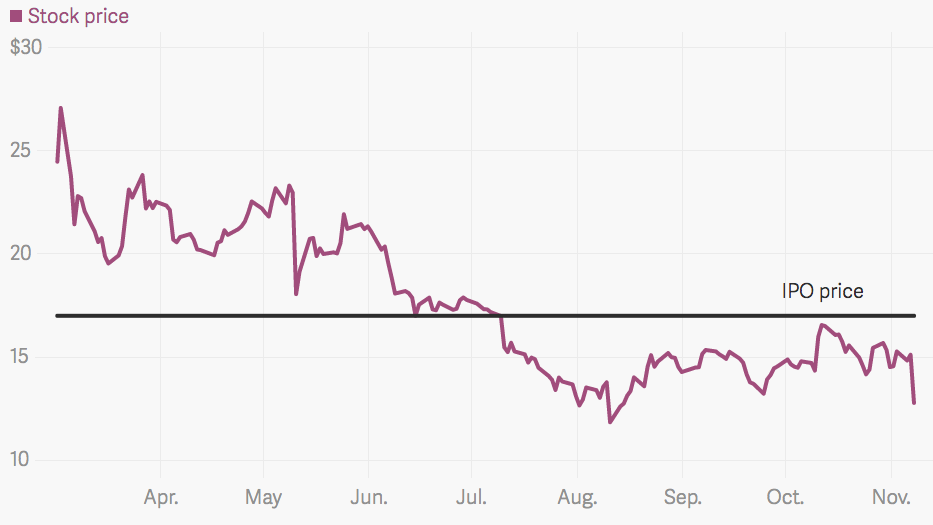

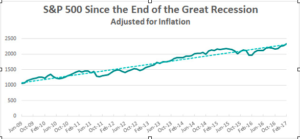

Marking the beginning of the United States’ recovery from the major 21st century recession at June 2009, the graph below details that the economy has been growing at a very similar rate for some time now.

But if this rate accelerates too much, over inflation is very possible, and therefore, like Hatzius said, the economy becomes ‘too much of a good thing.’ We witnessed the economy swell to unimaginable highs with risky subprime mortgages, a perfect example of an entity falsely fueling the economy while risk was wrongly assumed to be low.

Actually, a disinflationary trend—that is, a reduction in the rate of inflation—seemed to exist earlier in the year and was worrisome until the U.S. consumer prices, through the lens of core consumer price index (CPI), increased in October. Disinflationary trends lingering over longer periods of time concern Fed officials due to the potential to disrupt interest rate anticipations.

“The Fed has struggled this year in determining if the slowdown in core inflation has been due to a confluence of one-offs or more persistent disinflationary forces,” said Sarah House, an economist at Wells Fargo Securities, courtesy of Reuters. “The pickup clears the way for a December rate hike and supports the case for continued tightening in the year ahead.”

It seems to me like the Fed wants to appear more cautious than it has in the past, considering the financial struggles from ten years ago displayed a lack of governmental regulation as one of many undoings of the economy.