This just in: Los Angeles could become the only city to host three Summer Games other than London.

With the 2024 Summer Olympics nine years from now, Los Angeles was chosen Tuesday to be the new official U.S. bidder for the Games, replacing Boston after the city’s campaign surrendered to local opposition.

(The Los Angeles Coliseum/Source: The New York Times)

When we talk about economic opportunities related to sports events, we usually think of vast investments in sports venues, infrastructure, public transportation, and human capital, etc. However, historical data reveal that the Olympics hosting right has been an economic indicator of stock markets.

A study conducted by Bespoke Investment Group shows that under most circumstances, stocks markets rally during the Summer Games because investors are mostly distracted from gloomy headlines. Most of the times, the so-called Olympics Indicator is found to be a leading indicator of a rising stock market.

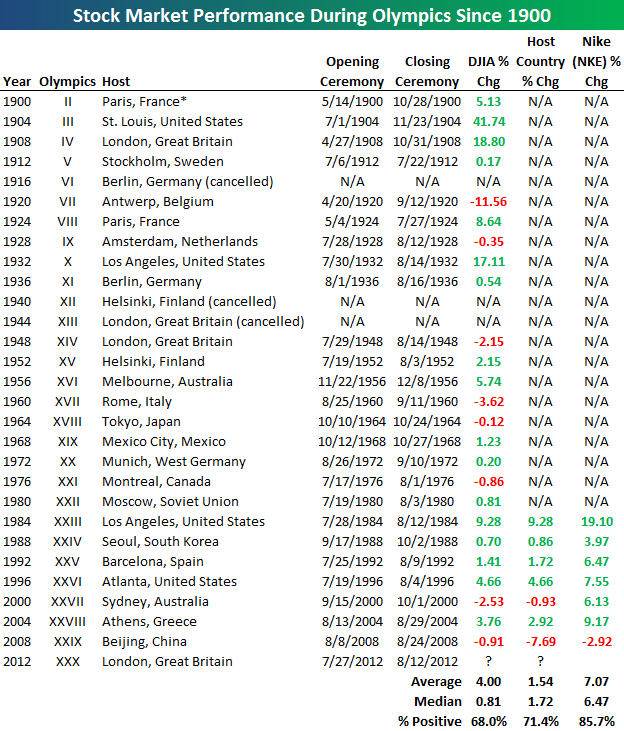

The study included the performance of the Dow Jones Industrial Average during the Summer Games since the 1900 Paris Olympics. It also calculated the market performance of hosting countries during the games since the 1984 Los Angeles Olympics.

The claim that investors are distracted by the games appears to be a little bit bizarre. However, from 1900 to 2008, the DOW had an average gain of four percent and the index was positive two thirds of the time. Therefore, if you buy $10,000 worth of stocks on the day of the opening ceremony and sell all of them on the closing day (that’s usually 14 days,) theoretically you can earn at least a brand new Apple Watch.

What about the stock markets of host countries? Since 1984, only two out of seven games have seen a negative growth in host countries’ stock markets. Both cases occurred because they were right in the middle of the dot-com bubble and the 2008 financial crisis, respectively. The average gain was 1.86% according to past performance of stock markets.

(Source: Bespoke Investment Group)

Even though there is no strong evidence showing a causal relationship between the Olympics Games and stock markets, it can be drawn from historical data that stock markets tend to perform better during the games. That’s partly because markets gain a sense of optimism and counteract the negatives in most years.

For investors seeking short-term profits, don’t just sitting in the couch watching the games. The Olympics Games can be an indicator for a positive market. Buying some Nike or Adidas stocks may be a good decision.

Sources:

USOC names Los Angeles the official U.S. bidder for the 2024 Summer Olympics