U.S. college tuition is one of the world’s most expensive; yet, Chinese parents are willing to pay the bills for American higher education anyways. In 2014, Chinese students in American colleges and universities alone contributed $9.8 billion to the U.S. economy, according to U.S. Department of Commerce.

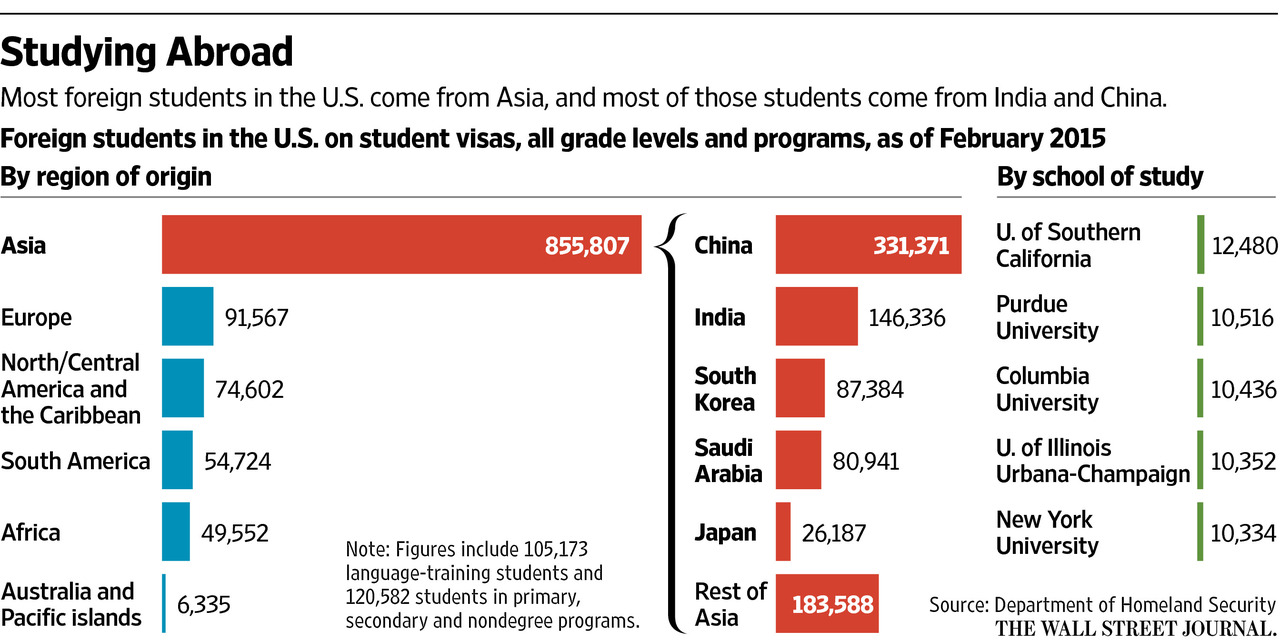

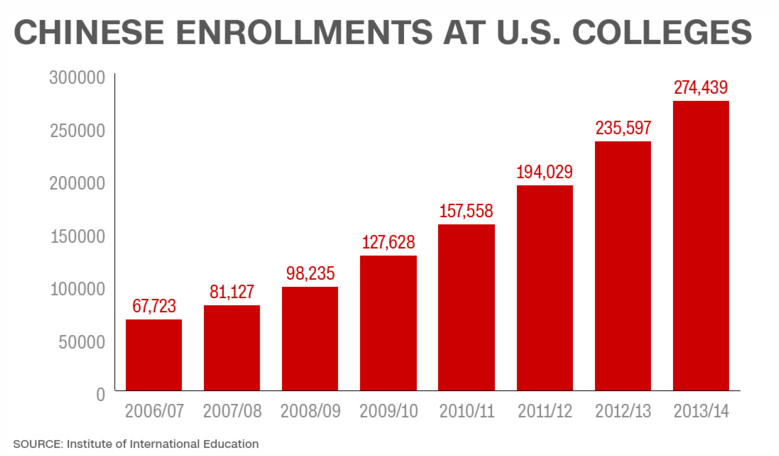

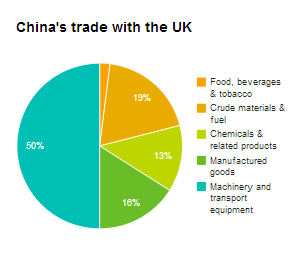

As China joins the World Trade Organization (WTO) in 2001, free trade with other countries of all kinds, including the trade of culture and education began to happen. As a result, University campuses in the United States have since accommodated triple times of total international students from China throughout the past ten yeas. Currently, students from China make up about 29 percent of total international students studying in the United States (WSJ). In the academic year of 2014/15, total number of students from China studying in the U.S. is 304,040, which is a 10.8% increase from previous year. Compared to ten years ago, when total Chinese students studying in the U.S. was around 62,582, the number today has more than tripled. Among all Chinese students currently studying in the US, or one year post-graduating from colleges, a majority of 41 percent are pursuing undergraduate degrees, 39.6 percent are graduate students, 5.3 percent are enrolled in other institutions such as private boarding high schools, and 14.2 percent are in the process of Optional Practical Training (OPT).

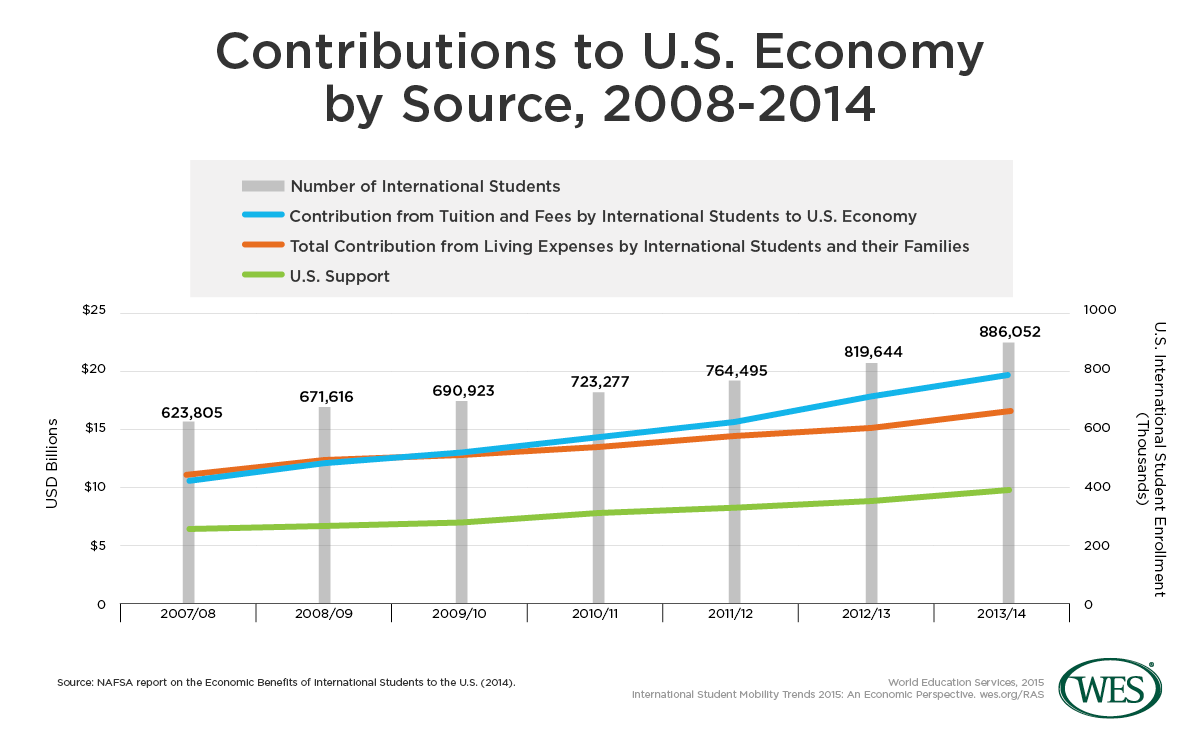

The growth in number of international students coming to the U.S. has created “significant positive economic impact” on the United States, commented the Open Doors Data. According to the U.S. Department of Commerce, “international students contributed more than $30.5 billion to the U.S. economy” (Open Doors Data).Most international students receive their funding for tuition and general daily expenses from their families overseas. Other than tuition, international students spend money on rent, cars, and daily expenses. For wealthy Chinese kids, expenses also include shopping for luxury goods, paying for vacations and other leisure expenses.

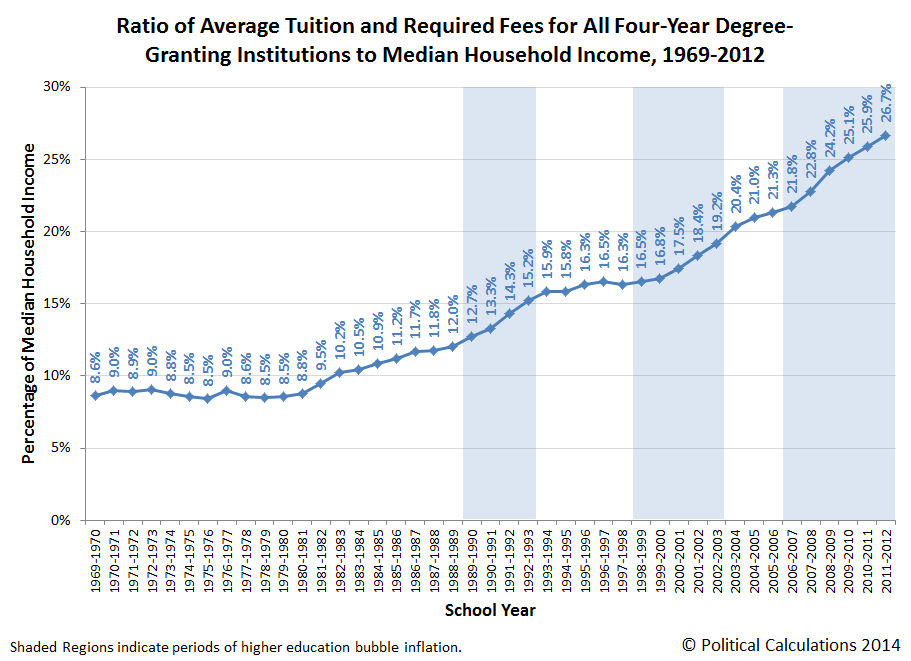

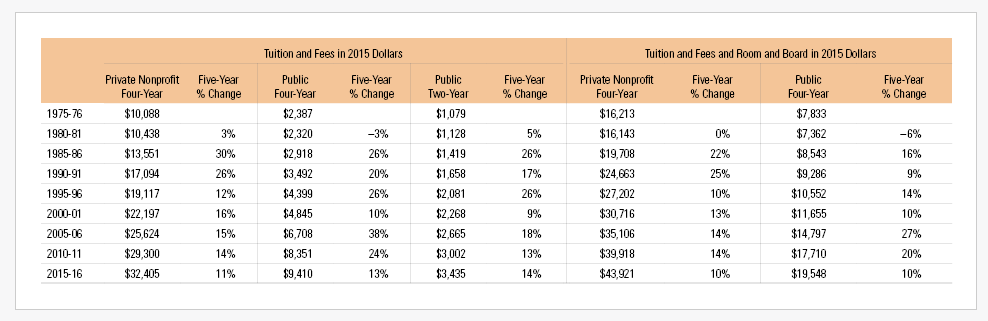

College tuition in the U.S. is not cheap. In fact, the US has one of the world’s most expensive higher education system in the world. On average, a private four-year institute costs from $45,000 to $50,210 per academic year. A public four-year institute, such as University of California—Los Angeles (UCLA) costs $12,753 for in-state students and $35, 631 for out-of-state students. Unlike most domestic students in the United States, for most international students, college tuition fee comes entirely out-of-pocket. American students have the option of applying for Federal student loans and pay back their tuition gradually after graduation; however, most international students are ineligible for financial aid or student loans, they have no other option than paying their bills all at once. About 64 percent of Chinese students cover 100 percent of their college education cost (Open Doors Data).

There is no surprise that Chinese families are willing to pay for these expensive tuition bills. As part of the Chinese cultural norm, Chinese parents have high expectations for their children. They expect their kids to succeed, which is usually judged by which schools their kids go to, which degrees their kids acquired, what type of jobs their kids do and how much money their kids are capable of making. Therefore, college education is viewed as the first stepping stone for success. Many Chinese families would rather save money to send their children abroad than making investments with their money. As China’s GDP soars after opening the gate for free trade, overall improving economic conditions in China allow more Chinese families to send their children overseas to receive higher education with higher quality.Additionally, because of China’s one-child policy, most college-age students are “only children” of their families; thus their parents, their grandparents might spoil him/her by granting financial support for luxurious lifestyle while studying abroad. The United States, known for its high quality in education, became one of the most popular destinations for studying abroad.

Based on recent trends in leap of students coming from China, many people cannot help but wonder: are numbers of Chinese students in the U.S. booming since the 2000s because of their excellent academic performance or simply because they are profitable?

Chinese students applying to US colleges and universities with fake high school transcripts, fake recommendation letters is almost old news. Service agencies in China that assist students with their college applications charge students various amount of service fees, based on the number and rank of schools that students intend to apply to. The wave of a growing study-abroad population has created a rising new market for service agencies in China, where fraud is a norm.

The real problem is, once these students step into their admitted colleges and universities, their academic performance do not match with their application resume. In order that these students become capable of joining mainstream programs, some schools provide language courses for international students whose language fluency level has not met the mainstream class standards yet. Of course, these intense language courses are not free, a 15 week intensive english program usually cost $5395.

However, some Chinese students facing academic struggles opted for other tacks. Since the 2012/13 academic year, universities in the U.S. have expelled as many as 8,000 Chinese students in three years (Kutner, Newsweek). The most common reasons for suspension and expulsion is cheating, plagiarism, and low academic performance. “I became aware of some services that Chinese students pay for getting their essays written, getting their exams taken and so on”, says Nansong Huang, a professor teaching Chinese literature courses at USC, “I think these students are wasting their parents’ money.”

Throwing back to ten years ago, when few Chinese students came to study in the United States, much fewer suspension and expulsion cases have been reported. One reason might have been the lack of social exposure back then, another reason is that compared to Chinese students now, most students came to study with full scholarship or financial aids provided by universities ten years ago. The group of students from China on US university campuses today are no longer the 1 percent most talented, intelligent and hardworking students; instead, they are more likely to have wide ranges of interests, passion for American culture and more willing to join fraternities and sororities. Therefore the images of Chinese students studying in the U.S. today is entirely different from the “nerdy” Asian image before.

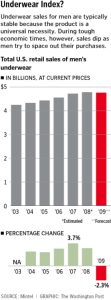

This is a result of American colleges and universities’ expansion on their international enrollment since 2000. Since the 2000s, American higher educational institutions have been raising tuition fees at the rate of 2.8 percent approximately. For example, USC’s tuition fee in 2005 was $44, 582 per year; today, USC’s tuition has reached $66,754 per year, an increase of almost 50 percent.

In American higher educational institutions, about 40 percent of institutional revenues for colleges and universities come from tuition, the rest consists of endowment and other income, state/local appropriations and federal appropriations. For domestic students, tuition is paid by Federal aid, non-federal aid and students themselves, among which Federal aid including loans, grants, tax benefits and work-study make up 55 percent (Department of the Treasury). For international students, tuition is mostly paid by themselves. This explains why US universities cannot resist the attraction of international students.

However, complains have been voiced by domestic students in the US, arguing that international students have “crowded local students out of their own state schools” (Stephens, Washington Monthly). “The university (USC) has admitted too many international students, in my opinion,” comments Professor Huang, “Resources at the university compared to the size of the student body is immensely inadequate. Sometimes professors have to argue with the university when assigned class schedules and classrooms, because no one wants to teach a Friday class.”

Some institutions such as UCLA are making new policies to restrict the number of out-of-state and international undergraduate students admitted each year, in order to create more opportunities for in-state students while preserving high student academic quality. “But the reality is”, says Professor Huang, “the university needs the money from international students, thus it is a difficult bargain.” “For many institutions who are looking to balance their budgets, increasing the number of students from countries where they’re willing to pay full tuition is a strategy”, says Michael Bastedo, director of the Center for the Study of Higher and Postsecondary Education at the University of Michigan (Kutner, Newsweek).

Professor Huang predicted that “as anti-corruption policies tighten up in China, there might be a decrease in the number of Chinese students overseas in the future.” Meanwhile, as Chinese college-age population shrinks, the sudden boom in study-abroad is likely to slow down in the future. China’s economic slowdown might also lead to some changes in Chinese’s saving and spending choices. In addition, Chinese education department is working on retaining high school students in the country’s local universities while attracting students from overseas to come to China. On the other hand, US universities would still remain an attractive destination for Chinese students pursuing higher education. In the meantime, US universities’ interest in Chinese students will not fade away anytime soon. Chinese students, together with international students from other parts of the world, not only bring economic benefit to the United States, but also contribute intellectually in areas such as the STEM fields. Therefore, the relationship between Chinese students and US universities might still remain positive in the future.

http://www.iie.org/Research-and-Publications/Open-Doors/Data/Fact-Sheets-by-Country/2015

http://www.wsj.com/articles/international-students-stream-into-u-s-colleges-1427248801

http://www.washingtonmonthly.com/magazine/september_october_2013/features/international_students_separat046454.php?page=all

https://www.treasury.gov/connect/blog/Documents/20121212_Economics%20of%20Higher%20Ed_vFINAL.pdf

http://blog.collegetuitioncompare.com/2012/12/usc-tuition-cost-10-years.html

http://www.newsweek.com/us-colleges-expelled-many-8000-chinese-students-3-years-337445