What has a) a million colors, b) a oft-ridiculous punny name, c) the capacity to survive a nuclear apocalypse on your toes but chips off in two days on your hands, and d) the ability to serve as an economic indicator?

Nail polish.

In the first ten months of 2011, less than five years after the Great Recession started, nail polish and product sales were 59% higher than in the same period a year ago, according to NPD Group, a market research firm.

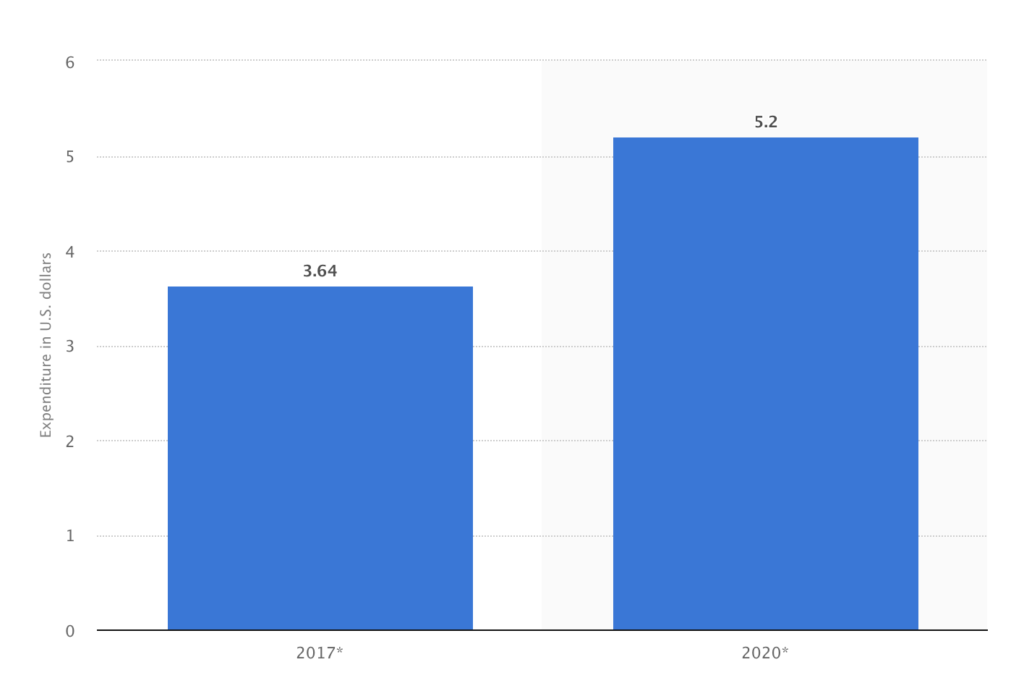

Adam Davidson, an economic journalist and co-founder of NPR’s Planet Money, wrote in a 2011 New York Times column that a “rise in nail polish sales indicates that we’re searching for bargain luxuries as the economy craters – and sales of nail polish are way up right now.” High nail polish sales = good times are a’coming. A 2017 study of the global nail polish market showed that the industry is projected to reach $15.5 billion in 2024. One factor in the projected growth is the popularity of nail designs in youth populations, as well as the popularity of nail polish products in international fashion capitals, such as Paris, London and Milan.

A key finding in the 2017 report is the increase of projected increase of gel polish. More expensive than the traditional “liquid” nail polish, gel is advertised to offer up to three weeks without cracking or chipping and faster drying time with the use of L.E.D. light. The high popularity of gel polish could be due to a variety of reasons, including a demand for longer lasting nail products. Consumers might be willing to pay more for what can read like a bionic manicure, but because of the durability of gel nails, may be spending less time at salons.

Economics is part psychology, as the recession-proofness of nail polish shows. A small pleasure, nail polish can be affordable (sometimes less than a dollar). Coming in a variety of colors from deep burgundies and plums to neon yellow, as well as a variety of textures (hello 2012’s “crackle” nail polish trend), nail polish is visually appealing, and for people that choose to forgo the luxury of a nail salon, painting your nails can be a relaxing, almost therapeutic activity.

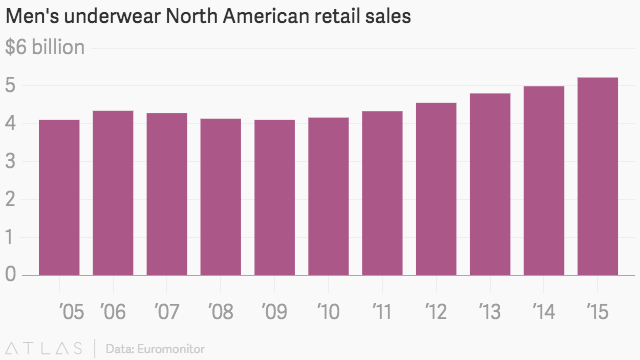

The Great Recession seems to have catapulted nail polish to the recession-proof big leagues – in 2011, TIME named it one of the “12 things we buy in a bad economy,” a list that also featured romance novels, donuts, chocolate and condoms. Good company?

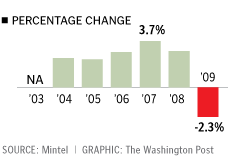

Nail polish appears to have pushed out lipstick as the recession-proof cosmetic. Termed the “lipstick index” by Leonard Lauder, chairman emeritus of Esteé Lauder, lipstick sales used to soar during not-so-great economic terms. Like nail polish, lipstick is a quick, colorful pick-me-up – (sometimes) affordable glamor in a tube. However, lipstick sales fell in 2010.

After the lipstick index’s accuracy was called into question during the Great Recession, Lauder expanded on his original definition, claiming it was never about just lipstick.

“We have long observed the concept of small luxuries, things that can get you through the hard times and the good ones. And they become more important during harder times. The biggest surge in movie attendance came during the 1930s during the Depression.”

Leonard Lauder, chairman emeritus of Esteé Lauder.

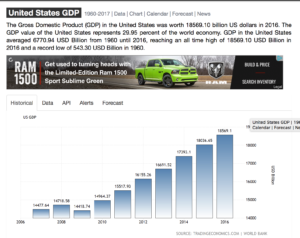

Although nail polish may not be as important an economic indicator, per se, as the GDP or unemployment, OPI’s puke-green “Uh-Oh Roll the Windows Down” demonstrates that even in times of frugality, people are still willing to spend on little luxuries.

SOURCES

- https://www.reuters.com/article/us-shopping-nailpolish/in-tough-economic-times-women-buy-nail-polish-idUSTRE7BI1I120111219

- https://www.nytimes.com/2011/12/18/magazine/adam-davidson-economic-indicators.html?_r=1

- https://www.grandviewresearch.com/press-release/global-nail-polish-market

- https://www.sears.com/sinful-colors-professional-nail-enamel-easy-going-300/p-SPM11530503225?sid=IDx20070921x00003c

- https://www.huffingtonpost.ca/2012/04/24/minute-16-shatter-nail-polish-_n_1449291.html

- http://business.time.com/2011/10/21/12-things-we-buy-in-a-bad-economy/slide/nail-polish/

- https://jezebel.com/economy-lipstick-index-is-now-a-nail-polish-index-5841575

- https://www.theodysseyonline.com/16-of-the-weirdest-whackiest-and-grossest-nail-polish-names