The newest administration has drawn significant attention to cons of Mexican-American trade, claiming that Mexico is overall hurting rather than helping America’s economy. One drastic impact that our southern neighbor definitely has is on the U.S.’s avocado industry.

The fruit itself has its roots in Mexico, so it comes as no surprise that this country has always been the world’s top producer. Although avocados are endemic to Mexico, the Fuerte variety found new popularity in America in the late 1800s. After the Hass variety, developed by Rudolph Hass at his farm in La Habra, CA in the 1920s, eventually became more favored for its taste and texture, subsequently gaining more notoriety after a marketing push in the 1950s. This was the beginning of the business’s widespread success and marked the start of its major growth.

As this new industry began to grow in the U.S., growers were protected from competition due to a quarantine set in place by the USDA in 1914 to prevent the introduction of seed weevils, stem borers, and other malicious pests that threaten the health of this crop. However, in 1997, this was amended to allow for 19 states to accept Mexican avocado imports from pest-free zones in order to comply with new trade regulations enacted by the North American Free Trade Agreement. Furthermore, in 2001, the Mexican Government won its plea to expand this number to 31 states as well as lengthen the shipping season, and in 2007, all states were allowed to import this produce.

These events significantly increased the amount of direct competition the American avocado industry faces. Though the growing seasons align, Mexico has the advantage of cheaper labor and water costs and is therefore able to offer a better price to consumers. As such, these imported fruits have dominated the American market; currently, 93% of Hass avocados in the U.S. come from Mexico, according to the Hass Avocado Board.

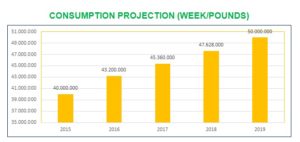

However, the past few years have provided hope for U.S. growers. First, the demand for avocados has risen exponentially. In 1985, Americans only consumed an average of 4 million pounds of avocados per week, but as of 2014, that number rose to a record-breaking 37+ million. The Fresh Fruit Portal projects this to rise to over 50 million by 2019.

Moreover, trade sanctions proposed by President Trump severely threaten the Mexican produce industry at large, as these tariffs, allegedly 20% or higher, will make it nearly impossible for trade to keep up in this $1.62 billion industry.

Sad news for avo toast and guacamole lovers, though: prices of the fruit will likely skyrocket if this trade restriction goes into effect. The high tax combined with the current and projected demand for avocados ultimately means a loss for consumers.

Other sources: California Grown; University of California Cooperative Extension Subtropical Fruit Crops Research & Education; Civil Eats; Statista