Anti dumping refers to the process by which governments levy extra costs and taxes to imports to protect domestic manufacturers. Dumping is the process by which foreign exporters make into an international market by providing goods for significantly lower prices. Foreign exporters are both willing to do so can do it because of several reasons.

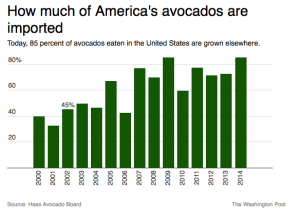

Firstly, foreign competitors might have comparative advantage over local manufacturers. Comparative advantage gives foreign importers the chance to produce the same goods more effectively because of better natural resource availability, better climate, productive skills, cheaper labor and other conditions that might provide a better environment for the same product to be made faster. Secondly, exporting to other countries is both accessible and profitable for many companies. Also, many companies are often able to find a huge demand for their product outside of their home country.

However, when these countries enter foreign markets, they have a huge impact on the foreign country and provide competition for domestic producers. Governments hence create anti dumping laws, trade barriers, and other legal restrictions towards foreign imports to improve their trade deficit, to safeguard niche and newly developing industries, and to give these companies a chance to grow and be ready to become competitive.

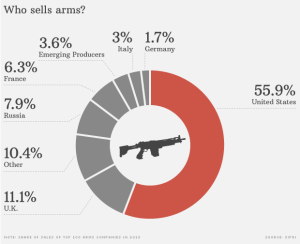

It is argued that international trade dumping is often occurred at the cost of domestic workers and domestic companies loosing market share. However trade barriers can also be detrimental to the overall efficiency of the economy. Trade barriers can also affect developing nations differently, because if developed nations have trade barriers, this would lead to them over producing and then dumping their products in developing nations for cheaper prices. Also, because the more richer and developed nations set the fundamental trade policies, developing nations face high barriers from these countries and cannot export from these countries to improve their own trade deficit.

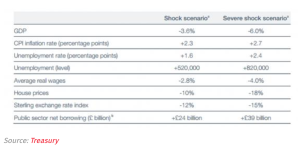

Anti dumping laws and trade barriers and weather they should be implemented have always been a subject of controversy. Anti-dumping laws can sometimes be a barrier to innovation and progress, because if new advanced products are not allowed to enter the market, then domestic producers might not have the incentive to research and develop their products because of lack of competition. Also, providing more choice and higher quality to consumers is also crucial for the economy. Trade restrictions also however improve the current account balance of a country, by improving trade deficit and net exports.

The debate on weather anti-dumping laws and trade barriers should be encouraged or dumped is not one that can be resolved easily, and this debate falls under the umbrella of the debate of Keynesian versus classical economics. However a balanced argument that considers arguments of both sides would convey that government intervention and trade barriers are required to an extent, because free markets would only work in an ideal world of perfect competition, where demand and supply would purely control the market. However, in the real world, some degree of government involvement and laws are required to ensure fair competition and balance of trade across nations.