It’s lunch time in Westlake Elementary school in Mississippi, the fattest state in the fattest country in the Western world. Uniformed lunch ladies stand ready behind the counter. Elementary students line up with trays in hand. Yes to chocolate milk, yes to chicken nuggets, yes to cheese fries, yes to orange jelly, no to salad. Bowls of iceberg lettuce and cherry tomatoes sit rim to rim, rejected.

Persuading children to eat vegetables is hardly a new struggle, nor would it seem to rank high on the list of world priorities. In an age of abundance, individuals have the luxury of eating what they like. Yet the U.S., for all its libertarian ethos, is now worrying about how its citizens eat and how much exercise they do. But it is no surprise, as it has become an issue of national concern.

The statistics are grim: Roughly two out of three U.S. Adults are overweight. This is defined as having a body mass index (BMI) of 25 or more, which for a man standing 5’9’’ means a weight of 170 pounds or more. Alarmingly, 36% of adults and 17% of children are not just overweight but obese with a BMI of at least 30, meaning they weigh 200 pounds or more at the same height. If current trends continue, by 2030 nearly half of American adults could be obese.

Americans may be shocked by these numbers, but for the rest of the world, they fit the stereotype. Burgers, sodas and fried foods are considered as American as the Stars and Stripes. But there is a glimmer of good news. After two decades of dramatic growth, childhood obesity rates are showing signs of leveling off. Government researchers at Proceedings of National Academy of Sciences (PNAS) have even reported slight declines among certain subgroups (such as young children and girls), leading some experts to speculate that the epidemic may have reached its peak.

But this turn around applies to some kids more than others. A closer look at the data indicates that this average decline doesn’t tell the whole story.

The researchers looked at adolescent obesity (an important predictor of adult obesity) by analyzing two large health surveys done by the NHANES and NSCH. While they confirmed that the obesity rate among adolescents is no longer climbing — after it “more than doubled over the past three decades” — this did not hold true across different socioeconomic groups.

Obesity is decreasing amongst adolescents who come from well-educated families, but it has continued to increase in poor teens. Looking at the obesity rate overall, this reads as a plateau.

It is unfair to aggregate trends in groups that are so different, the reality of the situation becomes unclear and misleading.

For adolescents whose parents have at least a college degree (black dots), obesity is on the decline. But for those whose parents have no more than a high school diploma (red dots), obesity rates are still rising — and the gap seems to be getting larger. (The short lines above and below the dots show the possible margin of error.)

Why are the rates of obesity so different among members of different socioeconomic groups, to the point where they are actually trending in opposite directions? The answer is more complicated than it might seem.

Exercise

A difference in exercise habits, not just eating habits, has been driving the obesity gap in children and adolescents. Take a look at the physical activity chart, which seem to mirror the obesity rate charts above:

On the left, NHANES, counts children as active in the if they had at least 10 minutes of physical activity in the past 30 days, an alarmingly low standard. On the right, NSCH counts children as “active” if they had at least 20 minutes of physical activity in the past seven days.

The disparity in rates of physical activity increased sharply in 2010 just like the disparity in obesity rates.

While the proportion of high socioeconomic-status adolescents has stayed about the same in recent years (most recently 94.7%), the latest NHANES counted just 82.1% of low socioeconomic-status adolescents as active — down from 90% in 2003.

Though there isn’t an exact reason for what’s causing the different levels of physical activity, a potential reason might be due to money and opportunities. Adolescents from poorer families are less likely to participate in school sports, which can cost money, and are more likely to attend schools that have had to reduce or eliminate their sports programs.

Parks and recreational facilities are funded by tax dollars collected within the surrounding area. In wealthier neighborhoods, tax revenue is higher and residents of the area will insist on these establishments. As a consequence, low income neighborhoods do not have as many parks or space to exercise. Though this is not the case everywhere, it is the case for many. The few opportunities combined with the safety of a neighborhood can affect whether kids are able or allowed to run outside or use parks or other recreational facilities.

A lead researcher at Xiaozhong Wen, a postdoctoral fellow at Harvard Medical School, shares interesting theories to the dramatic increase of obesity rates in adolescents whose family incomes are the below the poverty line. He draws his conclusions from distinguishing families based on needs of medicaid. “The health insurance is a proxy, or indicator, for some underlying… reasons for this disparity,” he says. “I think it might be the family environment, how the parents feed the children, how do they control or monitor the child’s eating or physical activity.”

Compared to more affluent children, Wen says, kids on Medicaid may be less likely to live in neighborhoods where they can play and exercise safely outdoors, and their caretakers are less likely to have access to supermarkets selling fresh, healthy foods.

Upper and middle-class adolescents are also four times as likely as lower class adolescents to have a regular doctor, so they may be more exposed to the importance of regular exercise. More contact with doctors, safer neighborhoods, more green space and better school programs may be part of the solution to encourage kids and adolescents to exercise. They doesn’t have to be competing in state level sports, healthy changes like a walk to the grocery store or an active video game can lead to positive results.

Parental Guidance

Parents of lower income families that lack education and job mobility are likely to work in low wage jobs with long hours. They have less time to be physically active and to encourage a healthy lifestyle for their kids from a young age. And when time and money are tight, it is cheaper to rely on fast-food meals than to buy and prepare fresh food.

In recent decades gender equality has improved and the work force is accepting more women. However, this improvement may have resulted in the growing percent overweight kids. A new study released in the Journal Child Development finds, “For each additional five-month period his or her mother is employed, a child of average height can be expected to gain 1 extra pound over and above normal growth” In addition, sixth graders with working mothers were found to be six times more likely than those with stay-at-home moms to be overweight.

Mothers who have jobs don’t directly cause weight problems in their children, but busy families may accelerate weight gain by relying too much on cheap convenient fast food rather than healthy meals. Food and lifestyle choices are definitely the direct cause of obesity, but it can also occur against a backdrop of physical and psychological challenges that can make weight watching a low priority.

In a recent study, published in Pediatrics, found that preschool-age girls in big cities were more likely to be obese if they had undergone stressful experiences such as witnessing household violence, having a mother who was depressed or abusing alcohol or drugs, or living in a tenuous housing situation.

Growing up in a unstable life with violence, moving around a lot or depression certainly means obesity goes down the rank of importance. These factors, however, were not associated with a higher obesity rate in preschool boys, which highlights the difficulty of making sweeping conclusions about obesity and socioeconomic status.

Children from low income families are hardly a homogenous population, and the relationship between obesity and family income varies wider by gender, age, ethnicity and geographic area.

A 2006 study in the American Journal of Clinical Nutrition that looked at several decades of national data found that obesity was strongly tied to socioeconomic status only among white girls. Mexican-American and African-American girls showed similar trends, yet they were still more likely to be obese compared to girls from white families of similar socioeconomic status.

Beauty is in the eye of the beholder

Regardless of age, race and socioeconomic class, girls all around the world strive to be beautiful. Whether it is to achieve the perfect skin tone, the perfect weight or the perfect hair color, many young females have the ability to improve their beauty if they tried hard enough.

The mean BMI of an African American women is 29.8 and mean Caucasian woman is 26.7. Interestingly enough there was no significant difference for BMI for men based on race. Though there is no research to explain this data, we are all quite familiar with the extremely thin standard of beauty immortalized by Barbie.

Sarah Constance from Irvine, Orange County, recalls a teenage memory. “Growing up in a primarily white and asian upper middle class suburb,I remember meeting up with other girls to get ready together before big dances. Each time we would all criticize our own bodies, and bemoan the fact that we weren’t measuring up to the ideal Victoria Secret model.”The girls always talked about what they ate and how much of it, as if it was a contest and the winner was whoever ate the least.

Sarah was surprised when a male from of Mexican heritage told her how sexy it was for girls to have “thick thighs”. A similar appreciation for a more voluptuous body type is also found in African-Americans. This could potentially relate to why Hispanic and African-American women are statically more likely to be obese, since those cultures do not equate such thinness with beauty and sex appeal.

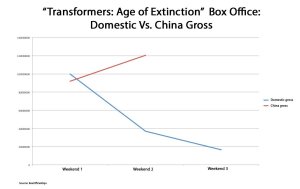

The American movie theater business is in a state of flux. Theaters are scrambling to come up with fresh ideas and marketing strategies aimed at attracting more people to their establishments. Digital technologies like 3D and IMAX formats have pushed theaters to increase ticket prices over much of the last decade. Finally, the growing popularity of streaming services, like Netflix and Amazon Prime, have given people across the country easier access to entertainment. Before the advent of new and emerging entertainment platforms, movie theaters provided many people with an escape from reality. Today, it remains questionable whether the industry has the same influence it once had over the entertainment world. Major chains like Regal Cinemas and AMC now face the challenge of updating their business plans and reminding the public why the movie theater experience is not going anywhere.

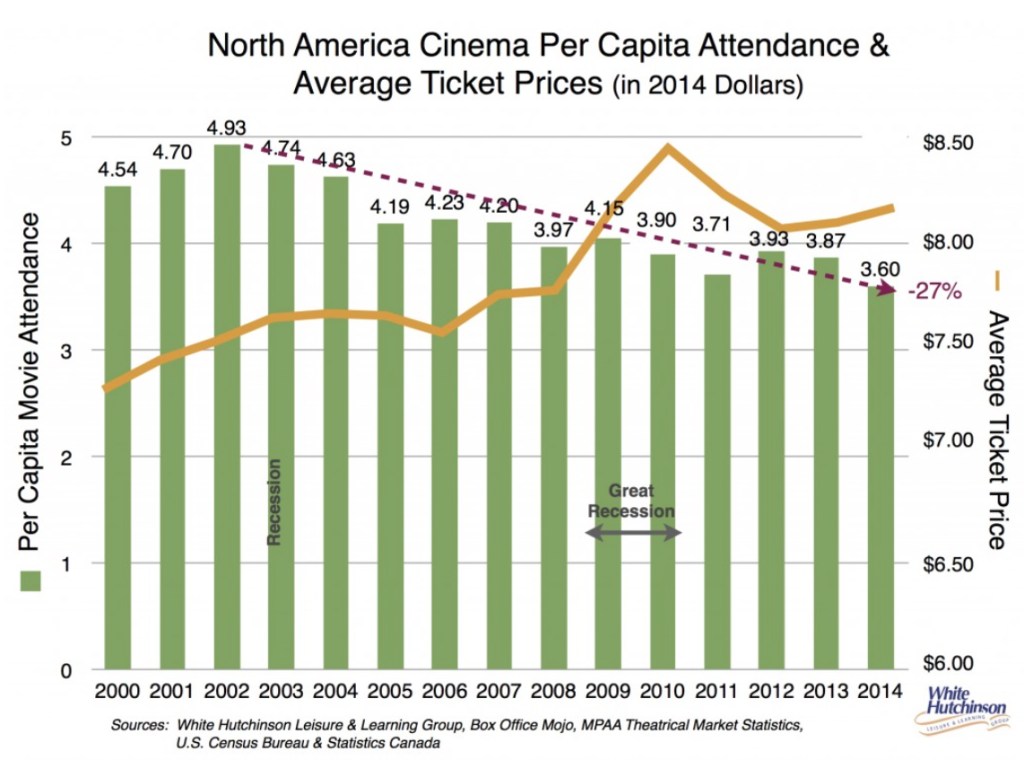

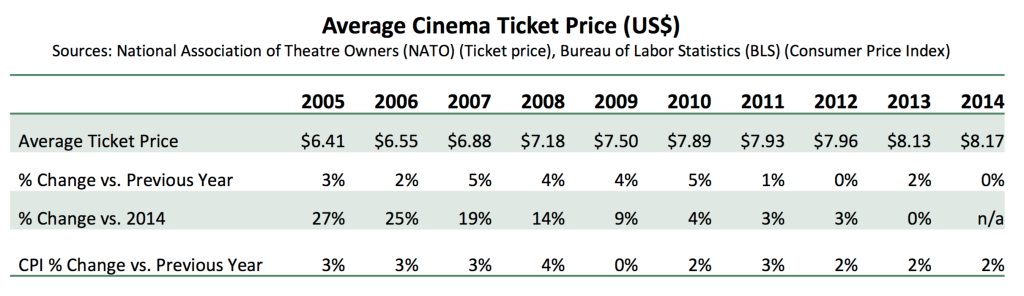

The American movie theater business is in a state of flux. Theaters are scrambling to come up with fresh ideas and marketing strategies aimed at attracting more people to their establishments. Digital technologies like 3D and IMAX formats have pushed theaters to increase ticket prices over much of the last decade. Finally, the growing popularity of streaming services, like Netflix and Amazon Prime, have given people across the country easier access to entertainment. Before the advent of new and emerging entertainment platforms, movie theaters provided many people with an escape from reality. Today, it remains questionable whether the industry has the same influence it once had over the entertainment world. Major chains like Regal Cinemas and AMC now face the challenge of updating their business plans and reminding the public why the movie theater experience is not going anywhere. In 2002, the average American went to a movie theater 4.9 times per year. In 2014, the number dropped to 3.6 times per year. Decreasing attendance has been a major factor in the decline of the old movie theater business model. According to CEO Randy White of the White Hutchinson Leisure and Learning Group, the last twelve years of per capita movie attendance had a steady drop of over 25 percent. The 2014 calendar year had only 1.26 billion consumers buying movie tickets which comes dangerously close to the 1.24 billion consumers seen in 1994. Overall, theater attendance does fluctuate every year, but the steady decline paints a negative picture of attendance in the long term.

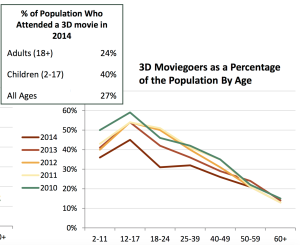

In 2002, the average American went to a movie theater 4.9 times per year. In 2014, the number dropped to 3.6 times per year. Decreasing attendance has been a major factor in the decline of the old movie theater business model. According to CEO Randy White of the White Hutchinson Leisure and Learning Group, the last twelve years of per capita movie attendance had a steady drop of over 25 percent. The 2014 calendar year had only 1.26 billion consumers buying movie tickets which comes dangerously close to the 1.24 billion consumers seen in 1994. Overall, theater attendance does fluctuate every year, but the steady decline paints a negative picture of attendance in the long term. In its most recent annual theatrical statistics report, the Motion Pictures Association of America emphasizes the dramatic decline in 3D movie attendance as another culprit. On average, 27 percent of the population went to a 3D movie in 2014, but the numbers for different age groups have all dropped between 5 to 10 percent since 2010. Since the arrival of Avatar in 2009, the U.S. film studios have hoped to replicate its success; however, the push to make more films in 3D might be losing steam mainly because it costs too much to make, which has an adverse effect on ticket prices.

In its most recent annual theatrical statistics report, the Motion Pictures Association of America emphasizes the dramatic decline in 3D movie attendance as another culprit. On average, 27 percent of the population went to a 3D movie in 2014, but the numbers for different age groups have all dropped between 5 to 10 percent since 2010. Since the arrival of Avatar in 2009, the U.S. film studios have hoped to replicate its success; however, the push to make more films in 3D might be losing steam mainly because it costs too much to make, which has an adverse effect on ticket prices.

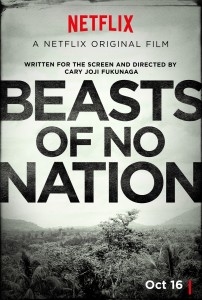

It is hard to avoid the rise in online streaming services as a major reason why movie theaters are scared about the future. In October of this year, streaming giant Netflix released its own feature-length film called Beasts of No Nation. This film marked the second time the company released a movie online as well as in the theaters, which did not make exhibitors very happy. In an article from Variety, the four largest theater chains – Regal, AMC, Cinemark, and Carmine – announced they would not show the film because it did not follow the ’90-day delay rule’ between theatrical and home release. They do not see the the release of the film on various platforms as fair to any theater chain around the country.

It is hard to avoid the rise in online streaming services as a major reason why movie theaters are scared about the future. In October of this year, streaming giant Netflix released its own feature-length film called Beasts of No Nation. This film marked the second time the company released a movie online as well as in the theaters, which did not make exhibitors very happy. In an article from Variety, the four largest theater chains – Regal, AMC, Cinemark, and Carmine – announced they would not show the film because it did not follow the ’90-day delay rule’ between theatrical and home release. They do not see the the release of the film on various platforms as fair to any theater chain around the country.

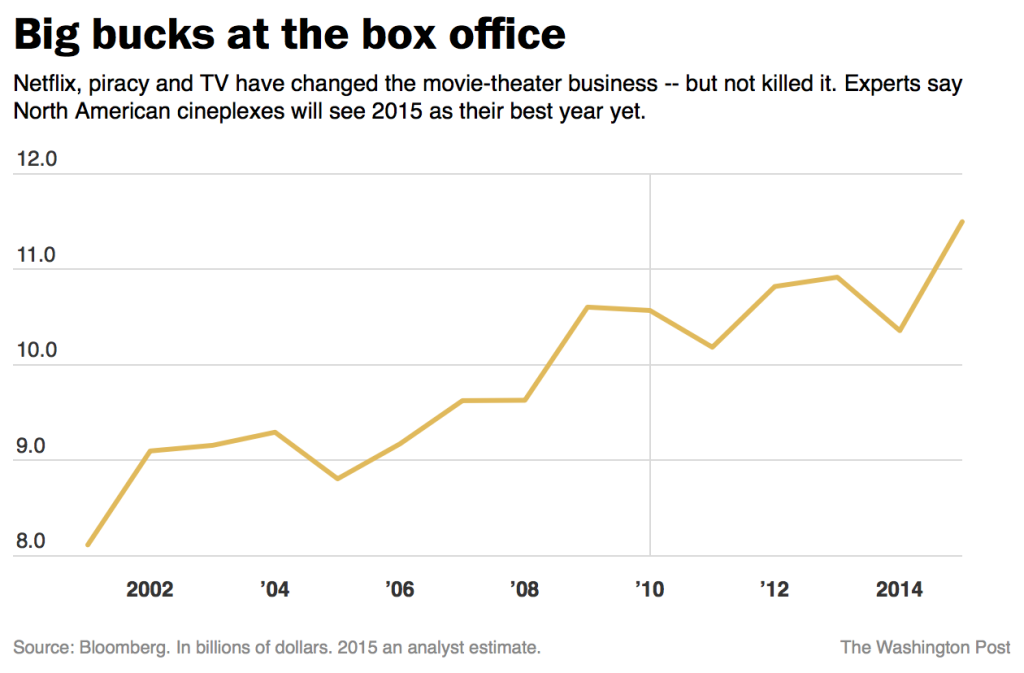

The revenue trends from the last twelve years, courtesy of analysts from Bloomberg, show how film business experts project revenue for the movie theater business to reach approximately $11.5 billion this year. The business seems to still be alive and companies are starting to notice what makes the average consumer want to come back again and again: incentivization.

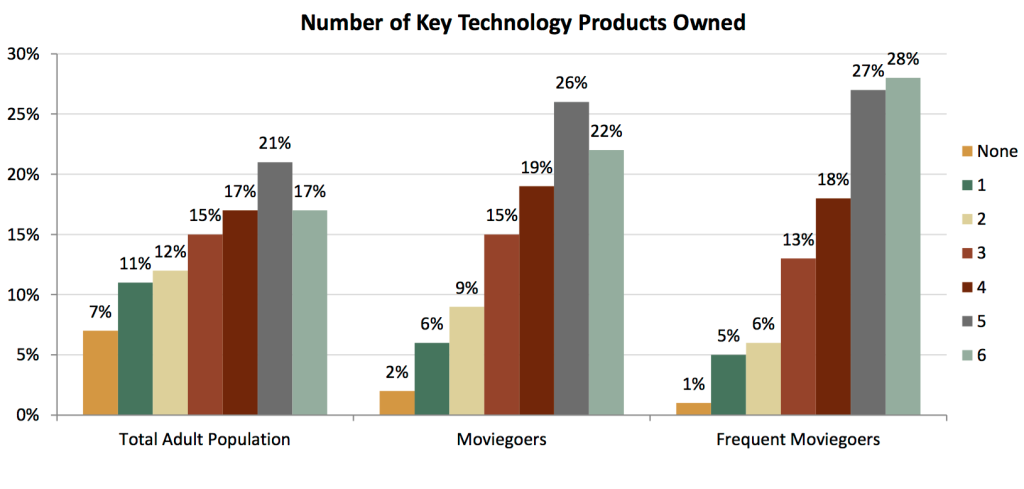

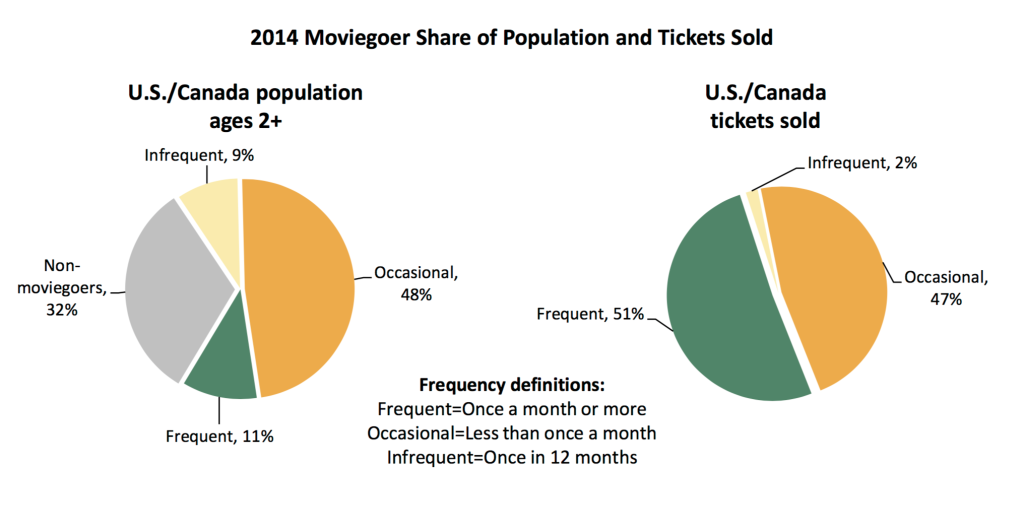

The revenue trends from the last twelve years, courtesy of analysts from Bloomberg, show how film business experts project revenue for the movie theater business to reach approximately $11.5 billion this year. The business seems to still be alive and companies are starting to notice what makes the average consumer want to come back again and again: incentivization. The MPAA says 11 percent of people in the U.S and Canada were frequent moviegoers in 2014, yet those same people made up over 51 percent of tickets sold. This information correlates with the increasing price of tickets: Film buffs are the people most willing to pay to see multiple movies over the course of the year, so they would likely make up a sizable amount of the tickets sold.

The MPAA says 11 percent of people in the U.S and Canada were frequent moviegoers in 2014, yet those same people made up over 51 percent of tickets sold. This information correlates with the increasing price of tickets: Film buffs are the people most willing to pay to see multiple movies over the course of the year, so they would likely make up a sizable amount of the tickets sold.