ESports, standing for “electronic sports,” are a form of online competition using video games. The first eSports competition was held at Stanford University in 1972, when players were invited to compete in a game called Spacewar. Since then, eSports industry has developed together with the surge of internet access and video game technologies. However, it has not become full-fledged until recent years.

Lionel Bonaventure | AFP | Getty Images

The explosive growth of eSports shows that people (especially youth) are adjusting their ways of daily interaction and socialization in the fast-paced world of constant techonological breakthroughs. eSports is going to be the first global sport, predicted by many experts.

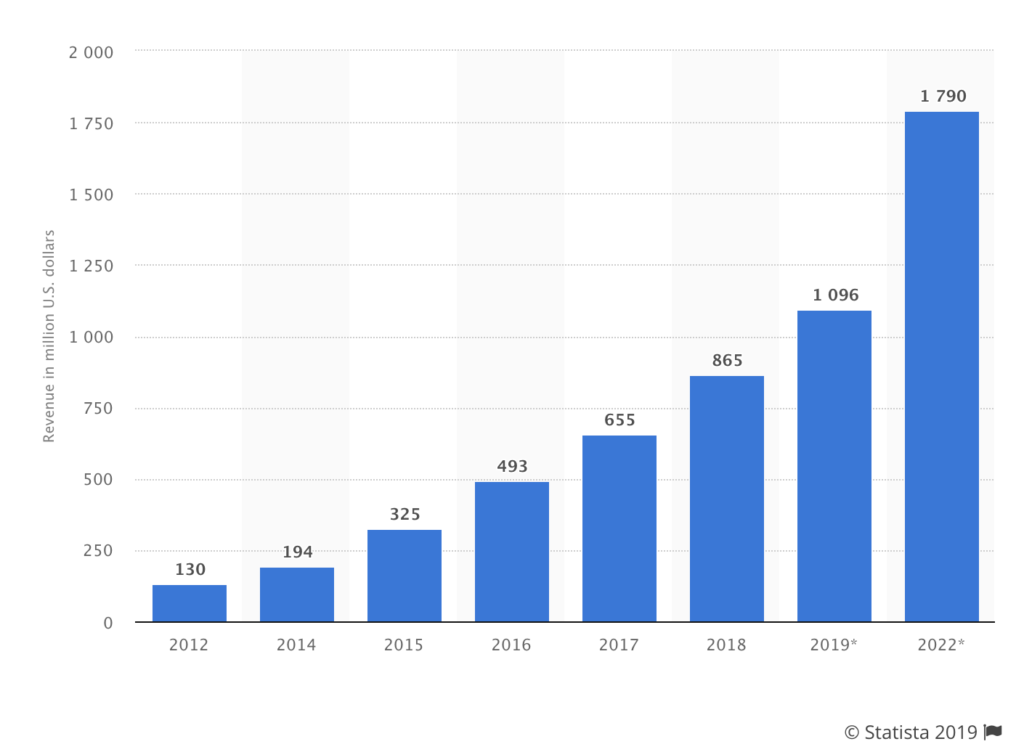

In 2018, eSports market revenue worldwide was 865 million dollars. Experiencing “phenomenal” year-over-year growth, the revenue is expected to double in 2022, reaching 1.79 billion dollars.

2019 is a landmark for eSports as the market surpasses 1 billion for the first time. According to Newzoo, eSports revenues will reach an impressive $1.1 billion in 2019, a year-on-year growth of +26.7%.

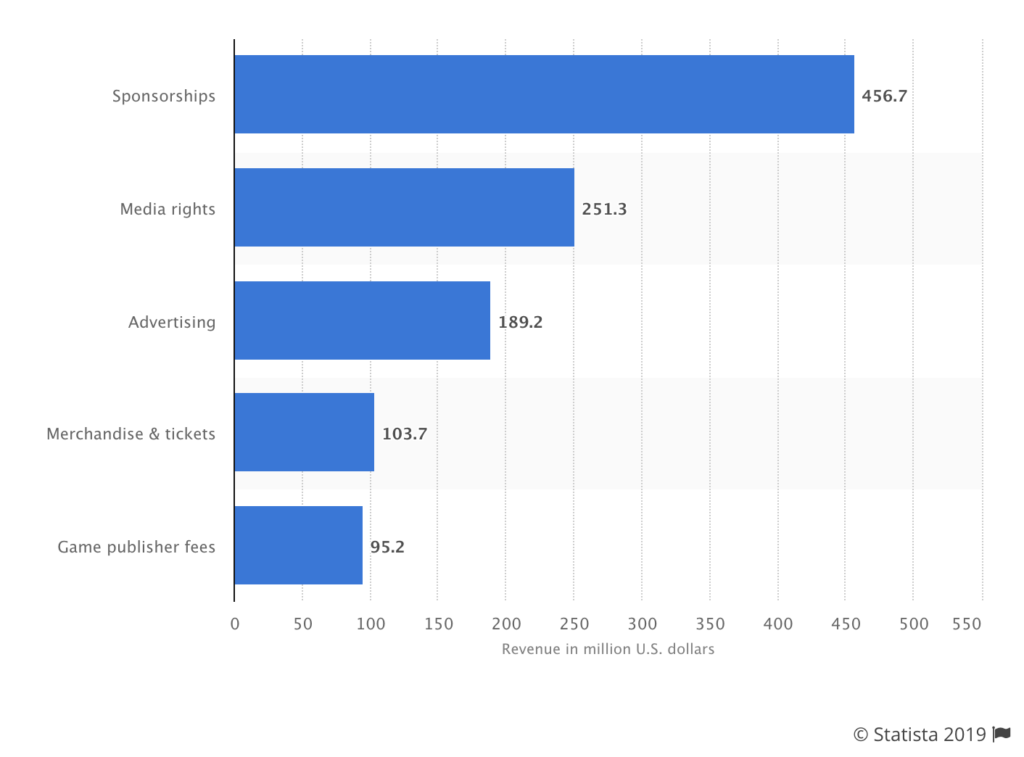

Sponsorship is currently the main source of eSports revenue, generating $456.7 million in 2019. But media rights remain the fastest-growing segment, increasing by 81.5% in 2017.

“When I look at 2018, I feel like it was the year that eSports really started cracking into the mainstream,” Jack Etienne, owner of North American eSports team Cloud9, told CNBC.

While the booming growth of eSports indicts infinite business opportunities across industries, retailers – who are experts on capitalizing opportunities – are eyeing on the gold mine eSports bring in.

Of course, game retailers can look towards pushing higher-quality hardware as models with more features are being brought to market. But they are also making profit by manufacturing and adding production – such as physical stores.

Game Digital, a British video game company nearly bankrupted in 2012, launched physical stores called “Belong”, where gamers can pay to play together, participate in fan events and test new technologies like VR.

With the rising of eSports, Game Digital seeks for its future not by just selling games but also by creating a mutual space for gaming, which shares the same idea of eSport competitions. In 2017, for the 12 weeks that ended on mid-March, physical game sales grew 0.5 percent in the U.K., according to Kantar Worldpanel.

Meanwhile, some retailers are dealing with a unique group of audiences – teenagers, also called Gen Zers.

Tilly’s, a Southern California-based accessories retailer focused on teenage customers, started a partnership with the High School Esports League (HSEL) and invited students across the country to win prizes by competing in augmented reality (AR) mobile game. The contest adds to the gross of revenue of Tilly’s physical stores.

Another trending and lucrative direction for eSports giants is holding world championship events. The 2018 “League of Legends” World Finals had early 100 million viewers – more than the Super Bowl viewers. World Championship like this creates a perfect ecosystem for brands to get involved. As mentioned, over a third of $1 billion industry revenue stream comes from sponsorships, which have been a big driver for “League of Legends” franchise. The publisher announced Mastercard as a global sponsor last year, and the Chinese branch of “League of Legends” signed a partnership deal with Nike months ago.

On the consumer’s side, annual spending on eSports-related accessories increased 33 percent from 2017 to 2018, to a record $4.5 billion. The 2018 Entertainment Software Association report found that 64 percent of households own a video game device and 60 percent play video games every day.

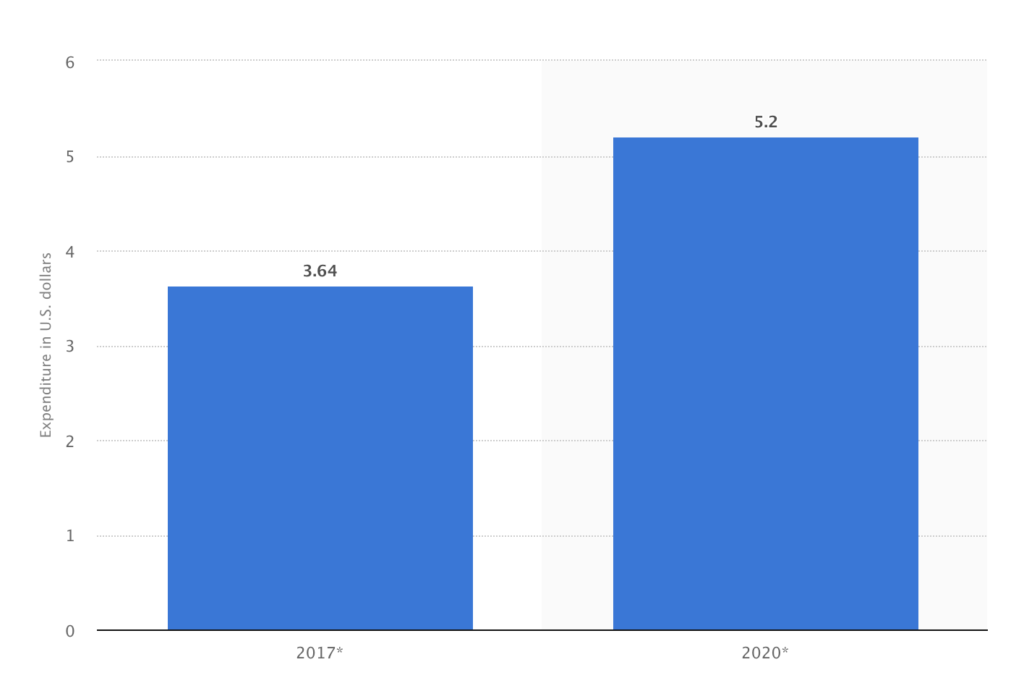

Statista shows that the estimated average per capita spending on eSports will increase by two-fifths from 2017 to 2020.

Both the industrial production(manufacturing) and consumer spending are swelling, indicating a big upsurge in eSports’ demand and supply. In fact, there is hardly any economic indicator shows the declining trend of Esports. With more and more eyes locked on this industry and more event held (i.e. The eSports Business summit to this month), this is definitely a golden era for eSports – with challenges ahead.

Sources:

- Desjardins, Jeff. “The Business of ESports.” Visual Capitalist, 29 May 2018, https://www.visualcapitalist.com/business-of-esports/.

- Goslin, Austen. “The 2018 League of Legends World Finals Had Nearly 100 Million Viewers.” The Rift Herald, The Rift Herald, 11 Dec. 2018, https://www.riftherald.com/2018/12/11/18136237/riot-2018-league-of-legends-world-finals-viewers-prize-pool.

- Gough, Christina. “Global ESports Market Revenue 2022.” Statista, https://www.statista.com/statistics/490522/global-esports-market-revenue/.

- Gough, Christina. “Global Consumer Spend on ESports 2020.” Statista, https://www.statista.com/statistics/691794/consumer-esports-spend/.

- Joseph, Seb. “Game Digital Is Looking to Esports to Turn around Retail Sales.” Digiday, 29 Aug. 2017, https://digiday.com/marketing/game-digital-looking-esports-turn-around-retail-sales/.

- Pannekeet, Jurre. “Global Esports Economy Will Top $1 Billion for the First Time in 2019.” Newzoo, https://newzoo.com/insights/articles/newzoo-global-esports-economy-will-top-1-billion-for-the-first-time-in-2019/.

- Pei, Annie. “Here’s Why Esports Can Become a Billion-Dollar Industry in 2019.” CNBC, CNBC, 23 Jan. 2019, https://www.cnbc.com/2019/01/20/heres-why-esports-can-become-a-billion-dollar-industry-in-2019.html.