Some background

Brexit is coming – and if Game of Thrones was still “in” right now, I would make a cheesy, poorly thought out “Winter is coming” joke. However, perhaps there is more in common with Brexit and the hit fantasy series, whose anticipated final season drummed up more controversy than acclaim, than meets the eye.

Like Game of Thrones’s final season, Brexit – referring to the United Kingdom’s decision to leave the European Union, a political and economic coalition – has been a long-time coming, stressful, messy, controversial and disillusioning. Ever since the 2016 referendum where Brexiters narrowly between the “Bremain” crowd 52% to 46%, the United Kingdom has not actually managed to leave the United Kingdom, delaying their departure date twice due to an inability to strike and approve a satisfactory deal with the European Union.

The United Kingdom is currently salted to leave the EU on Oct. 31, 2019. There is still no departure deal. Britain’s current prime minister, Boris Johnson – a controversial figure who has drawn comparisons to Trump for his hair and speech patterns – has stated that, if it comes down to it, the UK will leave the EU on Halloween without a deal.

With the battle for Brexit getting more heated and members of Johnson’s own party rebelling against him and working with the opposition to draft a bill that would prevent a no-deal departure, Johnson has threatened to call for an election, potentially reshuffling the lines of power.

What a no-deal Brexit could mean for the UK’s economy

A no-deal Brexit could impact not only the United Kingdom’s economy, but the economy of significant trading partners, such as the United States. In 2018, the Federal Reserve worried that a no-deal Brexit would make London subsidiaries of US banks make the costly relocation to another EU country in order to keep EU clientele and that it could become less profitable for US banks to loan to UK citizens.

Leaving without a deal would mean that the UK would leave a customs union and single market overnight. As a member of the EU, the UK’s goods were not taxed by other member countries. After going cold turkey on the organization, Britain will lose that privilege and the EU would start taxing their goods.

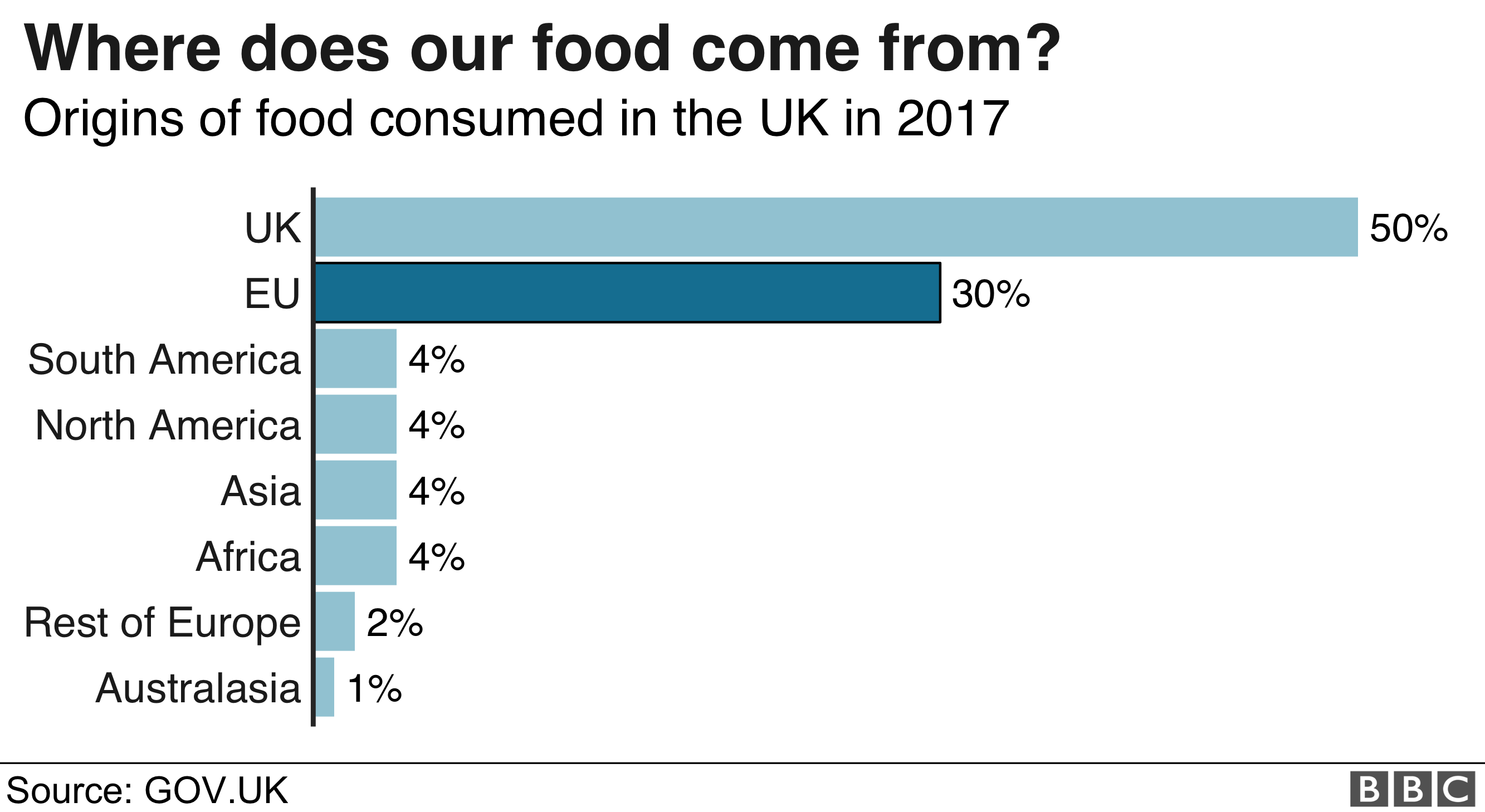

According to the BBC, “This could lead to delays at ports, such as Dover, Some fear that this could lead to traffic bottlenecks, disrupting supply routes and damaging the economy.” With almost one-third of food in the UK coming from the EU, food shortages are another concern.

In the weeks following the initial referendum, the value of the pound fell a little over 10% against the euro from €1.3017 to €1.1663, according to the Brexit currency fallout engagement rate tracker. The original vote also caused the Dow to drop 610.32 points. While Capital Economics’ Senior U.S. Economist Andrew Hunter points out for CNBC that the market volatility “unwound” itself in the weeks following the vote, and suspects the same could happen following Brexit.

What does the economic future of a country leaving the EU look like?

No one knows for certain. The United Kingdom would be the first nation to leave the European Union. There is no precedent. In many ways, it is a shot in the dark. A shot in the dark that has been making headlines for a little over three years and no satisfactory resolution in sight, creating a sense of anxiety for consumers. In August 2019, British consumer confidence fell to a seven-month low, with many attributing that to Brexit worries.

According to The Guardian’s Sean Farrell, Britain’s economy has been treading water because of consumer spending amidst manufacturing and constructing shrinking and the unwillingness of companies to invest. However, the UK’s decreasing consumer confidence could encourage people to save rather than spend, putting a dent in that part of the economy.

What exactly is Brexit an economic indicator for? It’s unclear. It could be nothing. Or, it could help push the nation into a recession. Only time will tell, but as the prospect of a no-deal Brexit becomes closer to a reality, the UK and the EU’s economic futures may be the scariest thing on Halloween.

Sources:

- https://www.bbc.com/news/uk-politics-32810887

- https://tradingeconomics.com/united-kingdom/consumer-confidence

- https://www.federalreserve.gov/econres/notes/ifdp-notes/what-equity-markets-said-about-brexit-related-costs-to-us-banks-20180202.htm

- https://www.bbc.com/news/uk-politics-49558596

- https://www.theguardian.com/politics/2019/aug/29/brexit-is-damaging-business-confidence-say-leading-uk-firms

- https://www.finder.com/uk/brexit-pound

- https://www.cnbc.com/2019/07/18/brexit-impact-on-the-us.html