The introduction of technology through a variety of platforms has greatly affected a number of different industries, including automobiles and oil production. Technology has changed the automobile industry through the introduction of electric vehicles (EV) and modernization of fracking practices. According to an article in BBC News, “Fracking is the process of drilling down into the earth before a high-pressure water mixture is directed at the rock to release the gas inside”. In correlation with increased technology and automobiles, is the concern over oil prices for the general public and corporations. Although oil prices are impacted by many things, from technology such as fracking, to war and peace in conflicting regions, the main contributor is the battle over changes in supply and demand.

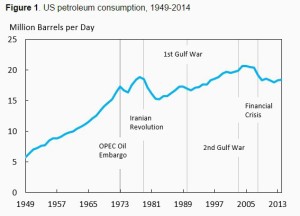

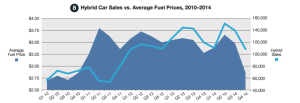

Significant economic events will also impact the amount of oil consumption. For example, Iran’s re-emergence into the world’s top oil producers will help to increase supply, which could eventually surpass demand. When supply is greater than demand, prices of oil will decrease so that people will be attracted to buy more gasoline at that moment. This will also be used as a tactic during times of economic turmoil, when the general public does not have the funds to spend money on gas. During the Financial Crisis of 2008, people were so worried about the outcomes of their financial inve stments that they saved all the extra money they had for necessities. People decided to make the switch from driving their own cars to using public transit as a means to save money. As seen in Figure 1, the

stments that they saved all the extra money they had for necessities. People decided to make the switch from driving their own cars to using public transit as a means to save money. As seen in Figure 1, the

re was a decline in US petroleum consumption between the years of 1949 to 2014 after each war and econ

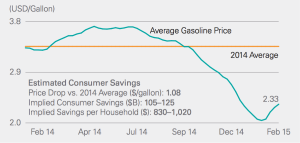

omic crisis. The average price per gallon of gasoline in the United States fell from $4.08 in June 2008 to $1.61 in December 2008. A shortage of demand for the supply that was available, created a surplus in gasoline and the need for a reduction in prices. As a result, there is a direct correlation between world economic events and supply and demand of oil, leading for a change in prices.

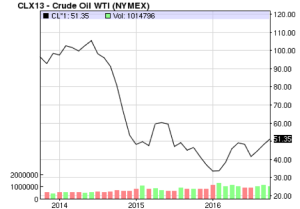

Over the last several years, United States production of oil has nearly doubled. This has lead to more competition, forcing Middle Eastern exporters to find new areas to sell to. Although Russia has constantly been through economic issues, it continues to hold its rank as the number one oil producer. The current price of crude oil hovers around $51.18 per barrel according to Reuters. In comparison, a barrel used to sell at above $100 at the midpoint of 2014. It is believed that this is a result of large oil companies reducing investments in new technology and exploration for new oil. According to a research report produced by RBC Capital Markets, “projects capable of producing more than a half-million barrels of oil a day were canceled, delayed or shelved by OPEC countries alone last year, and this year promises more of the same.” To reiterate the question that people ask of what drives a change in oil prices, it is a result of supply and demand, but as a result of competition. Companies are pulling out of new opportunities to find oil because the costs outweigh the benefits. In the past, drilling for oil created a cash cow that families like the Rockefeller’s were able to establish untouchable fortunes as a result. Surging United States’ production of oil has created cheaper prices for Americans due to cheaper transportation and importation costs and the ability to export oil to other countries. With increased competition among corporations and on a global level between countries, the supply for oil is increasing at a rate that demand is unable to keep up with.

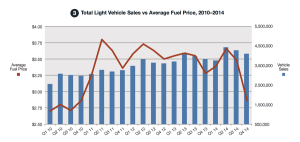

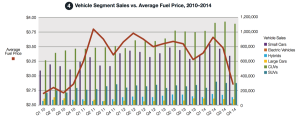

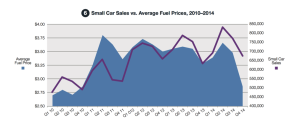

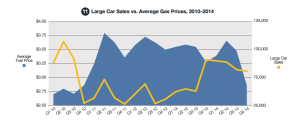

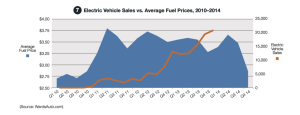

The introduction of electric vehicles has increased competition among the automobile industry. EV sales are increasing month-to-month in comparison to the same month during the previous year. However, this is not enough to keep up with total vehicles sales. The introduction of electric car dealerships, such as Elon Musk’s Tesla, has created a new target market for those who want to drive environmentally friendly vehicles. Total vehicle sales have increased from 2009 to 2016 by about 74.5%. September U.S. auto sales reported strongly at 17.8 million vehicles. Total electric vehicle sales during the month of September was reported at just below 17,000 units. The previous numbers are important to refute rumors that an increase in electric vehicles on the road will lead to a decline in oil prices. Ryan Lance, CEO of ConocoPhillips, stated that EVs “won’t have a material impact for another 50 years”. Yes, there is major growth in the industry and an increase in population of people who are looking to buy plug-in vehicles, but there is not enough competition to all-gasoline cars to disrupt oil production.

The Organization of the Petroleum Exporting Countries, also known as OPEC, plays an important role in determining the supply and production of gas. The oil minister of Saudi Arabia, Ali al-Naimi, is determined to keep oil production consistent in 2014. OPEC has the power to decide to cut production as a means to increase prices and revenue. Mr. al-Naimi firmly believes that keeping oil prices where they were would help to stimulate global economic growth. To show the rarity of reducing production, back in September, members of the organization agreed to cut production for the first time in over eight years. Fast forward to today, Russia’s Vladimir Putin showed support for OPEC’s proposal to “freeze oil production in order to reverse the slump in global prices”. He stated that oil prices have decreased by more than 50% in two years due to surplus production. Not only would freezing oil production raise the low prices of oil, it will also help to prevent price fluctuations in the future. Putin is in favor of freezing production, or reducing supply, to raise prices so that Russia can remain the dominant power of the oil industry. Currently, oil and gas make up 70% of the entire country’s export incomes, resulting in a decrease of about $2 billion for every dollar that oil prices fall. The organization is aiming to cut about 700,000 barrels per day at its next meeting on November 30, 2016 in Vienna, Austria. Many nations fail to reach agreements at these meetings because they are greedy or are involved in political battles with one another. For example, the proxy war between Iran and Saudi Arabia, two of the world’s largest producers of crude oil, has created tensions that would force them to refuse agreement in order to prove a point. There is no question over the strength of OPEC and its ability to make a decision that could either raise or cut the price of oil. However, as mentioned previously, the simple issue over whether prices will be increased or decreased comes down to worldwide supply and demand.

There is not a single, clear-cut answer to determine what the main force behind the change in oil prices are; however, we can correlate the change to surpluses and deficits in supply and demand. Economic events, such as the Iranian Revolution in 1979 and the Financial Crisis in 2008, were main contributors to changes in supply and demand for oil. The revolution created an oil shock throughout the United States, when oil exports were severely cut from Iran, decreasing supply. The economic crisis in the U.S. affected the other end of the spectrum, leading to a decrease in demand from oil consumers throughout the nation. Competition amongst oil producers around the globe has increased significantly over the last decade, forcing companies to slash prices in order to attract buyers for an excess supply. Lastly, OPEC, the dominant oil production coalition, has the most control over the oil industry and the ability to make decisions regarding prices and production. Talks about freezing production are lingering throughout Europe, specifically Russia, with hopes to reduce the supply and increase prices. Overall, each example provided refers back to the simple economic principles of supply and demand. When supply is greater than demand, prices go down; and, when demand is greater than supply, prices go up. Oil consumption and production are resulting forces of supply and demand.

Works Consulted

BBC News. “Opec Oil Output Will Not Be Cut Even If Price Hits $20.” BBC News. N.p., 23 Dec. 2014. Web. 10 Oct. 2016.

Cox, Lydia. “The Surprising Decline in US Petroleum Consumption.” World Economic Forum. N.p., 10 July 2015. Web. 10 Oct. 2016.

EIA. “U.S. Natural Gas Total Consumption (Million Cubic Feet).” U.S. Energy Information Administration. N.p., 30 Sept. 2016. Web. 11 Oct. 2016.

Krauss, Clifford. “Oil Prices: What’s Behind the Volatility? Simple Economics.” The New York Times – Energy & Environment. The New York Times, 29 Sept. 2016. Web. 11 Oct. 2016.

Reuters. “Auto Sales Down in September Even After Bigger Dealer Discounts.” Fortune – Auto. N.p., 3 Oct. 2016. Web. 9 Oct. 2016.

US Energy Information Administration. “World’s Top Oil Producers.” CNNMoney. Cable News Network, 22 July 2016. Web. 10 Oct. 2016.

Wise, Alana. “A Legendary Investor Thinks Electric Cars Will Raise the Price of Oil.” A Legendary Investor Thinks Electric Cars Will Raise the Price of Oil. N.p., 25 Sept. 2016. Web. 27 Sept. 2016.

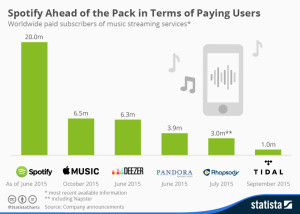

being seen as the next purchase for Spotify. Many believe this would be a smart move, as SoundCloud needs help finanacially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.

being seen as the next purchase for Spotify. Many believe this would be a smart move, as SoundCloud needs help finanacially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.