Breaking news hit this weekend regarding five attempted bombings that threatened New York and New Jersey. As citizens fear for their safety and officers are on high alert, there is also another group of people that are scrambling for resources. In order to bounce back from the tragedy, the federal government must pour money into heightened security and begin to finance city repairs. Although the safety of the American people holds a much higher significance than the money that is use to ensure that safety, it is still an aspect of the government that must be considered.

In the last year, the  number of terrorist attacks has been at an all time high.

number of terrorist attacks has been at an all time high.

These attacks have taken far too many lives and often leave parts of the city

destroyed. Although it is often not considered, these tragic results have an enormous effect on the economy in two ways. One way is that, it largely affects consumption and consumer spending. The other way is that the actual costs of repairs and increased security takes a large toll on the economy.

When attacks occur, people tend to stay inside due to a lacking sense of safety. By doing this, they avoid spending on leisure, goods and travel.

In addition, during times of crisis

businesses often decide to close, public services, like subways, temporarily shut down and cell phone towers even stop working because of the chaos. Although these factors may not seem like they would have a considerable impact on the economy, they actually cause a major disrution in every day life and impacts the economy on a global scale.

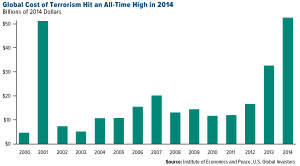

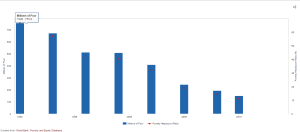

The economic impact of global terrorism has been rising since 2010. This can be seen on the graph below, which was created by the Institute of Economics and Peace. The graph shows that over $52 billion was spent globally on terrorism in 2014. However, this number only includes direct, short-term costs, excluding economic impact, war funding, future veteran’s care and increased national security. Therefore, the actual cost of funding after terrorist attacks ends up being much more. For example, the 9/11 attacks were initially estimated to cost $27.2 billion, but after factoring the effect that it had on the economy long-term, it came out to be around $3.3 trillion.

In addition to cuts in consumer spending, a majority of the costs incurred by terrorist attacks come from increasing military and security measures. After terrorist attacks the costs of special equipment, repair and deploying thousands of officers around the clock really adds up. In New York City’s metropolitan area annual protection usually comes out to be $1 billion according to Michael Paddock, CEO of Grants Office LLC, which tracks federal spending.  However, this price does not include the costs acquired when there are actual attacks. CNN Money reported that The Emergency Service Unit, which includes 500 elite counter-terrorism officers is always deployed during times of crisis and attack, and not at a cheap price. These officers usually carry Cold AR-15 weapons, which cost about $700 each with an additional $500 Glock 19 on their belt. These officers also wear an increased amount of armor, which includes $200 bullet-resistant vests and $1,000 helmets.

However, this price does not include the costs acquired when there are actual attacks. CNN Money reported that The Emergency Service Unit, which includes 500 elite counter-terrorism officers is always deployed during times of crisis and attack, and not at a cheap price. These officers usually carry Cold AR-15 weapons, which cost about $700 each with an additional $500 Glock 19 on their belt. These officers also wear an increased amount of armor, which includes $200 bullet-resistant vests and $1,000 helmets.

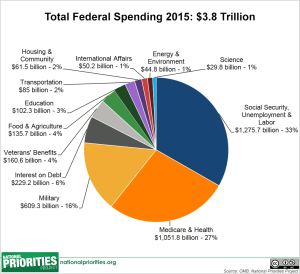

When all these prices add up, New York City is looking at a bill for about $540 million on anti-terrorism efforts by the ESU, police and fire departments. Thankfully, the federal government pays for $400 million of that and taxpayers come up with the rest. However, this is a small price to pay to ensure protection and safety through the United States.

Sources:

http://money.cnn.com/2016/09/19/news/nyc-terrorism-cost/index.html?iid=hp-toplead-dom

http://fortune.com/2015/11/17/terrorism-global-economic-cost/

http://www.cnn.com/2016/09/19/us/new-york-explosion-investigation/

http://pix11.com/2016/09/17/subway-service-after-chelsea-explosion/

http://www.nytimes.com/interactive/2011/09/08/us/sept-11-reckoning/cost-graphic.html