The Trans-Pacific Partnership (TPP) is a trade agreement signed by twelve Pacific Rim countries. The deal seeks to serve a path of entry of American goods into Asian markets, and is lately discussed in the context of President Obama’s administration’s “pivot to Asia.” Although the agreement primarily represents elimination of barriers between the United States and Asian countries the contract states 3 Latin American countries: Mexico, Peru and Chile.

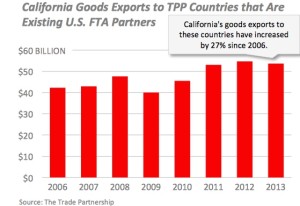

An invitation into the TPP signifies these countries entrance to a large trading bloc, which makes up about 40 percent of the world GDP. The counties have decided that their path forward is to embrace he the growing practice of globalisation and free trade agreements. Membership within TPP would facilitate I created integration with one another and offer a more coordinated approach to expanding trade with Asia.

The TPP can provide opportunities if the Latin American nations that are involved can climb the value-added chain, invent, say, the next Apple computer, and produce these products in competitive ways. The challenge is that other participants, for instance Vietnam [another member of the TPP] are also trying to upgrade their exports. Being part of the TPP is like joining a club. You have to perform when you get there.

Others may not get an opportunity to do so. The exclusion of an emerging giant such as Brazil will definitely hurt the country as much as its 7-1 World Cup semi-final loss to Germany. The economy is already facing a tough challenge to fight against protectionist measures, and the signing of this agreement will isolate the country from the global markets. Meanwhile, the more fortunate ones such as Chile and Peru must seek to take advantage. They benefit from reduced tariffs, but face stiff competition from Asia in terms of exports of food and vegetables. The opportunity is provided, but they must reap the benefits. Lastly, a member of NAFTA, and now TPP, Mexico can consider itself lucky to be next to the US.