After a three-week marathon in Vienna (July, 2015), the Islamic Republic of Iran signed a nuclear deal with six economic giants: Britain, US, France, Germany, Russia and China. The agreement was targeted towards controlling Iran’s nuclear enrichment program in return for lifting economic sanctions that have isolated the country and hobbled its economy. So what did the nuclear deal state? The deal requires Iran to reduce its current stockpile of low-enriched uranium by 98 percent, and limits it’s enrichment capacity and research and development for 15 years. Additionally, the nuclear watchdog, the International Atomic Energy Agency (IAEA) will take responsibility in monitoring the country’s nuclear facilities. Once initiated, the accord between the two parties will serve to revitalize Iran’s growth through access to foreign investment, technology and goods. Most importantly, the country will have the opportunity to renter into the global oil markets, attracting foreign interests that will increase production and exports of oil to drive the depressed Iranian economy.

Since the Iranian Revolution of 1979, Iran has been in a state of near constant unrest. The country’s political and economic instability has resulted in several accusations made against it. From entities accused of supporting terrorism, to nuclear proliferation, to officials in the government responsible for serious human rights abuse, Iran has consistently been considered a rogue nation. As a result of several violations, the US, in 1995, targeted the Iranian government through economic sanctions on companies dealing with Iran. Companies that violated the conditions were denied export licenses for exports and access to credit. In 2006, the UN levied further economic sanctions against resulting from the country’s refusal to suspend its uranium enrichment program. The new set of sanctions placed restrictions on the Bank of Iran and Iranian financial institutions, curbing access to foreign capital. However, the nail in the coffin was when the Congress issued the Accountability and Human Rights Act, 2012, targeting companies conducting business with Iran’s national oil company. “These sanctions have significantly hurt the exports of oil, which contribute to 80% of the country’s export revenue,” said Wayne Sandolhtz, Professor of International Relations at University of Southern California.

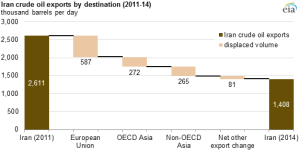

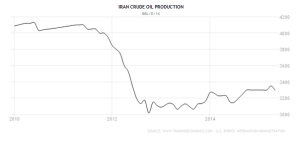

Economic sanctions have reduced Iran’s reach to products needed for the oil and energy sectors, prompting many oil companies to withdraw from the country. “Iran is annually losing $60 billion of energy investment, limiting its access to foreign technology”, said Wayene Sandolhtz. A fall in effeciency from reduced access to technology has significantly dropped production of oil by 23.08% from 2010 figures of 4.2 million barrels a day. Post 2012 sanctions, Iran’s oil exports reduced by almost half from 2.6 million barrels per day (2011) to 1.4 million barrels per day (2014). Fall in oil exports, which contribute to 80% of Iran’s export revenue, has severly damaged Iran’s flow of revenue. Additionally, sanctions levied against Iranian financial institutions have further reduced the flow of capital into the country. The fear of losing access to Western markets has also convinced international investors to avoid the Iranian economy. The resulting withdrawal from Iranian assets has devalued the rial (Iranian currency) by 80% since 2011. Consequently, Iranian’s have had to pay significantly more rials to purchase global consumer products. The cumulative impact has damaged the economy through reduced growth, increasing prices and rising levels of unemployment. Inflation is at 40%, with prices of basic food and fuel expected to further soar. Unemployment lurks at 10.3%, with unofficial figures rising to 35%. Recent sanctions (2012) have taken a heavy toll on Iran’s growth, with the GDP figures estimating a drop by 20% from 2012. However, with Iran agreeing to restrict its nuclear program, an opportunity for future economic growth has presented itself.

A recent conference in Tehran supplanted the nuclear deal agreed between Iran and the economic powers. New contracts were launched, with Iran expected to initiate 50 new oil projects in the coming year. These contracts, subject to the nuclear deal being passed (in the Congress), serve to provide a pathway for foreign investment in Iranian oil production. “The deal will increase production by 500,000 barrels per day,” said Syed Mehdi Hosseini, head of the country’s oil contracts. The deal and resulting contracts have major implications for Iran, as it opens the door for reentry into the global oil market. The country can now attract foreign investors who will supply capital to the economy. This will serve to bolster growth, primarily through rise in production and exports of oil.

According to the BP Statistical Review of World Energy, Iran leads the world in natural gas reserves and is fourth in oil. Influx of Western and European investment and technology could revive an industry that in a decade of sanctions has lost much ground to its rivals. “Since the sanctions in 2012, Iran’s oil production has dropped more than 20%. Meanwhile, Iraq has increased its production by 70%, where as Saudi Arabia has been pumping at near record levels,” said Mr. Gaurav Mukherjee, Professor of Applied Statistics at University of Southern California. “The country is currently producing 2.9 million barrels a day, and has a capacity to produce 4 million barrels a day. To fulfill this potential, Iran will require more investment than what the National Iranian Oil Company can muster. This opens the door to increased foreign investment.” The deal provides the perfect platform for influx of investment to aid Iran to step back into the oil markets, and challenge its competitors to gain back the lost share. The new contracts will increase daily production by 500,000 – 800,000 barrels per day (by end of 2016), significantly boosting the countries exports.

Iran will now become the largest country to rejoin the global marketplace since the breakup of the Soviet Union. Energy sector companies and business from other sectors have already travelled to Iran to seek market opportunities since the agreement to lift sanctions. “Iran holds potentially interesting promises and perspectives. We have to see how the market will develop,” said Shell Chief Executive Ben Van Beurden. Iran is already in contact with former oil buyers in the European Union – traders such as Vitol Group and big oil producers such as Royal Dutch Shell PLC, Total SA – as well as existing importers in Asia. Although Iran will welcome foreign capital, it will be careful on the manner of negotiations. Having just gained access to foreign markets, it will want to attract investment but not relinquish control of its assets. “Iranians are likely to seek deals in which they pay a fee per barrel for the output increases achieved by Western companies’ technology and investment,” Professor Sandolhtz. However, with the assured backing of foreign investors, Iran is likely to make a strong statement in the global oil market. In addition to increasing supply to 3.5 millions barrels per day, Iran will experience an influx of foreign technology and ideas. This combined effect is predicted to raise Iran’s economy by 2 percentage points, to more than 5 percent GDP growth within a year. After an additional 18 months, GDP growth could reach 8 percent. With new channels to trade, easier access to raw materials and technology will improve efficiency and reduce cost of operations. This will help combat rising prices. Additionally, investment and consequent growth will also provide more jobs in the economy, hence chipping off on the high levels of unemployment.

In the global oil markets, Iran will benefit from increasing leverage. The sanctions restricted Iran’s exports of oil to limited countries. Currently, Iran heavily relies on China as a consumer for its oil supply. More than 15% of Iran’s oil is shipped to China. Additionally, due to limited access to global markets, Iran imports 35% of its gasoline from China. Hence Iran is significantly dependent on China for the functioning of its economy. Entry into international trade will increase Iran’s export options for oil and the number of suppliers it has access to.

Apart from increased international leverage, Iran will benefit from domestic success. Scaling back sanctions will help Iran keep its best and brightest at home. From 2009 to 2013, more than 300,000 Iranians left the country in search for better job opportunities. Today, 25% of Iranians with postgraduate live in developed OECD countries outside Iran. This is a significantly high rate of “brain drain”. According to the World Bank, Iranian economy loses out on $50 billion annually as local talent look elsewhere for work. Iran’s GDP last year was US $368.9 billion. Hence, retaining its talented workforce will have a substantial impact on Iran’s growth. With access to high levels of investment and technology, the Iranians will regain confidence in their economy, willing to take their chances at home.

Although the Iranian economy will be brimming with optimism, lifting sanctions does not mean all players will invest in the economy. American oil companies, in particular, are subject to tighter restrictions than their European counterparts. They are likely to be far more cautious in their activities. Furthermore, oil experts predict that it may be some time before major oil and gas projects get underway. The lack of foreign investment has reduced Iran’s capacity to produce oil. Increase in investments will be directed towards facilitating improvements in capacity, which will eventually serve to raise production levels. “The level of interest in Iran will be high, but actual investment will be slow,” said Professor Mukherjee. Additionally, Iran cannot immediately increase its production to its predicted capacity of 3.5 million barrels per day. This will create an oversupply of oil in the market, dropping the price of oil, and hurting several economies in the Middle East. Hence, Iran must slowly work towards its target, which means realizing slow and steady growth.

The nuclear deal has raised interest elsewhere in the Middle East, with Iraq and Saudi Arabia keeping a watchful eye. The reentry of Iranian oil onto the global market could lower 2016 forecasts for world crude oil prices by $5-$15 per barrel. With the current price already as low as $49 per barrel, Iran’s activities will trouble its fellow members of the OPEC. “Iran, through its contracts and potential investment, will take away a major share of oil exports from Iraq,” said Professor Sandolhtz. Nearby, Saudi Arabia will also be dealt a significant blow. The leader of the OPEC has already increased the supply of oil, dropping the prices to where they are today. The country is heavily reliant on oil for its revenues, and will stand to lose market share to Iran. The tensed Saudis will have to look to diversify away from deep dependence on the US for markets for Saudi oil exports.