Post Iranian Revolution, the Islamic Republic of Iran has continued to be in a state of unrest. The country’s political and economic instability has resulted in several accusations made against it. From entities accused of supporting terrorism (2001), to nuclear proliferation (2005), to officials in the government responsible for serious human rights abuse (2010), Iran has been at the forefront of violation of international laws. Consequently, in 1995, the US implemented sanctions against Iran that extended to companies dealing with the Iranian Government. Additionally, in 2006, the UN levied economic sanctions against Iran as a result of the country’s refusal to suspend its uranium enrichment program. The nail in the coffin was when the Congress issued the Accountability and Human Rights Act, 2012, targeting companies conducting business with Iran’s national oil company. “These sanctions have significantly hurt the exports of oil, which contribute to 80% of the country’s revenue,” said Mr. Wayne Sandolhtz, Professor of International Relations at University of Southern California. Sanctions on Bank of Iran and Iranian financial institutions have curbed the flow of capital into the country. Reduced foreign investments have further contributed to the declining growth. Consequently, the sanctions have disrupted supply chains, contributing to higher operating costs. High costs and reduced investments have forced companies to lay off workers. As a result, the economy has been severely damaged. Inflation is at 40%, with prices of basic food and fuel expected to further soar. Unemployment lurks at 10.3%, with unofficial figures rising to 35%. Recent sanctions (2012) have taken a toll on Iran’s growth, with the GDP figures estimating a drop by 20% from 2012. However, with Iran agreeing to restrict its nuclear program, an opportunity for future economic success has presented itself.

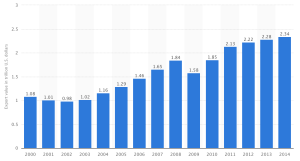

The recent conference in Tehran concluded on a nuclear deal agreed between Iran and the six economic giants: Britain, US, France, Germany, Russia and China. Iran agreed to limit its uranium enrichment program in return for the sanctions being lifted. New contracts were launched at the conference, with Iran expected to initiate 50 new projects in the coming year. “The deal will increase production by 500,000 barrels per day,” said Syed Mehdi Hosseini, head of the country’s oil contracts. This deal has major implications for Iran as it opens a door for reentry into the global oil market. The country can now attract foreign investors who will supply capital to the economy. This will bolster growth, primarily through rise in production and exports of oil.

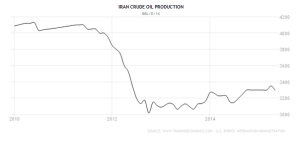

According to the BP Statistical Review of World Energy, Iran leads the world in natural gas reserves and is fourth in oil. Influx of Western and European investment and technology could revive an industry that in a decade of sanctions has lost much ground to its rivals. “Since the sanctions in 2012, Iran’s oil production has dropped more than 20%. Meanwhile, Iraq has increased its production by 70%, where as Saudi Arabia has been pumping at near record levels,” said Mr. Gaurav Mukherjee, Professor of Applied Statistics at University of Southern California. “The country is currently producing 2.9 million barrels a day, and has a capacity to produce 4 million barrels a day. To fulfill this potential, Iran will require more investment than what the National Iranian Oil Company can muster. This opens the door to increased foreign investment.” The deal provides the perfect platform for influx of investment to aid Iran to step back into the oil markets, and challenge its competitors to gain back the lost share. The new contracts will increase daily production by 500,000 – 800,000 barrels per day, which will significantly boost the countries exports.

Iran will now become the largest country to rejoin the global marketplace since the breakup of the Soviet Union. Energy sector companies and business from other sectors have already travelled to Iran to seek market opportunities since the agreement to lift sanctions. “Iran holds potentially interesting promises and perspectives. We have to see how the market will develop,” said Shell Chief Executive Ben Van Beurden. Iran is already in contact with former oil buyers in the European Union – traders such as Vitol Group and big oil producers such as Royal Dutch Shell PLC, Total SA – as well as existing importers in Asia. Although Iran will welcome foreign capital, it will be careful on the manner of negotiations. “Iranians are likely to seek deals in which they pay a fee per barrel for the output increases achieved by Western companies’ technology and investment,” Professor Sandolhtz. However, with the assured backing of foreign investors, Iran is likely to make a strong statement in the global oil market. In addition to increasing supply to 3.5 millions barrels per day, Iran will experience an influx of foreign technology and ideas. This combined effect is predicted to raise Iran’s economy by 2 percentage points, to more than 5 percent GDP growth within a year. After an additional 18 months, GDP growth could reach 8 percent. With new channels to trade, easy access to raw materials and technology will improve efficiency and reduce cost of operations. This will help combat rising prices. Additionally, investment and consequent growth will also provide more jobs in the economy, hence chipping off on the high levels of unemployment.

In the global oil markets, Iran will benefit from increasing leverage. The sanctions restricted Iran’s exports of oil to limited countries. Iran heavily relies on China as a consumer for its oil supply. More than 15% of Iran’s oil is shipped to China. Additionally, due to limited access to global markets, Iran imports 35% of its gasoline from China. Hence Iran is significantly dependent on China for the functioning of its economy. Consequently, this reduces it power to dictate terms. However, with increased consumers, Iran is likely to enjoy an improvement in its economic position allowing it to have leverage in negotiations.

Scaling back sanctions will help Iran keep its best and brightest at home. From 2009 to 2013, more than 300,000 Iranians left the country in search for better job opportunities. Today, 25% of Iranians with postgraduate live in developed OECD countries outside Iran. This is a significantly high rate of “brain drain”. According to the World Bank, Iranian economy loses out on $50 billion annually as local talent look elsewhere for work. Iran’s GDP last year was US $368.9 billion. Hence, retaining its talented workforce will have a substantial impact on Iran’s growth. With access to high levels of investment and technology, the Iranians will regain confidence in their economy, willing to take their chances at home.

Although the economy will be brimming with optimism, it is important to acknowledge that lifting sanctions does not mean all players will invest in the economy. American oil companies, in particular, are subject to tighter restrictions than their European counterparts. They are likely to be far more cautious in their activities. Furthermore, oil experts predict that it may be some time before major oil and gas projects get underway. “The level of interest in Iran will be high, but actual investment will be slow,” Professor Mukherjee. Additionally, Iran cannot immediately increase its production to its predicted capacity of 3.5 million barrels per day. This will create an oversupply of oil in the market, dropping the price of oil, and hurting several economies in the Middle East. Hence, Iran must slowly work towards its target, which means realizing slow and steady growth.

The nuclear deal has raised interest elsewhere in the Middle East, with Iraq and Saudi Arabia keeping a watchful eye. The reentry of Iranian oil to the global market could lower 2016 forecasts for world crude oil prices by $5-$15 per barrel. With the current price already as low as $49 per barrel, Iran’s activities will trouble members of the OPEC. “Iran, through its contracts and potential investment, will take away a major share of oil exports from Iraq,” Professor Sandolhtz. Nearby, Saudi Arabia will also be dealt a significant blow. The leader of the OPEC has already increased supply of oil, dropping the prices to where they are today. The country is heavily reliant on oil for its revenues, and will stand to lose market share to Iran. The tensed Saudis will have to look to diversify away from deep dependence on the US for markets for Saudi oil exports. And what about the political and economic implications for Israel?

generation shift.

generation shift.