When Farm Prices are low, farmers aren’t necessarily pessimistic. Farm Futures’ first survey of 2016 demonstrates that farmers are eager to plant more crops on their acreage no matter the circumstances.

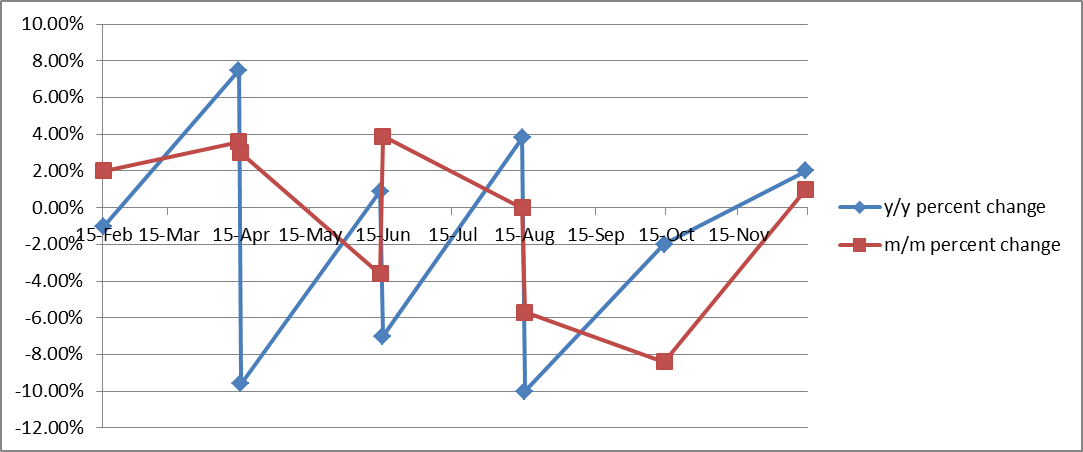

At the beginning of this month, the Department of Agriculture released an index of prices received from farmers for their current month. This index measures crop prices, livestock, and product prices. The outcome is farm prices – m/m % change is down -1.9% with an overall -5.7% and farm prices – y/y% change is down -7.1 with and overall -10.0%. The drops in numbers are mostly because of poor weather conditions earlier in the year.

Though the chart tells the public one thing, farmers express another.

Like the economy, there are many factors to farming that can affect its status. According to the article Farm Futures’ 2016, planting intentions survey shows low prices won’t deter grower’s conditions. Bad weather that occurred last fall interrupted crops like the red wheat in the Midwest. Wheat grounds in other areas could shrink, with farms predicting only to plant 40.4 million acres in the fall, which are about 220,000 lower than last year.

“While profit margins remain in the red, farmers are reluctant to cut acreage, knowing that volatile crop prices can turn around quickly if weather problems emerge,” said Farm Futures market analyst Bryce Knorr, who conducted the survey.

Even though the percentages of farm prices are low, the survey mentioned earlier, Farm Futures’ first survey of 2016, gives a different attitude for agriculture.

After farmers took this survey, it showed that they plan on planting 89.65 million acres of corn which raises the number 1% from 2015. Soybeans could have a jump in growth as well. The report indicates that Farmers would like to plant 86.32 million acres of soybeans, which raises it 2.4% more than was previously estimated.

The fact that farmers are finding other ways to be productive, even though farm prices are low, gives the future hope. Even when the market is not doing the greatest, it does not necessarily mean it will stay that way. Food is a basic necessity that humans need; therefore food products are extremely important. Farmers and economists know this and that is what makes The Farm Prices graph so interesting. Obviously, farming will continue and more products will be created no matter what the economy looks like. Farmers’ eagerness to expand their product and invest more in other produce is a sign of adapting to the economy and its demand.