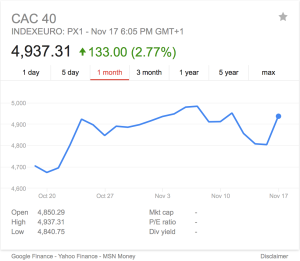

The French stock exchange opened for business again Monday after ISIS militants killed at least 129 people in the streets of Paris. The attack was one of the worst human disasters in Europe since the end of World War II. While France recovers from the tragedy, many financial analysts expect the financial markets to take a small tumble.

The French stock exchange opened for business again Monday after ISIS militants killed at least 129 people in the streets of Paris. The attack was one of the worst human disasters in Europe since the end of World War II. While France recovers from the tragedy, many financial analysts expect the financial markets to take a small tumble.

This is not the first time a country dealt with a small financial crisis in the wake of violent attacks. According to USA TODAY writer Ryan Biek, Tunisia lost $515 million in the tourism industry. In 2004 and 2005, the BBC reported markets in Spain fell 2 percent and markets in the U.K. fell 1.5 percent after bombings occurred in both countries. However, the tourism industry in France represents about 7 percent of the GDP, which means this could be the section of the economy hurt the most by the actions of the terrorists.

However, the stock markets actually rose only a couple of days after the attacks, which suggests the potential for a smaller impact on the economy. Although the country seems to be recovering without too many issues, France might be facing some short-term changes in different business sectors, including tourism and defense.

In 2013, France had about 83 million foreign tourists, making it the global leader in the tourism sector. Since tourism remains a large part of the European economy as a whole, some countries might experience a ripple effect in the aftermath of the Paris attacks. NBC News says many travelers will steer clear of neighboring countries like Belgium, where some of the terrorists are allegedly hiding. The drop in visitors mainly comes from a psychological response to the attacks: People are afraid to travel through Europe, even if the fear might be temporary.

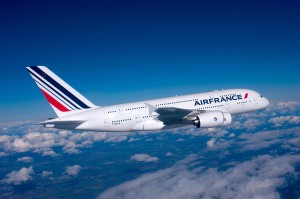

Airlines might also struggle in the next few months even as the holiday season continues. On Tuesday, flight officials announced two Air France flights heading from the United States to Paris were diverted due to bomb threats.

In contrast, defense spending might see a boost in investment. French president Francois Hollande declared war on the ISIS militants and commissioned airstrikes on major terrorists sites in Syria. He even proposed new laws to the French parliament, including 5,000 additional paramilitary troops and no reductions in defense spending through 2019. In addition, the prolonged state of emergency prompted French police to conduct raids throughout the country.

This week, defense stocks increased, with Raytheon, Lockheed Martin, and Northrop Grumman moving up 4 percent, 3.5 percent, and 4.4 percent respectively. Recent threats from ISIS against the United States have also forced congressional leaders to revisit the idea of increasing federal defense spending. According to the Baltimore Business Journal, the U.S. defense budget for the fiscal year 2015 reached a low point of $562.5 billion, in comparison to the 2011 budget which was $678.1 billion. It is unclear how sharp of an increase there will be in defense spending in the United States and Europe, but the upcoming meeting between President Hollande and President Obama may shed some new light on the direction the world is heading.

http://www.usatoday.com/videos/money/markets/2015/11/15/75830970/

http://www.cnn.com/2015/11/17/world/air-france-flight-diverted/