Patterns in consumer spending, which account for more than two-thirds of the economy, are most often the principal influence on both the stock and bonds markets. In times of economic downturn, both consumer confidence and consumer spending become diminished as people tighten their belts.

The 2008 US and world financial crisis that spurred economic recession resulted in a dip in consumer spending between a period of two years [2008-2010], according to the Bureau of Economic Analysis.

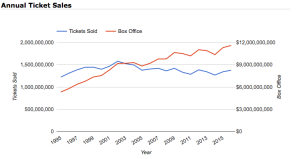

In 2009 US consumers spent 2.8 percent less, on average, than they did in the previous year. Expenditures essentially decreased across the board and entertainment decreased by 5.0 percent from the Bureau of Labor Statistics report from 2008. In spite of the overall decreases in spending U.S. box office sales hit an all-time high in 2009 at the height of the recession.

Short-term enjoyment as a means of forgetting economic despair is not uncommon consumer behavior. In fact, after the crash of 1929 that led to the Great Depression consumers flocked to their local theaters. This sort of escapist mentality was mirrored again during the Great Recession, with films like James Cameron’s record-breaking Avatar producing 2.788 billion USD in ticket sales.

ODEON Cinemas, the largest cinema chain in the United Kingdom by market share took this traditional consumer response a step further by observing trends in the company’s concession sales. Though not a perfect science the chart [below] indicates that while economic downturn may lead to more box office sales, dips in the FTSE – an indicator of consumer confidence – correlate to a decline in the consumption of concessions, more specifically popcorn for U.K. cinemagoers. The cause of these trends is obviously debatable but likely do to the fact that while people may be running to the cinema during periods of economic downturn, they are not necessarily buying up concessions.

The Odeon popcorn index of economic confidence compares average popcorn sales per ODEON cinemagoer with the Financial Times Stock Exchange 100 Index (FTSE 100 Index) of companies on the London Stock Exchange with the highest market value.

Rupert Gavin, chief executive of Odeon, tracked week-by-week popcorn sales and observed that sales of popcorn and the FTSE were not only correlated. At one point sales of popcorn were leading the FTSE.

Between June and July of 2009, popcorn sales continued to rise while the FTSE took a short drop, spiking up again by mid-July. This was significant because it meant that popcorn sales had the potential to predict future economic climates, while also reflecting current climates.

There is no way of knowing for sure whether or not movie theater popcorn sales will remain an economic indicator; however, at least for now they appear to hold a certain level of credibility for gauging the market and consumer confidence and spending.

http://www.thisismoney.co.uk/money/news/article-1679109/Popcorn-index-shows-economy-on-mend.html

games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.

games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.

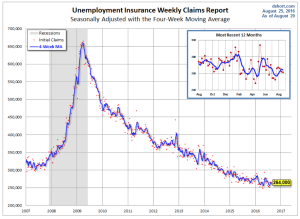

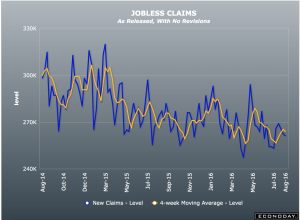

alysts believe that the jobless claims numbers will continue to remain similar throughout the next few months, as the economy continues to grow and the labor market improves.

alysts believe that the jobless claims numbers will continue to remain similar throughout the next few months, as the economy continues to grow and the labor market improves.