Over the last three years, President Trump has become quite infamous for a variety of things: his combover, the spray tans and his “build the wall” mentality. He’s also notoriously known for loving Twitter. Trump has garnered quite a reputation on this social platform, seeing as he’s the most Twitter-active president the U.S. has ever had.

President Trump’s tweets are, for the most part, immature, poorly informed and aggressive. However, to our country’s dismay, these 140 character-long posts have garnered the ability to impact the U.S. economy and the central banking system. Recently, Trump’s public criticism of the Federal Reserve on Twitter has cast doubt on the independence of the Fed from President Trump.

The tweets

Chairman of the Federal Reserve, Jerome Powell, is currently keeping interest rates much higher than President Trump feels is appropriate. Trump feels as though the Fed’s current monetary policy is pushing up the dollar and as a result, causing the U.S. to be less competitive on a global scale.

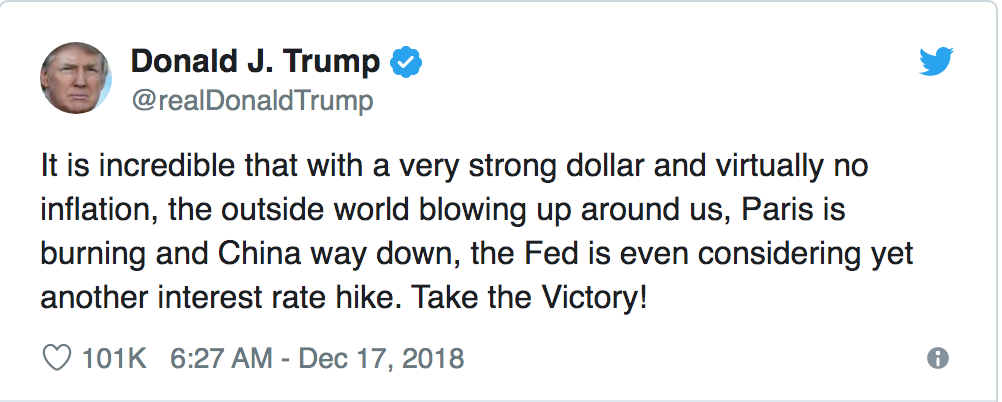

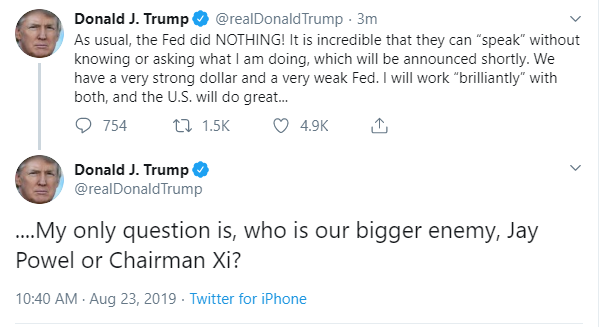

To voice his disapproval and frustration with the Fed’s recent decisions, Trump has essentially begun to cyberbully the Fed via Twitter. Shocking, no? In these string of tweets, Trump has accused the Fed of having no guts, sense or vision. He even deemed Powell a “terrible communicator!”. In the tweet pictured below, we see that Trump has gone so far as to suggest that the Fed raising interest rates is insensitive to other current events.

It’s important to note that in November of 2017, Trump himself nominated Powell to the position of Chairman of the Federal Reserve. Powell’s decisions that don’t properly mirror Trumps desires has caused Trump to publicly say, “Where did I find this guy Jerome?!”

As we know, the Federal Reserve operates independently from the President. This lack of control clearly has frustrated Trump’s and his dreams for an expansionary monetary policy. Like most rational adults, Trump has used Twitter as his emotional outlet. However, these exclamatory and bitter tweets are almost indirectly granting the President with a sense of command over the Federal.

The repercussions and findings

Economists from the London Business School and Duke University have come forward to report that Trump’s tweets have had a “statistically significant and negative effect on markets.” As a result, investors are now anticipating that central bank to give in to these political pressures and consequently, lower interest rates. A study performed by the National Bureau of Economic Research (NBER) has discovered these findings.

Economists and scholars have come to this conclusion by closely analyzing the shift in Fed funds future contracts, over both short and longer terms, in conjunction with their reaction to Trump’s tweets about Powell and the Fed. (The Fed funds futures are defined as the financial contracts that indicate what the market’s opinion of where the federal funds rate will be at the time of the contracts expiration)

CNBC explains that within the Funds Market, traders essentially bet on or predict where the Fed’s benchmark overnight lending rate will end up. Policy makers and economists have watched closely for changes in how the markets view where interest rates are heading. They have found that the 30-some-odd tweets about the Fed have lowered the Fed funds futures contract by 10 basis points.

Basis points are a common unit that are used in relation to interest rates and other types of financial percentages. 1 BPS is equivalent to .01%, 10 bps means .10% and so forth. Economists have noted that Trump’s tweets have knocked the Fed funds future by 10 bps, or as we now know, .1%. If we look at this not in the context of the Fed funds rate, this appears to be a pretty miniscule percentage. However, the Fed generally adjusts its rate by 25 bps and currently, the target fed funds rate is somewhere between 1.75% and 2%. So in reality, this .1% is a pretty substantial percentage.

The study done by the NBER infers that because of these findings, economists are reporting that the impact of these tweets will cause the Fed to give into external political pressure, which will thus tarnish the central bank’s autonomy. While Trump can not directly influence the Fed, his publicized pressure is indirectly changing market expectations of the Fed which in turn, can most likely influence their next move.

Why it matters

So why does this matter? The Central Bank is not a government agency and in turn, they operate autonomously from the President. It’s rights and privileges are guaranteed by the law. However, these findings show that the market expectations can and have a high chance of influencing the decisions of banks. When it comes to calculating monetary policy, the Fed may end up looking at market expectations to help decide on policy.

Additionally, these reports and predictions create a perceived lack of independence between politics and the Fed. Potential investors might feel as though this political influence and perceived interference in our central banking system might make investing in our economy too unpredictable and risky. This might in turn cause them to invest their money in foreign markets, therefore detrimentally impacting the U.S. economy.

Sources

- https://www.bloomberg.com/news/articles/2019-09-23/trump-s-fed-tweets-shown-to-have-significant-effect-on-trading

- https://www.cnbc.com/2019/09/23/fed-rates-markets-bet-that-trumps-twitter-attacks-will-move-rates.html

- https://www.cnbc.com/2019/09/24/trumps-tweets-on-the-fed-and-tariffs-also-are-impacting-gold-prices.html

- https://www.cnn.com/2019/09/24/business/trump-fed-independence-twitter/index.html

- https://www.reuters.com/article/us-usa-fed-trump-tweets/trumps-tweets-threaten-feds-independence-push-rate-expectations-lower-study-idUSKBN1W82II

- https://www.forbes.com/sites/simonconstable/2019/09/23/trumps-tweets-shows-how-the-fed-lost-its-credibility-with-investors/#f31db7871ae1