A rise in men’s underwear sales might be part of the signal that the Liaoning Province in northeast China’s is on the path to recovery.

The economic growth of Liaoning Province was 4.2 percent in 2017 and 5.6 percent in 2018. At the same time, according to a report released by JD Big Data Research Institute, part of one of China’s biggest online shopping sites, sales of men’s underwear in Liaoning rose 42 percent in 2017 over the previous year and went to another 32 percent in 2018. The rate of increase in underwear sales in Liaoning was greater than in any other province. An analysis of consumption also shows that Liaoning’s consumers pay more attention to the quality and color variety of clothes.

“The recovery is mainly due to coal and steel prices rising during the period, and the recovery can also be seen in the volume of railway and road freight, electricity consumption of industry, volume of business and employment,” said Liang Qidong, vice president of the Liaoning Academy of Social Sciences, on a Global Times report.

Liang also addressed that the Men’s Underwear Index and similar indexes like “yogurt index” and “bread index” could be taken as an economic indicator.

Liang was not the first person to come up with the concept. Back in the 1970s, Alan Greenspan, the former chairman of the Federal Reserve, first introduced and popularized the Underwear Index. Greenspan found that there was a close connection between the economy’s performance and the sales of men’s underwear. Declines in the sales indicate a weak economy, while upswings predict a recovery in the economy. Behind the theory, a basic assumption is that men’s underwear is a necessity instead of a luxury item, so sales of men’s underwear will keep relatively stable except in times of a sluggish economy. Therefore, men’s purchasing habits for underwear is thought to be an effective economic indicator that can detect the beginning of a recovery during an economic downturn.

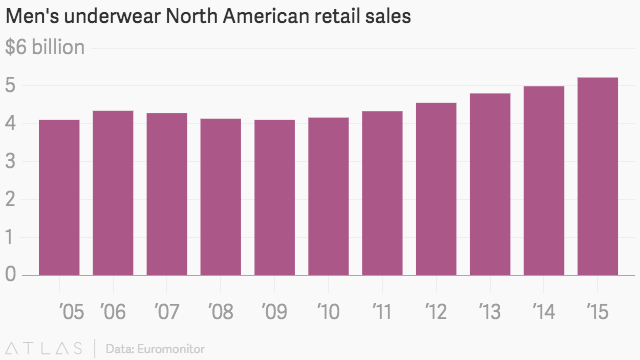

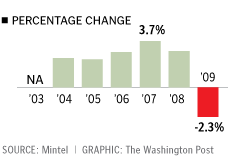

The sales of men’s underwear dropped in an economic recession in the United States. Data show a 2.3 percent drop in sales of entire men’s underwear products in 2009, according to Mintel, a London-based market research firm. While as the economy recovers, sales of men’s underwear in the United States have risen. As reported by Quartz, U.S. underwear sales grew by nearly $1.1 billion between 2009 and 2015, after falling in the wake of the 2008 financial crisis. Hanes, a popular lingerie brand, has seen a similar trend.

“If you look at sales of male underpants it’s just pretty much a flat line, it hardly ever changes,” economist Robert Krulwich told HuffPost in an article after the publishing of Greenspan’s book, “The Age Of Turbulence.” “But on those few occasions where it dips that means that men are so pinched that they are deciding not to replace underpants. And [Greenspan] said ‘that is almost always a prescient, forward impression that here comes trouble.’”

However, the concept may be not academically accurate, even though the Underwear Index can be used to reflect the economic situation from a province to a nation. Several reasons presented by critics on Investopedia should be considered, including the frequency of women purchasing underwear for men, and an assumption that men would not purchase new underwear until it is threadbare, regardless of the economic condition.