On a recent evening, Xiaofeng Li followed her usual routine, heading to the beach near her Playa del Rey apartment for an after-dinner walk. Lee used to make the five-minute drive to the beach in her car, but when the motorized scooter craze reached her neighborhood, she decided to give it a try. The ease and convenience of a scooter for the short trip hooked her immediately. On this evening like most others, after coming home from her job as an office engineer in a construction company, she grabbed a shared e-scooter from the stand near her front door, hopped on, and pointed it beachward.

This time, though, things went terribly wrong. As Li coasted downhill toward a busy intersection, she tried to engage the break but got no response. Instead the scooter continued to accelerate until she lost control, forcing her to leap off before colliding with traffic. Still in motion from the speed of the scooter, she tumbled to the asphalt, suffering gashes on her knees, arms and hands. The accident gave her a shock.

“I was desperate when the brake failed,” Li said, speaking in her native Mandarin Chinese. “The only thing I could do was jump. It was the first time I realized that the scooter is not safe.”

Since September of 2017, startups including Bird, Lime and Spin have introduced thousands of shared e-scooters to the streets in and around Los Angeles. The internet-connected scooters are managed through apps on smartphones and the steps are simple Download an app for a scooter company, use the map to locate the nearest scooter, enter the credit card information, upload driver’s license photo, scan a barcode to open a scooter and then you can ride it. Park the scooter and end the trip on the app.

Shared e-Scooters in Santa Monica | Photo by Yuming Fang

The scooter startups market their products as a cheap, easy and environmentally friendly way for riders to reach last-mile destinations in cities with traffic jams and gaps in public transportation. It costs a flat fee of $1 to ride a scooter plus 15 cents per minute using a pay-as-you-go financial model.

The shared e-scooters have been in people’s sights fewer than two years, but the safety problem has become one of the most serious issues that scooters encounter. Cities have limited the total that each operator can have on the streets. In Santa Monica, each operator is capped at 2,000. In L.A. the maximum number of e-bikes and e-scooters per vendor is 2,500. But even with these caps, critics say other problems with the scooters have not been addressed. Certain stretches of Santa Monica or L.A. can seem overwhelmed by scooters, which riders can simply deposit anywhere, and which often wind up scattered randomly on the sidewalks. And concerns are mounting that scooters present a range of unaddressed safety hazards, both in their regulation and design. Since Oct. 18, 2017, a total of 60 scooter related incidents in Santa Monica have required an Emergency Medical Services response, according to the Santa Monica Fire Department. Incidents included scooter rider and vehicle collisions, as well as pedestrians tripping and falling over abandoned scooters strewn on sidewalks.

“My opinion, get rid of them,” said Julian Zermeno, Santa Monica’s EMS paramedic coordinator, in an email. “We have been on many scooter medical calls due to the riders falling down, crashing into people and getting hit by other vehicles.”

In addition to the safety problem, critics say dockless scooters block sidewalks, disability access ramps and green spaces, and rampage through the streets, which affect both pedestrians and vehicle drivers. As scooters are dumped in public places, people who don’t like them have easy access to abuse them. An Instagram account “birdgraveyard” says it is “a place for people to show their frustration” with the scooters, and features images of scooters that have been vandalized and discarded in the ocean and in dumpsters and shopping carts.

Credit to @birdgraveyard

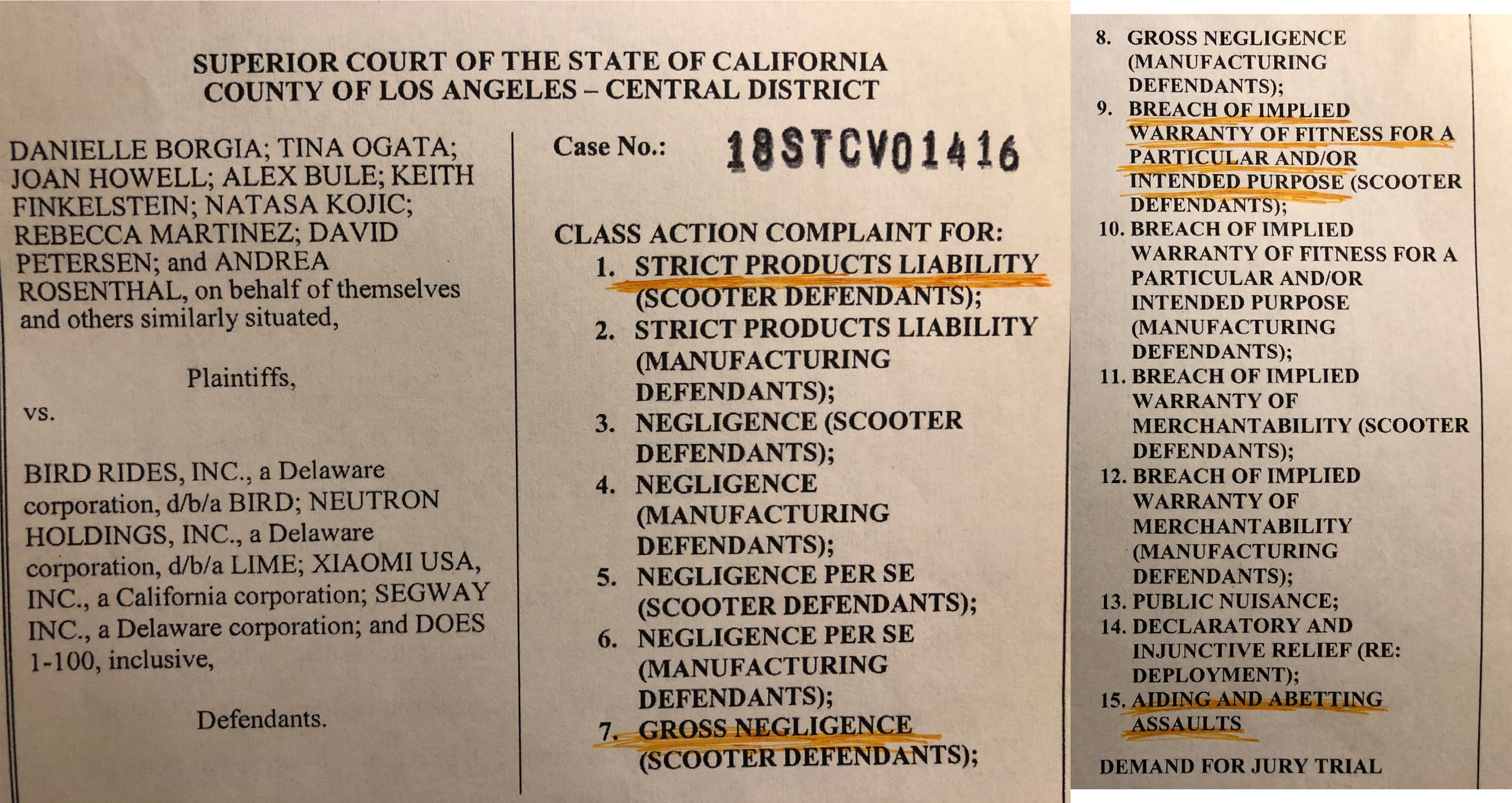

Now, a class-action lawsuit filed in Superior Court of California has accused Lime, Bird, Xiaomi as well as other scooter firms of “strict products liability”, “gross negligence” and “aiding and abetting assault.” The plaintiffs of the lawsuit include a scooter rider, a motorist with a disability who was unable to access a parking space because it was blocked by scooters, and seven pedestrians injured by electric scooters.

Lawsuit File | Photo by Yuming Fang

Also, Lime, one of the leading scooter startup, was reported that their scooters would break apart when using. However, the problems didn’t block their growing speed for the nature of capital to pursue profits. The scooter craze has captured the heart of Silicon Valley and attracted billions of dollars of investment from venture capitalists. According to Bloomberg, Bird’s evaluation has reached $2 billion in June at an astounding pace. And the new fundraising round of Lime in June has valued Lime at a $1.1 billion. There is no authoritative statistics to show how many scooters the startups have distributed to the streets. But statistics from Lime and Bird show that Bird has worked out to 98 markets while Lime has had 149 markets within one year. With the powerful push from capitals, scooters startups cannot slow down their pace but expand their scales and markets at home and abroad, thus resulting in negligence in product quality and operational management.

Looking back the past three years, e-scooter is not the first shared micromobility launched for last-mile distance. From 2016, bike sharing took off in China’s cities, with lots of companies flooding the city streets with millions of shared-bikes. Time reports that around 60 companies have dumped between 16-18 million bicycles on Chinese streets. Similarly, shared-bikes can be unlocked when riders use the app to scan the barcode on bikes, charge riders with lossmaking low rental fees based on the time length per ride, and be parked at the roadside for the next customer. However, over the three years, China’s bike sharing project has experienced mania, then from bad to worse. What has happened to china’s shared bikes and will American’s shared scooters encounter the same experience?

According to People’s Daily, the state-run media in China, China has 400 million registered bike-sharing users and the daily number of riders peaks at 70 million. Also, Seventy-seven shared-bike companies have emerged in China over the last two-plus years, with a combined total of 23 million bikes distributed in China’s cities, towns, and even villages.

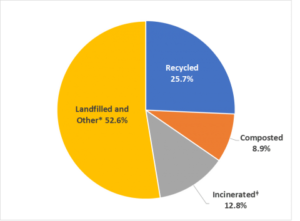

However, China’s bike fever has reached its saturation under unlimited blind competition. For the purpose of expansion, bike-sharing companies continuously purchased bikes from suppliers and distributed bikes on the streets. For one time, people can see eye-catching colorful bikes in every corner of the streets, resulting in an overcrowding of public spaces specifically in areas centered around public transportation such as sidewalks, metro stations, and bus stops. Also, without timely inspection and maintenance, dozens of bikes are broken and left casually in corners. In order to manage the situation, local municipalities have collected the bikes and dumped them in landfills. On the outskirts of leading Chinese cities, rows of brightly-colored bicycles are packed like trash in the tight formation after they are reclaimed. In August 2018, China’s national-level Ministry of Transportation issued a formal regulation, after which 30 Chinese cities passed regulations to guide shared bikes’ production, operation, and maintenance. The pace of bike production and distribution has slowed down and accordingly cooled down the cash-burning bike-sharing trend.

Shared Bikes Landfills in China | Source: Reuters

From June this year, several sharing-bike companies experienced capital chain rupture and stopped operation. Even Ofo, one of the two dominant dockless bike-sharing companies in China, got into trouble that it quitted overseas countries and cities from June and its domestic users could not get in-app deposit refunds because the refund button became grey and the customer service didn’t work. China’s media reported that “Ofo is getting into the capital chain problem and struggling for survival.”

According to the China Business Network, an employee of Ofo said the bike-sharing companies’ trouble is due to their lack of management. “It invested heavily in rapid market expansion, leaving less money for refined management, and operation and maintenance,” the employee said. Bike sharing companies should have focused on operation and maintenance details such as product optimization, scheduling and repair, and products’ revenue and costs. However, these companies didn’t stop to solve management problems but constantly asked for fundraising for speedy scale expansion. Also, the governments didn’t carry out regulations timely until they cannot ignore the problems shared bikes have brought to the society.

In comparison with shared bikes, e-scooters in the U.S. are experiencing similar situations. But we couldn’t conclude that the fate of shared e-scooters in the future would be similar to shared bikes in China. The lessons we could learn from shared bikes in China is that don’t let capital control the company’s development; in other words, scooter startups should focus more on user experience and products upgrading rather than pursue venture capitalists’ investment. Now, at first, the safety problem should be the top priority to resolve for scooter startups.