With a growing number of cell phone repair stores in Los Angeles, how do they grasp their competencies, how do they survive, when new technology updates and brings new phones to the market every year?

In a 1500-square-foot store on South Figueroa Street in Los Angeles, Nathan Kim sat in front of his work station all alone, covering his eye with a head loupe magnifier and installing the last tiny round widget on the back of an IPhone screen. As soon as he finished up, he put the screen aside, away from the pile of different brass and gray widgets sprawled all over the desk.

Kim opened the iPhone repair store after he graduated from the University of Southern California with a bachelor’s degree in computer science. Seeing the fast updates and replacements in the cell phone market, many people like Kim were attracted by the potential profits and opened phone repair service stores.

In L.A., there are about 40 similar stores searchable on Google Maps. Some stores try to keep their locations concealed. Some of them run in apartment complexes; others provide door-to-door services by making appointments with repairers via phone or Craigslist (a classified advertisements website).

“They are doing home business without a proper license,” Kim said when he found an “iPhone screen repair” service on Craigslist. “This only costs $39 to fix a screen, while I charge $65.

Kim’s working station. Electronic Registration certificate hanged in front of this desk.

“If there is any problem, they won’t be responsible for that, and their customers will become the victims.” The license he referred to was an Electronic Registration certificate issued by DCA (Department of Consumer Affairs), which hung in front of his work station.

Cutting the cost and keeping the business small but efficient are the core strategies for most store owners. Running the store in an apartment would be less nerve-wracking and probably cost less money than subletting a commercial property. Having only one or three people running the store would also allow each person to take home a larger share of the pie. Also, finding good retailers to supply continuously with cheap phone parts would help a lot.

Regardless the labor cost during repairs, phone parts suppliers have the greatest power of controlling the prices. “When the iPhone 5 was first released, the part (screen) cost about 180 bucks. Now it’s 80 bucks,” Kim said.

Every time a new phone came out, large demand would promptly cause the suppliers to lower the prices of the old phones’ parts. Particularly, the value adjusted a lot when iPhone 5 was released.

“There was a mass production of them (iPhone 5 parts) – the screens, the back plates, the batteries. Everybody needed them. Everything was super cheap,” said Herbert Reyes, the owner of All Wireless World located at East Hollywood. “Repair, that’s the best thing (to earn profits).”

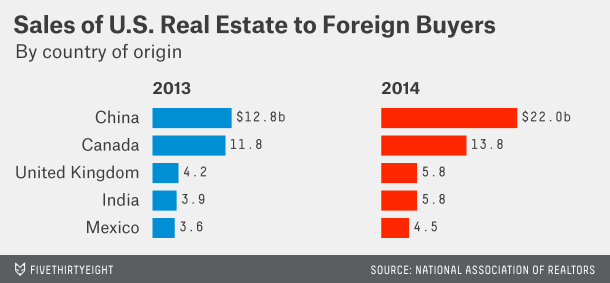

China, the world’s factory floor, has become the biggest supplier behind these dispersed phone repair stores in L.A. “They (parts and accessories bought from Chinese retailers in L.A.) are pretty much the same quality you will get for $35 from somewhere else,” he said.

Purchasing large amounts of parts will give buyers cheaper prices than buying a single part. Thus, the cheaper prices the store owners could get from retailers, the cheaper prices they would sell to their customers. Kim offered the customers discounts depending how the prices vary. Reyes chose a new path by providing a customer discount once they did a check-in or a review on Yelp (an online service to provide consumers with information about local businesses). He would also evaluate the prices offered by the others on Yelp, and then lower his price $5 to $10 below than the average price.

The phone repair business is extremely competitive in L.A., which forces many business owners to compete with the lowest price that they can offer. Most business owners are confident and positive about their competencies.

Since cell phones have become an essential needs for most people, customers who come into the stores mostly need to get their phones fixed as quickly as possible. Having a background in Computer Science and engineering, Kim said he knew the basic structure of the phone, which made him an experienced, fast phone-fixer.

“My customers tried to fix their phone in other places but they didn’t know how to fix it; they didn’t know how to fix water damages,” he said. “I’m pretty sure they will have some problems whenever there is a new phone coming out.”

When the iPhone 5, 5C or 5S first came out, Apple did not only upgrade their iOS systems and cover them with better-looking cases, it also changed their interior design, which made the phones easier to fix.

“The first time I opened an iPhone (4), it took me 4 hours to open it and 2 hours to close it,” Reyes said. “Now I can do it within 20 minutes. (The screen of) iPhone 5 is actually much easier to fix, because you don’t have to take everything apart.”

As iPhone 6 and 6 Plus have been released on Sept. 9, most of the business owners are unsure about what will they do if someone bring a broken 6 or 6 Plus to their stores. Reyes said he would contact his suppliers to make sure they had the parts, so that he could get prepared for any upcoming damages to these new phones.

Harbert Reyes’ All Wireless World and his employee.

“I will get myself an iPhone 6. And I will open it to see which part goes with which,” Kim said.

Regardless of dealing with technological difficulties, Reyes values customer services more than anything else. “As long as you do really good customer service, people will come to you,” he said. “There is a well-established strong connection between me and people.”

To make extra profits, many owners like Kim and Reyes expand their businesses by selling accessories, such as phone cases. “People will get a phone, and they will need accessories,” Reyes said. “There is always something to sell.”

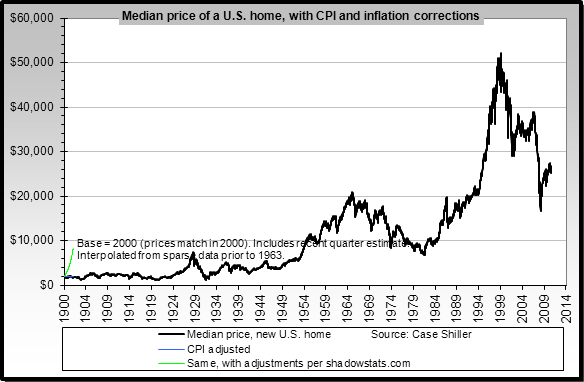

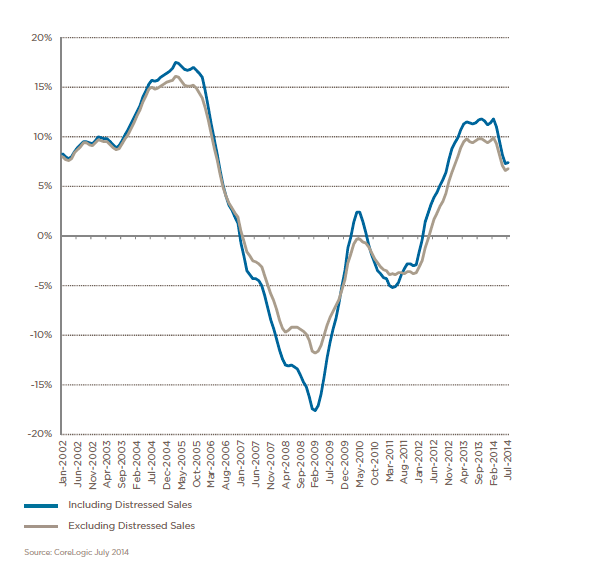

When asking about the future of real estate market in the U.S., Ji expressed her concern over the median-price house market: “One challenge we are facing now is that there are less and less affordable houses in the market.” While the demand for median price house is going up, the supply is actually going down. In July, the median transaction price was $457,000, which is 7.6% higher than that of last year. Also, the market volume, which is 7012 this year, is 12.5% less than that of last year, according to CoreLogic’s recent report. Ji is worried that if the interest rate starts going up next year, there will be more competitions in the median-price house market.

When asking about the future of real estate market in the U.S., Ji expressed her concern over the median-price house market: “One challenge we are facing now is that there are less and less affordable houses in the market.” While the demand for median price house is going up, the supply is actually going down. In July, the median transaction price was $457,000, which is 7.6% higher than that of last year. Also, the market volume, which is 7012 this year, is 12.5% less than that of last year, according to CoreLogic’s recent report. Ji is worried that if the interest rate starts going up next year, there will be more competitions in the median-price house market.