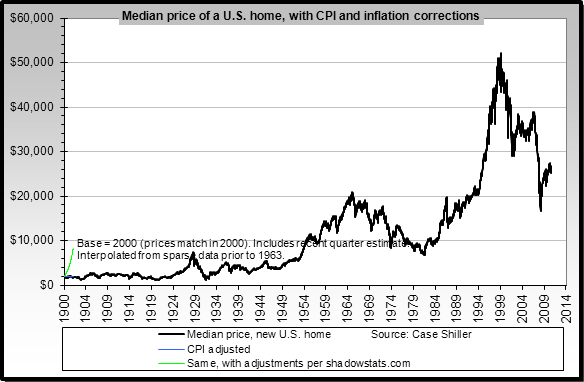

Speaking of the great depression in 2008, Craven Ji was a little bit upset: “The sales of homes dropped by 50% that year, and house prices also decreased by 30% on average.” “However,” she then added, “As the economy is recovering recent years, the market is seeing a brighter future. Home prices have recovered by approximately 25%, which almost reach that of the peak time in 2006.”

Craven Ji, a real estate agent in Real Estate eBroker Inc. in Los Angeles, has been in the business of real estate for almost 9 years. Different from her colleagues, most of Ji’s customers are Chinese. According to Ji: 67% of all her customers are Chinese immigrants while another 33% of them are overseas investors from China, either looking for investment opportunities or trying to find a new house in America. Ji does most of her business in Pasadena, Arcadia, San Marino, USC and UCLA neighborhoods where Chinese people aggregate.

“The year 2008 was a hard time for me,” she said, “There were little overseas Chinese investors that time, and the local market was also frustrated by economic recession.” Ji only sold 7 properties in 2008, which was much less comparing to her average record of 20 houses sold per year. In fact, although the U.S. interest rate was pretty low during the economic downturn, most homebuyers were frightened by the poor economic performance and were thus resistant to borrow money from the bank. “When people earned money, they’d rather pay off their debt to the bank than spend them on other consumptions. They were simply not confident with the market,” said Ji. Because most of her customers rely on bank loan to buy house, the unwillingness to borrow money would definitely impact her business. Also, as bank owned foreclosures set home prices extremely low, home sellers had to cut down their price to the same level to be competitive in the market. The two sides kept going back and forth, which resulted in a huge decline in the market volume.

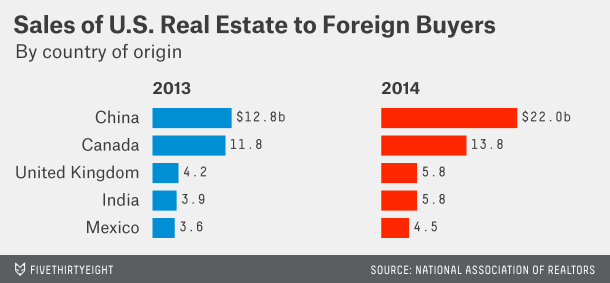

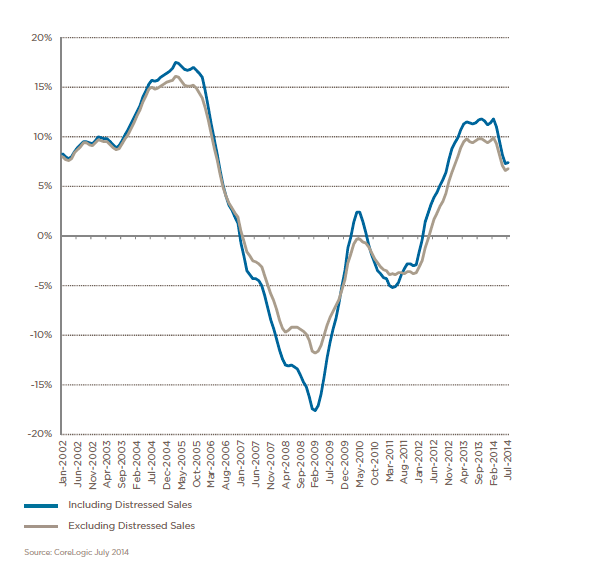

Now, several years after the real estate nightmare, the situation seems to get better. “Not only does the local market start to recover, but also does overseas capital continue to pour into the U.S. market,” said Ji. According to property consultant firm CoreLogic, home prices rose by 7.4% year over year in July 2014, and are expected to rise by 5.7% from July 2014 to July 2015. Moreover, according to LA Times, overseas homebuyers and new immigrants spent $92 billion on U.S. homes in the last year. The $92 billion amounts to 7% of all money spent on U.S. homes within a year, which is 35% higher than the year before. Among those purchases, 25% of them were made by Chinese buyers. Statistic shows that they are extremely interested in the Real Estate market in southland, including the city of Los Angeles, San Francisco and Irvine, which also helps drive up home prices in these areas.

Percentage Change in Home Price Index Year After Year

When asking about the future of real estate market in the U.S., Ji expressed her concern over the median-price house market: “One challenge we are facing now is that there are less and less affordable houses in the market.” While the demand for median price house is going up, the supply is actually going down. In July, the median transaction price was $457,000, which is 7.6% higher than that of last year. Also, the market volume, which is 7012 this year, is 12.5% less than that of last year, according to CoreLogic’s recent report. Ji is worried that if the interest rate starts going up next year, there will be more competitions in the median-price house market.

When asking about the future of real estate market in the U.S., Ji expressed her concern over the median-price house market: “One challenge we are facing now is that there are less and less affordable houses in the market.” While the demand for median price house is going up, the supply is actually going down. In July, the median transaction price was $457,000, which is 7.6% higher than that of last year. Also, the market volume, which is 7012 this year, is 12.5% less than that of last year, according to CoreLogic’s recent report. Ji is worried that if the interest rate starts going up next year, there will be more competitions in the median-price house market.

With home prices showing an upward trend and overseas cash flowing to U.S. market, some people may ask: will there be another cyclical real estate economic downturn in the future? Also, what about the housing bubble that once led U.S. economy to collapse? Well, the questions may be hard to answer now, but one thing we are pretty sure is that the housing market won’t crash, since buying house is an American dream that will never die.

Leave a Reply

You must be logged in to post a comment.