May 2012, Facebook’s IPO turned into a huge Wall Street debacle and plumped to $17.73 that summer. Today, the tech giant’s stock price has remained around $76 since this July, doubling the company’s IPO price of $38.

CEO Mark Zuckerberg belled ringer by his mobile strategy. When the social network went public, almost all its revenue came from desktop-based ads. But with more than 500 million people consuming Facebook portably, Zuckerberg needed to transition his business.

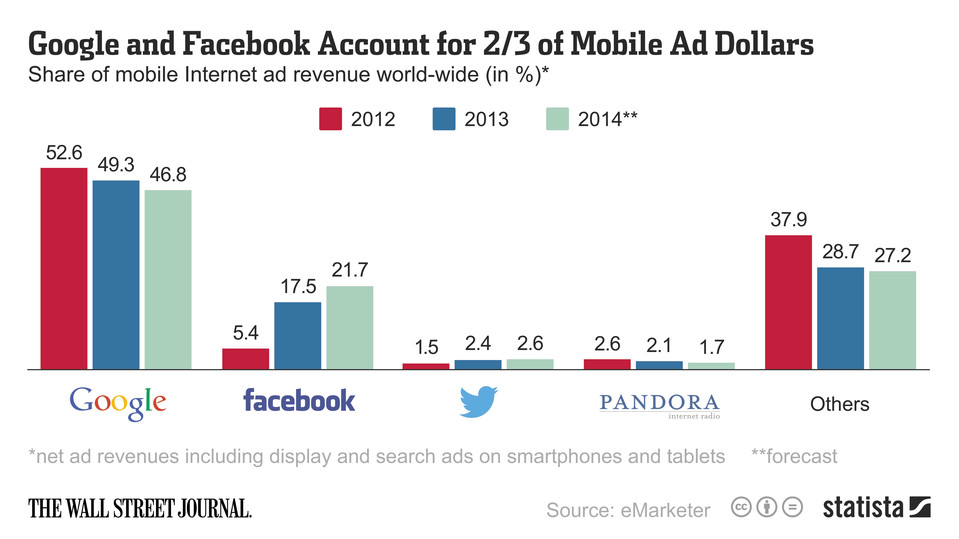

And that transition to mobile business turned out to be smooth and successful. What has been doubled is not only its stock price, also its mobile active users — around one billion people are actively using Facebook mobile app. What’s more, the social network’s mobile ad revenue takes up more than two-thirds of its total ad revenue. Facebook’s share of total mobile advertising market is predicted to pass 12 percent in 2014, quadrupling that in 2012. That makes Facebook the biggest beneficiary of the mobile age.

Google is another big player of mobile advertising. But its mobile ad revenue accounts for only one-third of its total ad revenue and the price tag on Google’s mobile ads are much less than that of its desktop ads, according to The New York Times. From Facebook’s perspective, things look completely different: one year after its IPO, Facebook’s VP of global marketing solutions Carolyn Everson claimed that Facebook’s mobile ads cost more than desktop ads.

The new auto-playing video product is helping Facebook’s mobile monetization as well. The company wrote in a blog post that its 15-second Premium Video Ads will start playing without sound in the News Feed, and the sound will start only when users tap the video.

The company started testing premium video ads last December and introduced these ads on Facebook with a select group of advertisers this May. Facebook will sell and measure the ads “in a way that’s similar to how advertisers already buy and measure ads on TV.” This new function targets “advertisers who want to reach a large audience with high-quality sight, sound and motion.”

Facebook-owned Instagram’s performance will also charge the giant’s mobile business ahead. The photo-sharing app, with 150 million active users, only started to play ads last November. Michael Kors and Ben & Jerry’s are Instagram’s early-stage clients. Spending $1 billion on Instagram two years ago, CEO Mark Zuckerberg has every reason to expect the photo-sharing app bringing in real dollars.

This March, Instagram made a 40 million digital ad deal with Omnicom, a major holding company having a great many big-brand clients, including Nissan, AT&T and Pepsi, and looking to establish a strong relationship with the growing mobile platform. Instagram will be displaying video ads some time as well, just as its parent does.

For today’s Facebook, “Every moment is mobile.”

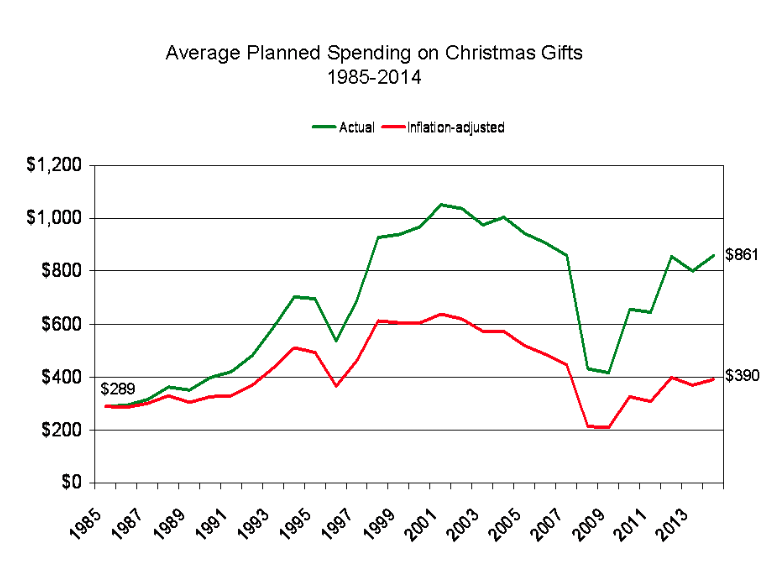

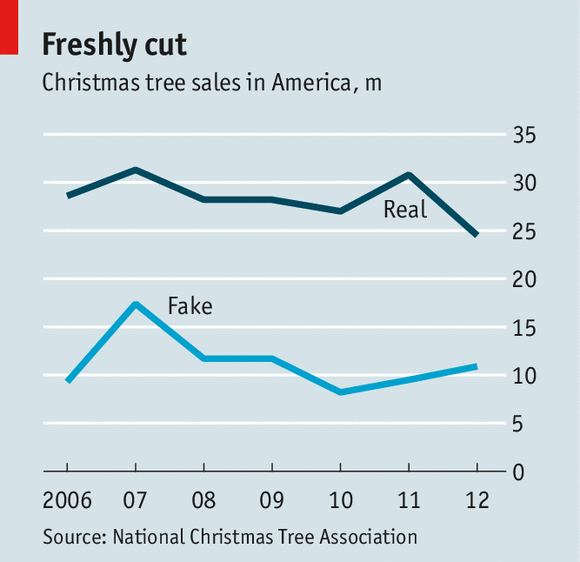

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an

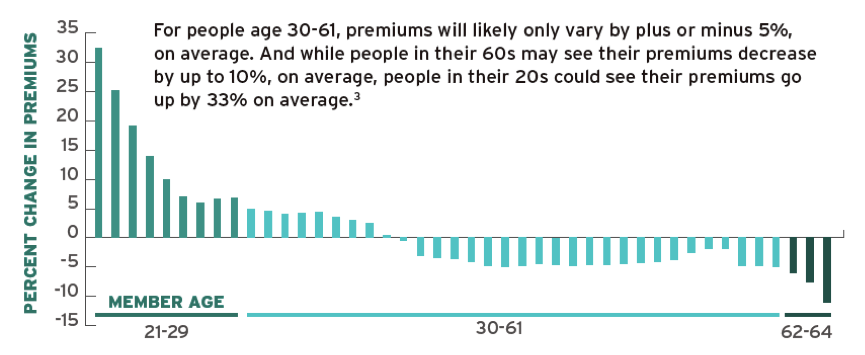

Some people may argue that there are subsidies available for young people with limited income. Yes, there are. But the truth is, for those who earn a little more than the poverty line, it’s hard for them to choose whether to earn more with no subsidy or to earn less with a small amount of subsidy. More importantly, for those healthy people who usually don’t have health problem, they would rather end up with paying penalties instead of purchasing health insurance, which is far more expansive than the penalty.

Some people may argue that there are subsidies available for young people with limited income. Yes, there are. But the truth is, for those who earn a little more than the poverty line, it’s hard for them to choose whether to earn more with no subsidy or to earn less with a small amount of subsidy. More importantly, for those healthy people who usually don’t have health problem, they would rather end up with paying penalties instead of purchasing health insurance, which is far more expansive than the penalty.