The United States emitted 6,511 million metric tons of carbon dioxide in 2016. Approximately 8% of those emissions are associated with agricultural industry. Globally, agriculture accounts for 24% of global emissions. Livestock alone accounts for about 14.5% to 18% of global totals, making the impact of animal production alone greater than that imposed by the entirety of global transportation. These emissions are warming the planet and cause for grave economic concern, should inaction remain the dominant strategy.

Source: EPA

According to Drawdown, the self-proclaimed “most comprehensive plan ever proposed to reverse global warming,” shifting to plant-rich diets is ranked the fourth most impactful solution (out of 80), reducing atmospheric CO2 by 66.11 gigatons.

If 50 percent of the world’s population restricts their diet to a healthy 2,500 calories per day and reduces meat consumption overall, we estimate at least 26.7 gigatons of emissions could be avoided from dietary change alone. If avoided deforestation from land use change is included, an additional 39.3 gigatons of emissions could be avoided, making healthy, plant-rich diets one of the most impactful solutions at a total of 66 gigatons reduced.

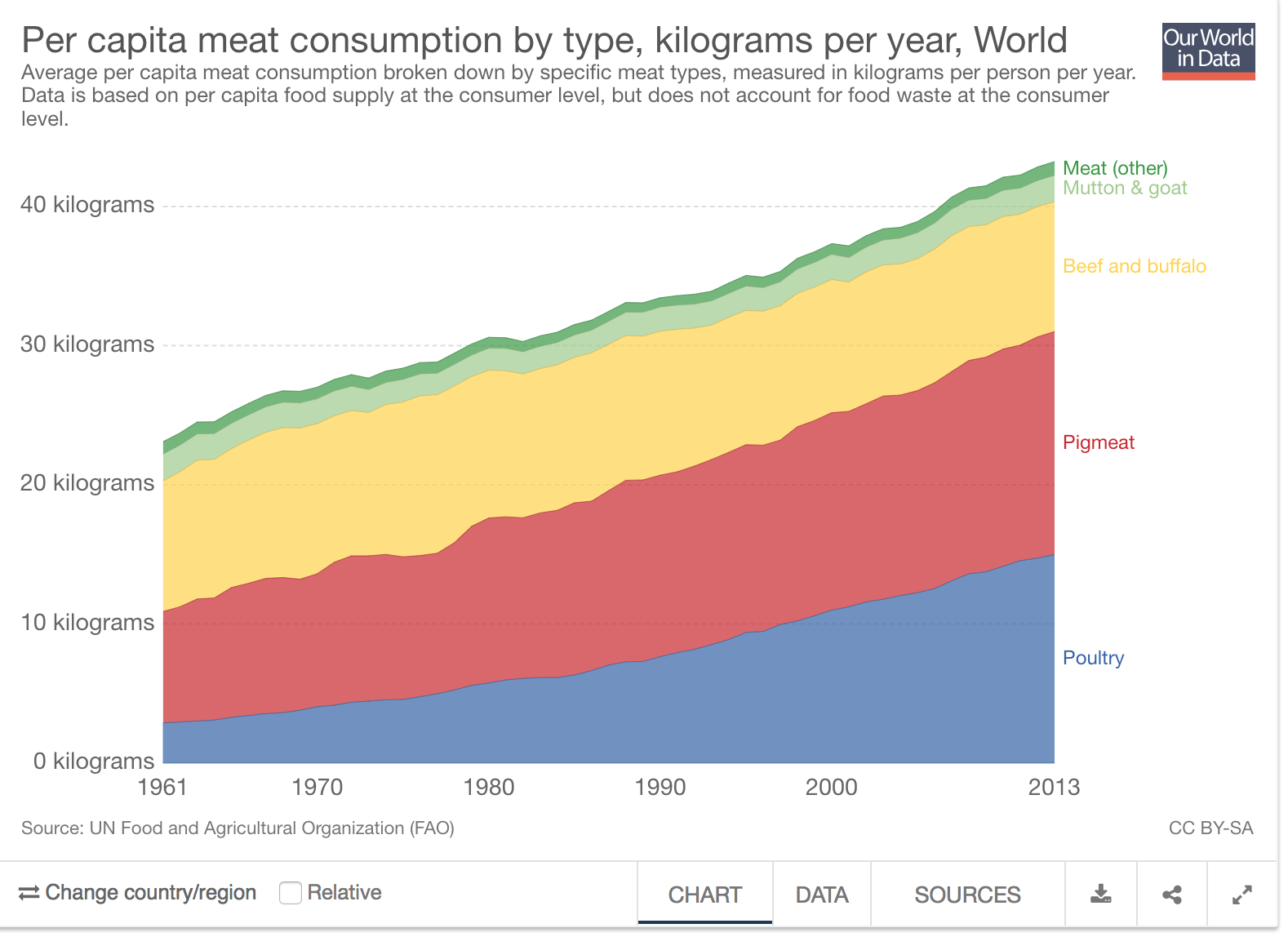

Despite the well-documented research of the benefits of a plant-rich diet, there has been little impact on global meat consumption. Global meat consumption in all categories has increased linearly since the 1960s and doesn’t appear to be slowing down.

Source: Our World in Data

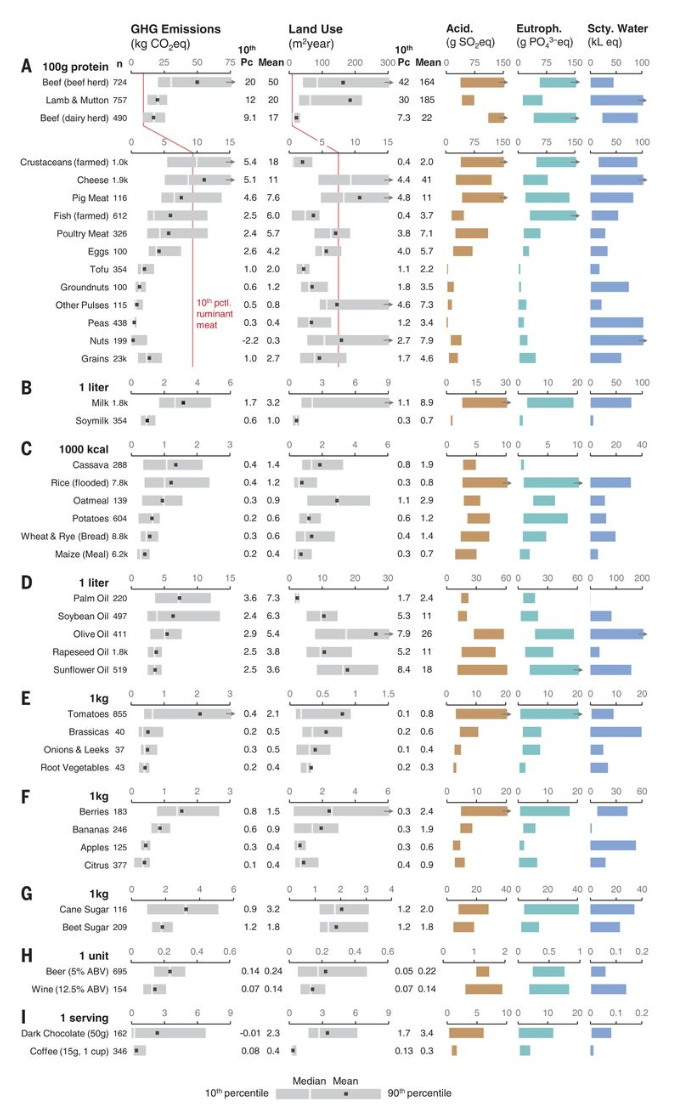

A recent paper authored by Joseph Poore of Oxford University and published in Science indicates both alarming new research regarding food emissions and hopeful solutions. Poore’s findings indicate that animal products, particularly red meat, contribute substantially more to carbon impact than any plant based food. Average greenhouse gas emissions, or kilograms of CO2 equivalent, for 100g of protein from beef are 50 kgCO2eq. For peas, that number is 0.4 kg.

Source: Science Poore offers a powerful solution: give more power to the consumer. Food consumption is a uniquely personal choice requiring individual change, making any restriction on consuming foods with a high carbon impact (namely, animal products) rather impossible. Poore, and I, contend that labeling a food’s carbon impact is a viable action that may yield substantial results. In practice, this would look like an added piece of information required on nutrition labels. Carbon impact, like calorie content, would be required. On unpackaged food, carbon would be labeled on grocery store tags. Enforcement of a policy such as this not only democratizes information regarding food impact, but also allows customers to make conscious choices about the foods he chooses to purchase.

Poore offers a powerful solution: give more power to the consumer. Food consumption is a uniquely personal choice requiring individual change, making any restriction on consuming foods with a high carbon impact (namely, animal products) rather impossible. Poore, and I, contend that labeling a food’s carbon impact is a viable action that may yield substantial results. In practice, this would look like an added piece of information required on nutrition labels. Carbon impact, like calorie content, would be required. On unpackaged food, carbon would be labeled on grocery store tags. Enforcement of a policy such as this not only democratizes information regarding food impact, but also allows customers to make conscious choices about the foods he chooses to purchase.

The execution of a policy such as this must be nuanced, to be sure, and there are several questions that must be answered. Who will absorb the costs to obtain this information? Will all ground beef be labeled with the same carbon footprint, or will the label vary by supplier? How would we educate the public so that they understand the meaning of these new labels?

Providing more information to the consumer nearly always sounds like a good idea. But there are very real costs associated with a benefit such as this. Labeling all food products requires impact studies and manufacturing changes. Simply updating a food label costs businesses, on average, $6,000 per SKU, a significant cost for firms that produce hundreds of food items. We could imagine that labeling carbon may cost much more, as there are no current metrics to update—the information would have to be completely created. This information would be gleaned from impact studies, research that derives from tracing each ingredient to its origin and calculating its carbon impact in each setting, an activity that is sure to be much more costly than traditional nutrition labels, where information can be tested in a lab. Supply chains are rarely transparent or easy to track, and doing so will cost substantial amounts of money in compliance. There is also the matter of verification. Should companies be charged with labeling the carbon impact of each product, it would be easy, and almost predicted, that some of those numbers may be inaccurate and therefore, counterproductive. To execute this policy successfully there must be verification agencies in place—auditing for environmental impacts, not just financial ones.

To many companies, $6,000 or more per item is pocket change. For others, like emerging start-ups in the food industry, it’s the end of the company. For some farmers and suppliers of meat and produce, it’s unthinkable. For a policy such as this to be effective, all foods, not simply packaged foods, must be labeled. This puts extraordinary pressure on small players in the industry, many of which are those providing the healthiest, least polluting items. This dynamic indicates the need for government subsidies to assist financing large projects such as this.

Government subsidies may cause public outcry, particularly given the intense budget negotiations and lobbying power in Washington. In 2017, the United States government issued $16,185,786,300 dollars in farm subsidies, over $7 billion of which was allocated to commodities alone. If we were to allocate a fraction of these subsidies away from crops that we artificially overproduce, we could provide substantial funding for these impact studies that may assist in tangibly relieving the environmental impact of carbon in the food system.

As with all new ideas, these suggestions are bound to bring warranted debate and discussion, but the debates alone should not discourage us from enacting such policies. As with any action, there are trade-offs. An investment in labeling carbon is a plausible first step towards investing in a new version of the economic growth that considers environmental health in addition to financial.