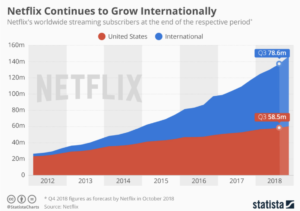

With 130 million subscribers, reaching an estimated 300 million people worldwide, Netflix has become an international phenomenon that has millions of people now binge-watching a variety of TV shows and movies. Netflix has completely disrupted and changed the distribution and content creating landscape in the entertainment industry. What started as a DVD rental delivery service has transformed into a streaming service spending over $11 billion a year on creating original, exclusive content. Netflix has effectively put Blockbuster out of business, is shrinking cable companies by the quarter and has studios scrambling to innovate to avoid being the company’s next casualty. The enormous effect the streaming giant has had on entertainment has led people in the industry to coin the term, “the Netflix effect.”

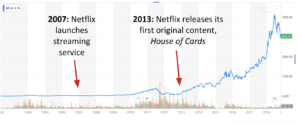

After Reed Hastings walked into a Blockbuster in 1997 and paid $40 in late fees after returning his VHS copy of Apollo 13, he came up with the idea of Netflix. Blockbuster operated 10,000 stores at its peak and had a market value of $5 billion in 2002 (Harvard Business Review). A company that once seemed unbeatable was being disrupted by a company that offered a more convenient business model and was significantly less expensive – especially without the dreaded late fees. At its beginnings, Netflix was a competitor of Blockbuster but not yet close to putting it out of business. Ironically, in the early 2000s, CEO Reed Hastings wanted Netflix to be bought by Blockbuster. When a deal wasn’t met, Netflix continued to grow on its own. Hastings clearly saw the opportunities the internet offered, and he invested in streaming. In 2007, Netflix launched its streaming service – they were no longer offering the same service as Blockbuster, they were offering more, and at a cheaper price. By 2010, Blockbuster filed bankruptcy and four years later all Blockbuster stores were closed.

Netflix has continued to expand its business, launching its first piece of original content in 2013 with House of Cards. At this point, their stock (NFLX) began to sky-rocket and their number of subscribers domestically and internationally were growing rapidly.

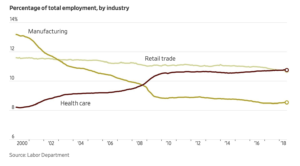

The vast amount of content Netflix was offering – from people’s favorite old TV shows to movie classics to fresh, original content – was extremely valuable to customers, at a still very low monthly fee. Studios and networks were benefiting off of Netflix as well; they were now able to sell Netflix TV shows and movies that had been collecting dust in their archives for years, and begin to make money off of that property again. It is cable companies who began to see “the Netflix effect” after the launch of original content in 2013, and have suffered tremendously ever since.

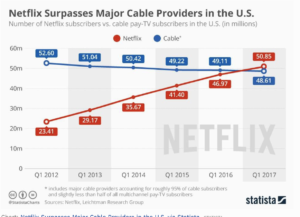

Netflix subscribers doubled from 2012 to 2017 while cable subscriptions were simultaneously declining quarter after quarter. In 2017, total Netflix subscribers surpassed total cable subscribers in the United States (Forbes).

More and more people started to see the value in cutting their expensive cable subscriptions for cheaper, commercial-free content. This had led cable providers, like Xfinity, to launch their own streaming services. But these have not been successful – live sports are the only thing keeping cable companies afloat at the moment.

As of December 2016, Netflix had a 75 percent market share in the streaming services market. YouTube was closest behind, at 53 percent, while Hulu, Amazon and HBOGo were all competing closely for market share (TechCrunch). While Netflix still maintains its dominance in the market, the landscape of competitors is about to drastically change, with traditional studios entering the market.

Netflix is now heavily spending on original content and this has studios, who were once working harmoniously with the company, trying to compete directly with them through launches of their own streaming services. Disney pulled all of their content off of Netflix earlier this year in preparation for the launch of their direct-to-consumer service, Disney+. Similarly, WarnerMedia has announced they are launching a streaming service, using their library of 7,000 films and 5,000 TV shows in order to attract customers. Additionally, there have been massive moves towards consolidation in the industry – most recently with Disney purchasing 21st Century Fox, effectively eliminating an entire studio. Disney now has more content at their disposal, and one less competitor trying to edge out Netflix.

Netflix has been challenging the studio system for a few years now, forcing them to modify their traditional practices. They have lured some of the most coveted industry talent away from their long-time studio homes with enormous contracts. Ryan Murphy, creator of Glee and American Horror Story, signed a $300 million deal with Netflix, leaving 21st Century Fox. Creator of Grey’s Anatomy, Scandal and How to Get Away with Murder, Shonda Rhimes, left ABC (Walt Disney Co.) after over a decade for a $150 million deal. These deals have not only increased hostility between Netflix and studios, but they have changed the entire economic system of the industry. Producers used to own a piece of their shows outright, potentially earning hundreds of millions of dollars by selling the rights to reruns. Tom Werner, for instance, made enough money from The Cosby Show and Roseanne to buy a sports team. Friends creators and talent are still earning residuals every time an episode is aired on Nick At Night or TBS – or sold to Netflix. There’s no back end on Netflix. “You get more upfront with less risk, but potentially less upside in success,” explains Chris Silbermann, Rhimes’s agent at ICM Partners. Rhimes now is working on developing and producing several shows at once through Netflix, something she would not have been able to do at ABC.

In order for studios and networks to maintain their top talent, they must now offer extremely competitive contracts to their employees. Warner Bros. recently offered one of their star producers, Greg Berlanti, a contract worth $400 million to stay at Warner Bros. until 2024. Berlanti currently has fifteen shows on the air, the most of any TV producer in history. Warner Bros. cannot afford to lose him and his success, so they must pay the extremely high price that Netflix has set for them. Lionsgate and Disney have made similar deals with their top executives. Traditional studios are tired of Netflix, and they are beginning to fight back relentlessly. A talent agent at Creative Arts Agency, Joe Cohen, has noted how harsh of an environment this has become in the industry, “There is a lot of crazy stuff happening in the market today, and there is an aggressive dividing line between what is now considered old media companies and new media companies.” This is a line that old media companies are trying to blur as much as they can, and have put an enormous amount of their efforts and money into doing so.

All of these major changes in the entertainment industry prompted by Netflix’s disruption are so significant, and have gained so much media attention, because the industry has not shifted this much and this dramatically since 1948. Then, the supreme court hearing, United States v. Paramount, ended studios being able to own theaters and exclusively show their own movies at those theaters. The studio system completely collapsed and studios were forced to adjust. Now, the old media companies, which now encompass the studios, must adjust to the disruptions caused by Netflix and begin to innovate themselves. The result is an aggressive environment, with no signs of the growing disruptor slowing down. For reference, AT&T shares have sunk 15 percent in five years compared to a 480 percent rise for Netflix. (The Hollywood Reporter)

With all of Netflix’s massive successes – unbelievable subscription numbers, huge international reach and 112 Emmy nominations in 2018 – it is easy to overlook their massive debt problem. They spent $11.7 billion on new content in the last year, but only brought in $14 billion in revenue. The reality is, Netflix is a barely profitable company that has approximately $10 billion in outstanding debt, with no signs of slowing down on their spending. Steven Birenberg, founder of Northlake Capital Management, notes, “Netflix seems to have proved that a model of all types of content, all genres for all people, can be successful — at least if success is measured by subscribers.”

With more players entering the direct-to-consumer market, many industry professionals are wondering how sustainable Netflix’s business model is. Many financial analysists already believe that Netflix stock is overvalued, but when their market share soon begins to be eaten into by streamers with a library of premium content, they will no longer have such a unique business. Big tech companies like Amazon and Apple, who have a lot of money to spend, are also working for their share of the pie in the streaming space. With the potential of Netflix being disrupted itself in future years, investors will likely take notice to the change in landscape and urge Netflix to cut back its spending in order to maintain long-term success. Already in the last six months, NFLX stock has declined dramatically – a perceived correction of an over-evaluation by analysts and investors.

Not only are all of these changes affecting companies internally, and within the Company Town of Los Angeles, but navigating this new landscape poses a potential challenge for consumers. It will be a battle among marketing and public relations professionals to communicate to them in the future. Will a single household be subscribing to Netflix, Hulu, HBOGo, a Disney service and a Warner Bros. service? Or will there be even more consolidation?

Sources:

https://www.hollywoodreporter.com/news/netflix-effect-can-rivals-compete-by-bulking-up-content-1162416

https://www.hollywoodreporter.com/features/welcome-hollywoods-new-age-anxiety-1127792

https://www.forbes.com/sites/ianmorris/2017/06/13/netflix-is-now-bigger-than-cable-tv/#217b95cf158b

https://hbr.org/2013/11/blockbuster-becomes-a-casualty-of-big-bang-disruption

https://www.latimes.com/business/hollywood/la-fi-ct-att-streaming-service-20181010-story.html

https://www.bloomberg.com/news/articles/2018-10-04/netflix-is-forcing-hollywood-into-a-talent-war

Netflix reaches 75% of US streaming service viewers, but YouTube is catching up