From the second quarter of 2014, there has been a sharp decline in global fuel prices, which not only meant a lot of extra money being saved for vehicle owners, but also meant major changes in the sales and profits of automobile manufacturers. Vehicles and fuel are dependent on each other, and the price and demand for one affects the price and demand for the other. The fuel industry is driven by car sales, and changes in fuel prices also greatly impact consumer spending on vehicles, which in turn affects the revenues and profits of automakers. There are different ways in which automakers can be affected by volatility of oil prices. Changes in oil prices affect overall consumer spending and behavior. Also the sales of fuel-efficient, high fuel consuming cars and alternative fuel cars are affected differently when hit by a substantial increase or decrease in oil price.

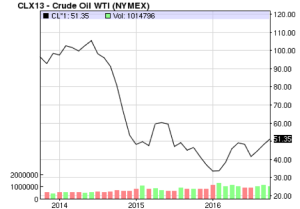

The trend in oil prices for the past three years is shown in the following graph published by the NASDAQ stock exchange.

The last three quarters of 2014 is the crucial period that is to be focused on when exploring the correlation between declining fuel prices and vehicles sales and profits made by manufacturers. A more comprehensive view of these quarters as compared with its previous years can be seen in the following graph.

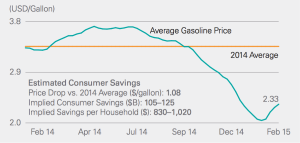

The average oil price decrease through 2014 has greatly impacted consumer spending and saving. When oil prices go down, consumers think they are inevitably saving a lot of money. In a paper published by NACS, Jeff Lenard elaborated that fuel is a commodity that is intertwined into an average citizen’s everyday life and changes in fuel prices fundamentally impact consumer spending and behavior in different ways.

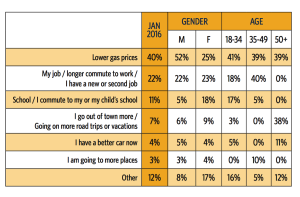

Firstly, some consumers might change their driving habits. When asked through a NACS survey why people were driving more when compared to the previous year, the answers by people from different genders and age groups were very close to the results summarized in the table below.

It is evident from this table that lower gas prices were 40% of the reason why people chose to drive less and these people were almost equally distributed throughout all the age groups. Hence this indicates that fuel prices have an affect on consumer spending and consumer behavior, which is critical to the sales of the automobile industry.

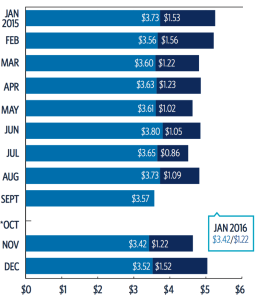

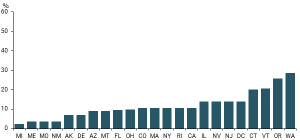

Secondly, consumers are sometimes able to make decisions on weather they will reduce their driving if gas prices increase. A different survey, also conducted by NACS explored this issue and asked people how much would oil prices have to increase for them to lower the number of miles they drive, and the results were summarized in the graph below. The graph below illustrates the average gas price for each month and the increase in the oil price that would have to occur for consumers to start reducing their driving. Most results show that if oil prices were even $1.00 more per gallon, there would be a direct effect on the number of miles driven by vehicle owners.

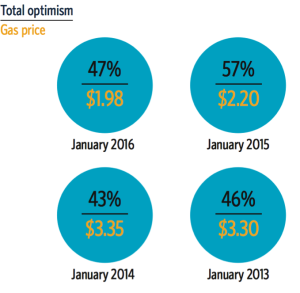

During changes in fuel prices, not only is consumer behavior changing accordingly, but people also feel differently overall about the economy which affects every industry, and the automobile industry is especially hugely affected by this. The overall feel of an economy is a subjective term that can be defined by varying characteristics. For example, it could be defined by many characteristics, like economic recessions, decline in the stock markets, or political instability. However, it could also be measured by more specific factors like decline in oil prices. For example a survey that asked target customers during 4 different years (with distinctive oil prices) about how they essentially felt about the economy, their response reflected that the there was more optimism in the economy within people and their consumer behavior during the periods of sharpest decline in oil prices. The outcomes of the survey are presented in the diagram below.

When people have a positive attitude towards the economy because of decline in fuel prices, they tend to be more liberal about spending money, because as mentioned previously, they think they are certainly saving money on gas (vehicle owners). As a result, this benefits the retail industry, and the sales and profits of automobile manufacturers are impacted in an interesting manner.

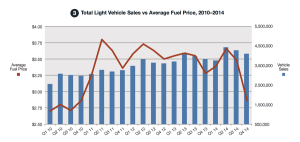

The data pertaining to light weight vehicle sales and oil prices throughout the years is displayed in the graph below.

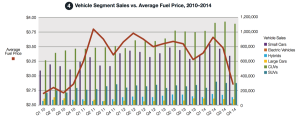

It is evident from the graph the fluctuation in oil prices is not directly consistent with the sales of light weight vehicles. However, it would be useful to breakdown the broad category of these vehicle sales into categories to analyze the trend in detail, firstly, small light weight cars, secondly big SUVs and trucks and lastly hybrid or electric vehicles that do not run on fuel.

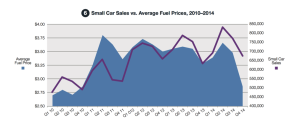

Small vehicles that have a high mileage, which means they drive for a high number of miles for the amount of gallons of fuel, and these vehicles are usually the more fuel-efficient vehicles. Fuel-efficient vehicles usually have higher sales during of periods of rising or high oil prices.

As can be seen in the graph below that is comparing fuel prices and sales small fuel-efficient car sales, the trends of both have been very similar. There is a direct correlation for the trends of oil prices and sales of small cars from 2010-2014.

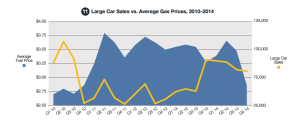

The second category of cars that can be explored is large cars that include SUVs and trucks. These large cars are usually gas-guzzlers, which means they give a lower number of miles for a certain amount of gallons of fuel and hence consume a lot of gas. The trend between large car sales and oil prices from 2010-2014 can be seen in the following graph.

There is not a consistent relationship or trend between changes in oil prices and sales of large cars. For example, there is a major decrease in sales of large cars in the second and third quarter of 2010, but there is a decrease in oil price in the second quarter and increase in the second quarter. Also during the last two quarters of 2013, when the US was progressing towards recovering from the financial crisis of 2008, there was an increase in fuel prices but large car sales were slowly diminishing: which could have been because of their low mileage and fuel efficiency. During the period of decline in oil prices, the sales of large cars did not increase. It continued to decrease, but at a much lower rate. This shows that oil prices are not the sole factor that determine or influence car sales, especially in the large cars/SUVs segment.

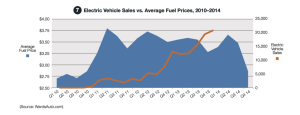

The third and final category of automobiles that can be explored is the alternative fuel (electric or hybrid) vehicles. Within alternative fuel vehicles, there are electric cars and hybrid cars. Only about a little less than 1% of households in America drive an EV, so though they do not have a very significant contribution towards the automobile industry, it is extremely important to consider EVs, especially when comparing its trend with fuel prices, because EVs are the primary potential solution to the energy and fuel crisis. Analyzing the trends of sales of EVs is important because they are a key alternative to fuel run cars that will face a major crisis in the future.

The following graph shows the trends of oil prices as compared with electric vehicles, and there is almost no correlation between the two. However as mentioned before, electric vehicles only make up less than 1% of total car sales, and how oil prices affect EV sales would not drastically matter for the automobile industry as a whole.

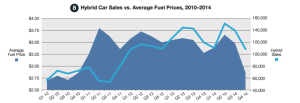

Hybrid cars are cars which combine the systems of both a conventional fuel run engine and an electric vehicle. Hybrid cars make up a larger percentage of the automobile industry than electric vehicles. The graph below quantitatively compares the trends of changes in oil prices and sales of hybrid cars.

It can be inferred from this graph that the sales of Hybrid cars have been quite coherent with changes in oil prices, except for in the last few quarters of 2011. Similar to the trend in small cars, hybrid cars are also considered very fuel-efficient. Hence their sales go up as fuel prices go up because they do not require as much fuel to run for the same number of miles as other cars, and when fuel prices decrease, consumers inevitably think they are saving money and opt for bigger gas guzzler cars, reducing the sales of hybrid and small fuel efficient cars.

In conclusion, to answer the research question posed at the very beginning of this composition: fluctuations of fuel prices do affect car sales, but very distinctively for different categories of cars. Changes in oil prices both directly and indirectly affect car sales. Fuel prices directly affect car sales when trends in sales of a certain type of car changes correspond to trends in oil prices (for example small cars and hybrid cars). Changes in fuel prices indirectly affect sales of cars by influencing consumer spending and behavior, which is in turn reflected in every retail industry, including sales in the automobile industry. Fuel and cars are almost like complimentary goods from an economic perspective and hence the connection between oil prices and car sales is significant. Consumers’ decisions to purchase certain types of cars is however not solely dependent on fuel prices. A vehicle buyer takes a lot of different factors into account before buying a certain type of car. Also, with the swiftly progressing nature of technology, hybrid cars and electric vehicles have been revolutionizing the nature of the automobile industry. Though EVs do not make up a large percentage of car sales, hybrid cars, especially the Toyota Prius have been becoming increasing popular. Another interesting element to consider could be that many of the self driving cars being built by Uber have been focusing on increasing fuel economy, reduce oil use and curb carbon emissions, according to an article in the wall street journal, written by a former energy advisor for the government. This could also make car sales and decisions made by consumers less dependent on fuel prices. However, driving habits itself have been affected since the initiation of Uber, and car sales have been affected since, so it would be intriguing to see how much further effect the introduction of self-driving cars by Uber have on car sales. Nevertheless, fuel prices continue to affect sales of automobile manufacturers in a substantial manner.

Sources:

http://www.usatoday.com/story/money/2015/08/03/nissan-us-sales-up-8-big-vehicles-soar/31046075/

http://www.fuelsinstitute.org/researcharticles/fuel-prices-auto-sales.pdf

http://www.nacsonline.com/YourBusiness/FuelsCenter/Pages/2016-Retail-Fuels-Report.aspx

http://www.lazardnet.com/docs/sp0/18334/USConsumerAndCorporateBehaviorInALowOil_LazardResearch.pdf

http://www.nacsonline.com/Media/Daily/Pages/ND1114144.aspx#.V_xRSenBzzI

http://www.nacsonline.com/YourBusiness/FuelsCenter/Documents/2016/Consumer-Sentiment.pdf

http://www.ucsusa.org/clean-vehicles/electric-vehicles/bev-phev-range-electric-car#.V_1LV-nBzzI

http://blogs.wsj.com/experts/2016/04/27/how-driverless-cars-might-actually-harm-the-environment/

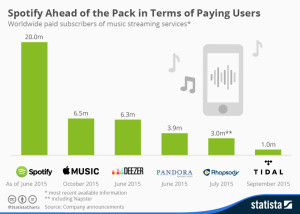

being seen as the next purchase for Spotify. Many believe this would be a smart move, as SoundCloud needs help finanacially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.

being seen as the next purchase for Spotify. Many believe this would be a smart move, as SoundCloud needs help finanacially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.