The art market is not unlike the stock market. The auction floors of Sotheby’s and Christie’s akin to the trading floor of the New York Stock Exchange, men and women gesticulating or waving paddles as prices for the commodity – the work of art being sold – rise. People speculate and they buy to sell. Buying up art has become a show of strength and capital – both monetary and cultural – for the world’s wealthiest people seeking status and future profits. The problem though is that art is not a commodity of quantifiable worth. The price of a Francis Bacon triptych – regardless of how beautiful or one of a kind it may be – is subjective and driven by what a buyer is willing to pay. Art does not have an intrinsic value like gold, oil or other traditional investments constantly being bought and sold on the market.

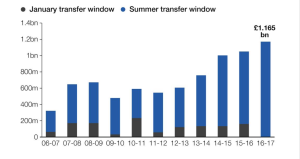

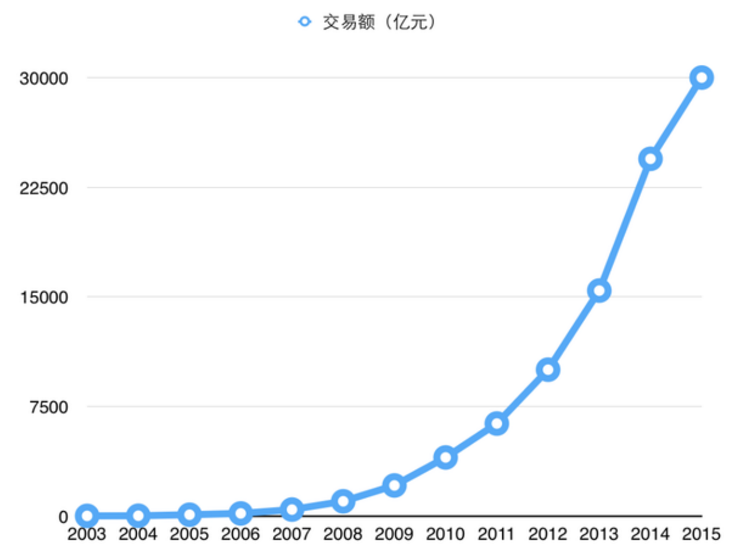

Speculation is ultimately the largest driver of the art market and has resulted in the distortion of art valuation, and like any market speculation leads to inflated prices and potential bubbles. The art market’s decline in 2009 is indicative of its vulnerability during times of economic turmoil; however, following the world financial crisis prices of art began to rise and inflate again with people believing art to be a safe asset to invest in when other markets are doing poorly (Segal).

Art is enticing because the gains that can be made in the short-term are much higher when compared to other forms of investible assets; and continued low-interest rates have made it easier for lenders to borrow more money, driving up prices as well. Since the 2008-09 global recession, the value of art has more than doubled since financial recovery (Helmore). The problem again is that art, is illiquid, it has no fundamental value and is driven by oligarchs that call themselves collectors. These so-called collectors are really just interested in turning a profit and thus the boom for art, failing to take into account issues of exposure to oversupply; because art, specifically contemporary art is essentially in endless supply, with a new Warhol or Koons or Hirst coming onto the scene. While this is all good and fine as long as people continue to be willing to pay these prices, there is no question that market has been overheated by the “irrational exuberance” of speculators.

Current trends of buying up art as an asset with the expectation that it will be worth more in the future mirror that of the dot-com bubble of the 1990s and the collapse of the housing market in 2009, the prices simply cannot continue to sustain themselves.

Referenced:

https://news.artnet.com/market/art-market-bubble-report-409136

http://www.artbusiness.com/osoquspec.html

https://www.theguardian.com/artanddesign/2016/jan/17/art-market-mania-phase-bubble-report