A place to live is one of the most basic human necessities on earth. Yet for many across the country, recent economic trends have made finding an affordable place to live increasingly difficult.

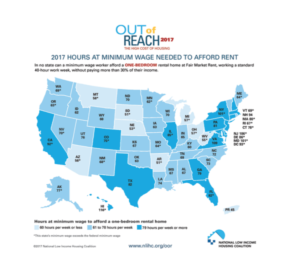

Today, more than half of America’s homes are at higher prices than they were before the Great Recession. And the issue doesn’t just impact buyers – according to the National Low Income Housing Coalition, no state in America has enough affordable rental housing for the lowest income renters. In California specifically, the state faces a shortage of over 1.1 million available rental homes for extremely low income (ELI) individuals.

Source: National Low Income Housing Coalition

In somewhat rare form, this issue hurts not just those at the bottom, or ELI and homeless individuals, but also those at the top, who also have to cough up more dough in order to afford a home or luxury apartment. Alan Greenlee, Executive Director of the Southern California Association of Nonprofit Housing, says he’s sure “Dr. Dre is pissed off that he had to pay 15 million dollars for Gisele Bundchen and Tom Brady’s house in Malibu,” just like regular Americans across the country are growing progressively disheartened by and frustrated with the trend.

Luckily, a multitude of creative and ambitious tactics are already underway across the country. Some Americans are choosing to participate in the ever-growing “Yes in My Backyard” or YIMBY campaign, which seeks to convert extra living spaces in backyards into licensed and habitable areas for low-income or homeless individuals. The movement has local chapters across the United States, and just held its annual YIMBYtown conference in Boston in late September. In particular, YIMBY has aggressive goals in California, where it sets out what it calls an “Inclusionary Policy Design” to compressively address the housing crisis in the state.

Local legislators are also stepping in. In Denver, the city is subsiding luxury apartments, allowing individuals who make between 40-80% of average area incomes to pay only up to 35% of their salaries to live in expensive apartments that would otherwise sit empty. In Austin, nonprofits and grassroots organizers pushed in June for the City Council to approve a bond initiative that would dedicate $300 million to build new permanently affordable housing units. And in Los Angeles, a variety of propositions and measures have been paying special attention to affordable housing since 2016.

Although these tactics and transformations are bold and well-intentioned, are they doing enough?

At the end of the day, the housing crisis sweeping across the nation is “a pretty simple economic issue. Supply under-paces demand, and as a result, prices go up,” says Greenlee.

While the relationship between supply and demand relationship is the root cause, in Denver, which was pegged to be one of the nation’s “hottest” housing markets in 2018, “sales and construction activity have slowed,” according to Ben Cassleman at the New York Times, meaning less homes are on the market. In fact, across the US, residential investment has been falling steadily for three consecutive quarters, meaning construction and brokers fees are continually shrinking. From there, add in rising mortgage rates. Mix together all of those forces and there you have it – a deadly combination that created a slowdown in the housing economy, leaving Americans to feel the burn all across the country.

Citizens have chosen to adapt in different ways. From Greenlee’s perspective, it comes down to two options: either live in a “catastrophically overcrowded situation” in order to afford high rent in a desirable or at least tolerable place, or move further away from where you work, which in Los Angeles means that you usually subject yourself to a horrific morning commute.

In California specifically, Greenlee argues that the state is a victim of how good it was at building housing after the second World War. At that time, everyone believed that living in the coastal state meant you could get a house, a yard, and a nice green lawn. Today, that is nowhere near the case. Compound the trend of not building enough homes over the course of an entire generation, and Greenlee says you have the very simple explanation for how we arrived at where we are today.

One way to curb the higher costs that come with less supply may be through higher wages. From 2007 to 2015 in the United States, the median price of rent rose 6 percentage points, whereas the median income for renter households rose only 1%. In California in 2017, a worker would have needed to earn around $31 an hour or work 118 hours a week at minimum wage just to afford a two-bedroom apartment. Perhaps even more startling is the fact that rents over the last 10 years in California have gone up 13%, but incomes have actually gone down 6%, says Greenlee.

Source: National Low Income Housing Coalition

But of course, California just raised the minimum wage to $13.25 an hour, with a progressive system set up to continue increases for the next few years. While higher wages translate to more money in people’s pockets to spend on housing, that policy change—although certainly not intended solely to fix the housing crisis—addresses the symptom, which is expensive houses, not the cause, which is not enough homes on the market.

There’s also a notion in California that trends such as our growing technology sector—when combined with the state’s historic dominance in the entertainment industry plus boundless sunshine and lanky palm trees—have caused an influx of migration, just making the issue worse. On this topic, Dr. Benjamin Henwood, a professor at the University of Southern California and an expert on homelessness and affordable housing, notes that while creating jobs and attracting Americans towards our coast is great, “people who fill these jobs need a place to live.”

However, Greenlee says not so fast – if no one else moved to California, just by birth and death rates alone over the next 10 years we still would not have enough housing to meet demand. Thus, while our robust economy certainly draws people in, the core issue comes back to basic economics.

Given what we know about the need for more housing in Los Angeles to meet demand, how can we get people to want to do something about it? Perhaps the answer lies in a deeply correlated issue that we see firsthand in Los Angeles every day.

No matter whether you live Downtown or in West Hollywood, you’ve likely seen homeless people living on the street in your area. Even if you live in a suburb where the homeless are nowhere to be seen, you probably take the freeway to work, where you get to see first-hand the tents and makeshift shelters that our city’s massive homeless population is forced to live in. The issue is unavoidably and unquestionably visible.

Although homelessness is a function of many contributing factors, on the most basic level, “homelessness is primarily a housing issue,” says Henwood. Although not all affordable housing addresses the needs of homeless people who are out of the housing market entirely, Henwood also argues that “housing shortages will continue to undermine best efforts to address homelessness.”

A plethora of research backs up his argument. One 2017 study by a data agency based out of San Francisco found that eight of the 10 states with the largest number of homeless individuals also have the country’s highest average home prices.

In 2017, California was one of 10 states with both high homelessness and the most expensive housing (Inman)

Furthermore, Zillow researchers in 2017 found that the “relationship between rising rents and increased homelessness is particularly strong in four metro areas currently experiencing a crisis in homelessness,” one of which was—unsurprisingly—Los Angeles.

Source: Zillow

Thus, although getting the prices down for apartments for low-to-middle income Americans by building more places to live for them may seem unrelated to homelessness, in general, less expensive rent and more options for Americans will help not just those currently on the search for a home, but could potentially also have the trickle-down effect of reducing the number of homeless as well.

After voters in Los Angeles had to live and breathe in direct contact with the sprawling homeless population for a number of years due to changed regulations, they took action, and in November 2016 passed measure JJJ, which “changed fundamental land use rules around how you build in order to make sure that if developers are going to make something, it had to include housing that was available for low-income people” says Greenlee. That same year, voters also passed Proposition HHH, which funded affordable housing through a bonding program. And before that, the County in 2015 dedicated $100 million a year to support affordable housing development. Why the sudden change? According to Greenlee, “because people decided our current situation related to homelessness was intolerable.”

Thus, although housing affordability may be deeply rooted in failed city planning and put tremendous financial strain on a plethora of individuals, true visibility of the issue through the homeless is what caused Angelinos to act. And by Greenlee’s standards, while the programs in place are not an end-all solution, they are certainly steps in the right direction.

Given that a variety of measures and propositions are already in place, what more can people in Los Angeles do? First, support similar initiatives as they show up on the ballot. And second, Greenlee says that financially secure Americans can be vocal in their support for greater density and affordable housing in their areas rather than “going bananas” when they hear affordable housing is coming in. In particular, Greenlee cited a recent housing development program put forward by the Mayor of LA, in which council districts would be required to create temporary housing. In some areas – like Koreatown, Venice, and Sherman Oaks – local residents met that proposal with furry, enraged that they would have to live in close contact with the homeless. While it’s human nature for people to want to be separate from the poor, that argument ignores the fact that homeless Californians are already residents of our neighborhoods—they are just forced to sleep on the street rather than in apartments or homes.

Protestors in Koreatown, Los Angeles reacting to plans for homeless housing in their area (LA Weekly)

To more comprehensively address the issue, Angelinos—and for that matter, Americans across the country living in areas where housing prices have spiked—may need to get more comfortable with homeless and extremely low income individuals moving into their neighborhoods. Although that is sure to be an uncomfortable transition, it’s a necessary one if we are serious about addressing the crisis. In long-run, everyone from Dr. Dre to the homeless living in tents under the freeway stands to benefit.