Amazebowls – acai bowls topped with fruit and granola

Desmond Ng is the co-founder and owner of “Amazebowls,” a trendy, popular food truck that can usually be found situated on the outskirts of USC. Contrary to the stereotype, Amazebowls doesn’t sell the stereotypical greasy street fare one might expect; instead, this bright purple truck offers customers fresh and tasty acai (ah-sigh-ee) bowls, topped with fruit and granola. Described by Ng as a “healthy alternative to ice-cream or sorbet,” these vegan and gluten-free treats offer health-conscious students a delicious replacement to the usual fast food options offered at USC.

Amazebowls was founded in August 2013 by Desmond Ng and Bryan Leong after the two came across the concept in Santa Barbara. “I pretty much fell in love with them,” Ng admitted. “However, when I came back to LA, I realised that hardly anyone was selling it. Places that did sell it were either too expensive or not that good at all. So I started making them at home, and my friends told me that if I wanted to start something with it they’d invest in it. So we tested it out at SC – we trialled it at a couple of different events like Taste of Downtown LA, KXSC-fest, Springfest, Study Nights… and the response was really positive.”

One of the most difficult obstacles for a small business is finding initial capital – whether that be through loans, investors, or one’s own savings – especially in the current economy. According to Gallp Inc., 28% of small businesses indicated that they were less optimistic about their business’ future going into 2014 than they were going into 2013. While Ng was fortunate enough to have two close friends who were willing to invest in him and the product, he too struggled to initially start his business. “We wanted to start a store, but we couldn’t find a good location at a good price,” said Ng. “A food truck was our next best option.”

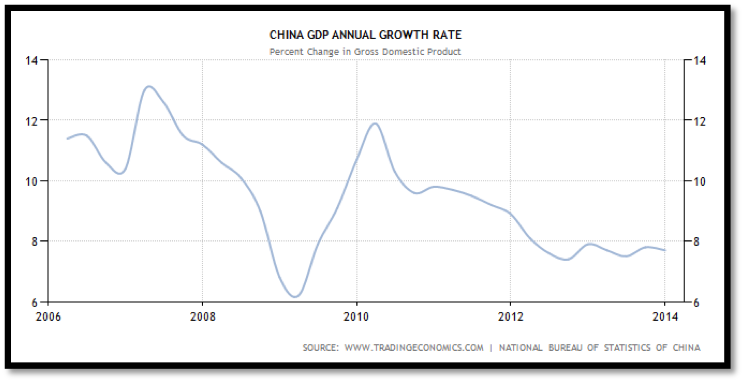

As Amazebowls is a relatively new business, it hasn’t had much time to adapt to the ever changing economic cycles. Furthermore, its main customer base – USC students – doesn’t seem, at least in the short-term, too frugal about spending their disposable income. “We haven’t really been affected so far from the recession,” said Ng.

However Amazebowls still had is main share of challenges. Ng lists the factor of uncertainty as one of the biggest challenges in running his business. “It’s [the food industry] very competitive,” explained Ng. “We have to do a lot to make ends meet – even though we get a lot of sales, the costs are really high. The costs of running the truck, wages, running costs, etc. It all adds up.” Furthermore, the recent opening of “Nectar,” a juice bar on campus serves as another competitor to Amazebowl, targeting a similar audience.

While Ng doesn’t have to pay rent, owning a food truck offers a different set of challenges. “Sourcing a food truck is not cheap, and a lot of people don’t realise how big the expenses are,” explained Ng. “Also, a lot of things are just out of our control. It’s not like a store where things are fixed and people can deliver to you – we only have a certain amount of space in the truck and we have to restock every day. It takes a few hours for us to get all our supplies. It can also be difficult finding parking. If we don’t find parking in the morning, we can lose crucial hours of business which cuts into our profits.”

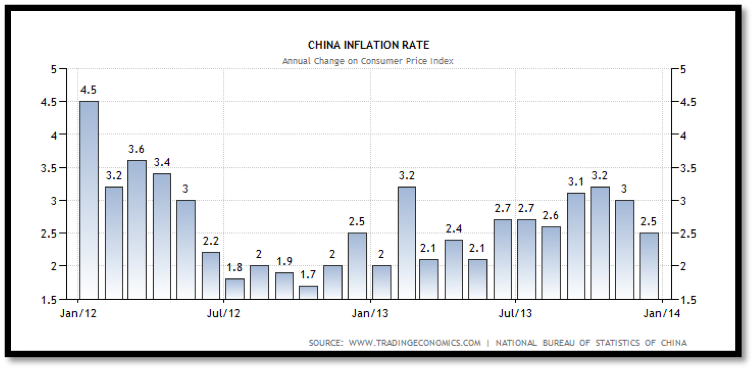

Amazebowls is also heavily affected by the weather and the seasons. “The weather definitely affects our business – even more so because we’re a food truck. People don’t like coming to food trucks when it’s cold,” said Ng. “We also definitely felt that there was less business after big holidays like New Year’s and Christmas – people had spent too much during that time and were not as willing to go out as much to eat.” Furthermore, the colder weather has not only decreased their customer base but also increased costs. For example, since the summer, the price of strawberries – a main fruit in the acai bowl – have gone up dramatically, further affecting Amazebowl’s profit margins.

A major concern which has not only Ng but other food truck and small business owners worried is the possibility of minimum wage going up. “Right now, we’re reworking our cash flow just in case minimum wage goes up,” explained Ng. “That’s a big thing. A lot of food truck owners that I speak to are worried that the increase in minimum wage will affect their businesses. Basically you’ll have to either raise your prices or absorb the losses – and that eats into your profit a lot.” When asked whether Ng will resort raising prices if wages do go up, Ng showed reluctance. “I’d rather not,” he admitted. Instead, Ng hopes to be able build a larger, loyal customer base with aggressive and clever marketing techniques so that profits maintain high.

In the future, Ng hopes to be able to expand Amazebowls into an actual store – however the challenges that come with that are immense. Rent is a main factor, with the average price per square foot in Los Angeles increasing 13.8% from last year to $428. “A lot of food trucks try and get into stores and they end up being unsuccessful,” said Ng. “We did a lot of research, and it’s a lot easier for a restaurant to get a food truck than a food truck trying to become a restaurant. We have to do a lot more research, and wait for both us and the economy to be in a good place.”