A research team from Reuter’s posted a pair of charts (see Figure 1 below) with nearly paralleled curves back in 2011 which suggests that Macau’s gaming revenue tells a lot about China’s economy. The curves reveal not only how China’s collective wealth has grown, but also where that big chunk of money is going, given the fact that many managed to legitimize shady income amid the buzz at the world’s new casino capital.

China’s GDP boom since around 2003 has created new wealth among heads of national conglomerates as well as regional manufacturing-oriented powerhouses. Some city officials – the likes of Bo Xilai and Liu Zhijun – also took their share from doing “favors” to businesses cutting deals for government contracts. Whatever their day jobs may be, these people are the “high-fliers” when they land at Wynn’s VIP room in Macau. And change in Wynn’s gaming revenue often suggests tweaks in the Chinese government’s grip on its economy and its mega rich.

Figure 1. Macau Gaming Revenue and China GDP

Chinese high rollers made up nearly two thirds of Macau’s gaming revenue, not out of their love for throwing dice, but because they saw Macau a good fit for money laundering, according to an article from The Economist. With enough help from an apt junket, a corrupted government official who has taken bribes in yuan can readily swap his filthy money into Macanese pataca at a gambling table. A billionaire who has cut corners to get rich and wants to elude future scrutiny when political tide changes can turn most of his fortune into foreign dollars and hoard them better. In some other cases, the rich simply don’t want to put his money at home.

These are the main players in China’s economy, and the way they’ve chosen to do with their money reveals two things: a) a big chunk of the new wealth has left China instead of being reinvested into sustainable economic activities; and b) there is a trust issue between China’s nouveau riche and Beijing because the latter still has authority to crush someone’s property for no solid reason.

When China’s new leadership laid down rules in early 2012 to crack down on lavish spending and its more recent rein in corruption, we’d expect them to have an impact on Macau’s gaming revenue much as they did to the sales of foreign luxury brands. The cynical ones on social media, however, said the new measures would always be staying just on paper.

If we check Macau’s gaming revenues for answers, it presents a different story, as world-class alcohol makers and watchmakers took hit from Beijing’s gift crackdown.

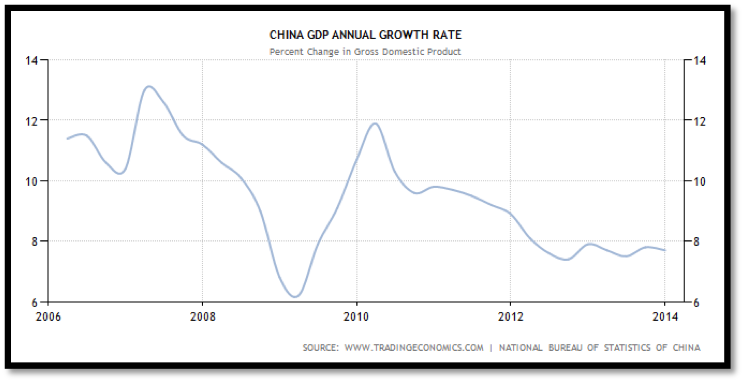

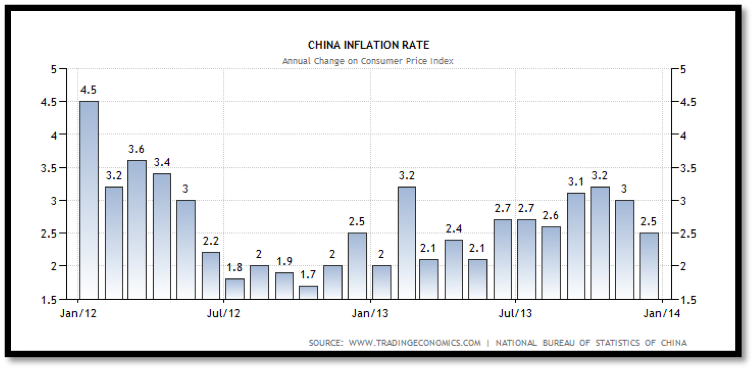

China’s inflation-adjusted GDP changed less in 2013 than a year earlier, going upward by 7.2 percent and 10.3 percent respectively (see figure 2 & 3 below for real GDP calculation).

Figure 2. China GDP Annual Growth Rate 2006-2013

Figure 3. China Inflation Rate 2006-2013

During the same period, however, Macau’s gaming revenue kept climbing in two consecutive years despite a slowdown in China’s economy. The number went up first by 13.5 percent in 2012, and again by 19 percent one year later, according to Yahoo News and The Wall Street Journal. Meanwhile, there has been a flurry of Chinese tourists touring and buying real estates in the U.S. The rich folks may have sped up transferring their money outside China as Beijing’s new leadership tightens its grip.

Leave a Reply

You must be logged in to post a comment.