Gary Russell stood behind his counter in the Grand Central Market in downtown Los Angeles. Surrounded by those old-fashioned, bold-colored vendor signs, Russell in a casual red shirt and his clean-designed counter felt like an invader to the atmosphere of nostalgia.

Photo credit: Peiwen Jing

Nevertheless, the crowd walking inside of the market in their sportswear brought the sense of modern to this over-100-year-old marketplace, just like what Russell did with his kombucha tea bar in the past eight months.

It was Saturday noon, one of the market’s busiest hours throughout the week. Two customers grabbed several traditional pork carnitas tacos, stopped by Russell’s counter, tasted different flavors of the kombucha teas they produced, and got two bottles of “midnight rose” as their drinks.

It was Saturday noon, one of the market’s busiest hours throughout the week. Two customers grabbed several traditional pork carnitas tacos, stopped by Russell’s counter, tasted different flavors of the kombucha teas they produced, and got two bottles of “midnight rose” as their drinks.

“The market has been there since 1917 and I don’t know some other place in LA quite like this,” said Russell. “The dynamic, the atmosphere, and also for the new organic and healthy choices coming in.”

Photo Credit: Peiwen Jing

Russell works for the Better Booch, a small business manufacturing kombucha tea in downtown Los Angeles. They get the organic tea leaf supply from the Art of Tea in Beverly Hills, brew the teas, and then add bacteria and yeast to let the mixture to ferment for a couple of weeks.

Better Booch has been in the business for more than two years. The small crafted kombucha tea brewery now has five employees, including their husband and wife duo co-founders Trey and Ashleigh Lockerbie. All of the five people working with Better Booch began their career in the show biz as touring musicians, mainly backing up popular international artists. “After years of exhausting travel and inconsistent schedules, we decided to make a change,” said the founder Trey Lockerbie.

The tiredness of inconsistent traveling around the world was one of the personal stimulators for the Lockerbie couple to switch their gears into the small business of cottage product. Meanwhile, the policy makers also sent their encouragement, by passing the bill to support the movement.

California passed the Homemade Food Act, which went into effect in January of 2013. Since then, the cottage food industry has been booming, bringing more and more food artisans to farmer’s markets and craft shows. Food artisans crafting everything from bread, candy and cupcakes to dried pasta and nut butters were legally allowed to sell their wares to the public.

The policy benefited to the Lockerbie couple. They started to sell their products in the famers’ markets across LA, and had no idea that the Booch is selling through 40 different locations. The spot in the Grand Central Market is their only retail revenue so far.

“Through our experiences with Better Booch, we’ve seen our highest highs and our lowest lows,” Ashleigh Lockerbie described their experience of running this handcrafted small business in this way. “You don’t get very far if you don’t work as a team and whether it’s music, a tea business or navigating life’s domestic challenges.”

The Booch promises only use organic loose-leaf teas from a local supplier, with no added sugar in the way of juices, purees, syrups or powders. According to Russell, The cost for Booch’s manufacturing is generally higher than the similar kind of product, even higher than a national standard.

The Booch promises only use organic loose-leaf teas from a local supplier, with no added sugar in the way of juices, purees, syrups or powders. According to Russell, The cost for Booch’s manufacturing is generally higher than the similar kind of product, even higher than a national standard.

“You earn a little bit less but you are making a better product,” Russell thought the higher cost was hard to afford, but worth it. “We want the quality of the product.”

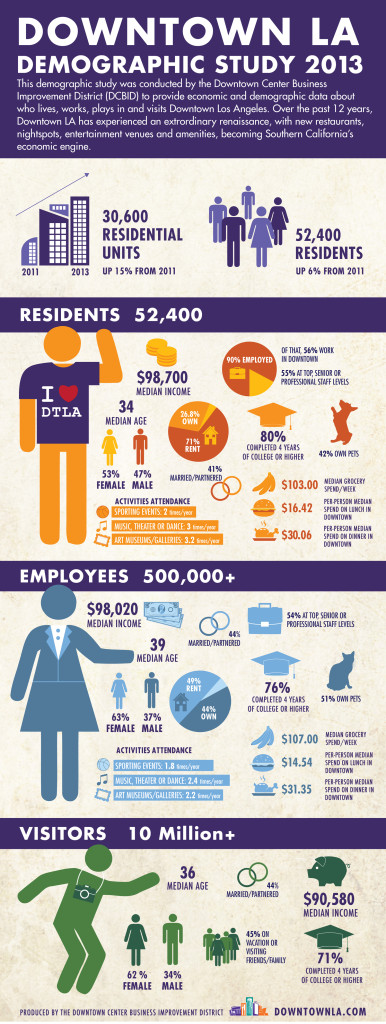

The business keeps going up, in Russell’s word, “each week is getting busier and busier.” Nevertheless, in Russell’s opinion, the larger the sales didn’t mean the larger the profit from running the small business. Some things have made the small business running a major challenge: the cost to produce, the high rent in downtown’s commercial zone, and now the possibility of a minimum wage hike in the following years.

“I think these guys who are governing have studied economy are just making a rough guess that you are making enough to pay people,” said Russell. “If we get more small business going, they can hire more people; that is better than a lot of people don’t have work, I think that is what they need to know.”

Nevertheless, as a employee, Russell’s income has been effected by the minimum wage level. “It could be a good thing but nobody can afford to pay that. They make the small business owners pay more, but somebody will get fired,” he said.

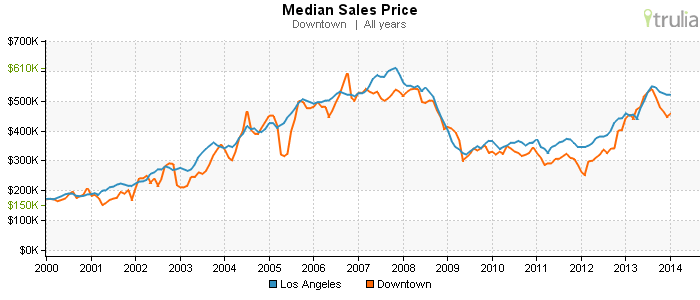

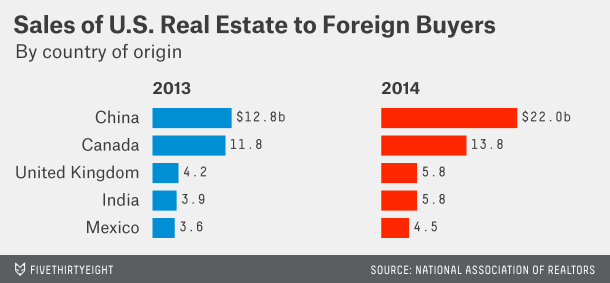

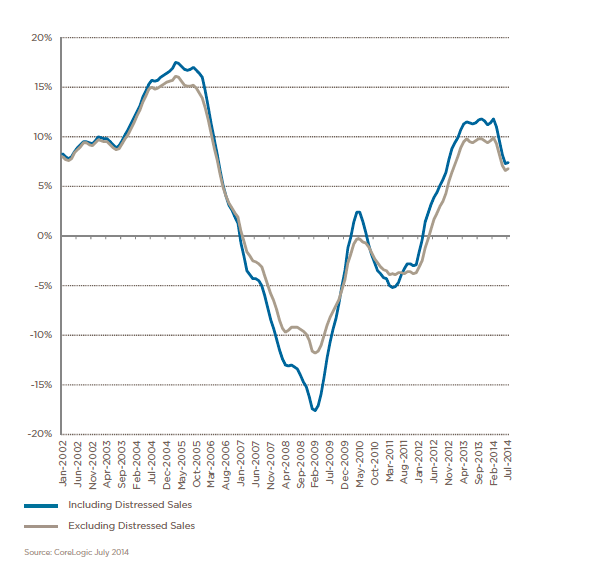

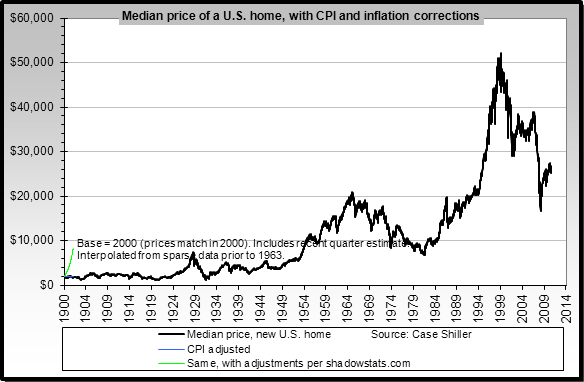

When asking about the future of real estate market in the U.S., Ji expressed her concern over the median-price house market: “One challenge we are facing now is that there are less and less affordable houses in the market.” While the demand for median price house is going up, the supply is actually going down. In July, the median transaction price was $457,000, which is 7.6% higher than that of last year. Also, the market volume, which is 7012 this year, is 12.5% less than that of last year, according to CoreLogic’s recent report. Ji is worried that if the interest rate starts going up next year, there will be more competitions in the median-price house market.

When asking about the future of real estate market in the U.S., Ji expressed her concern over the median-price house market: “One challenge we are facing now is that there are less and less affordable houses in the market.” While the demand for median price house is going up, the supply is actually going down. In July, the median transaction price was $457,000, which is 7.6% higher than that of last year. Also, the market volume, which is 7012 this year, is 12.5% less than that of last year, according to CoreLogic’s recent report. Ji is worried that if the interest rate starts going up next year, there will be more competitions in the median-price house market.

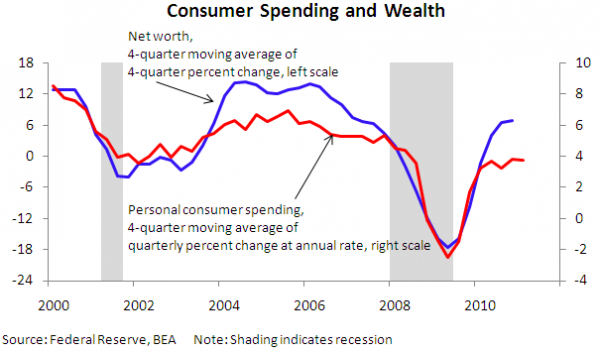

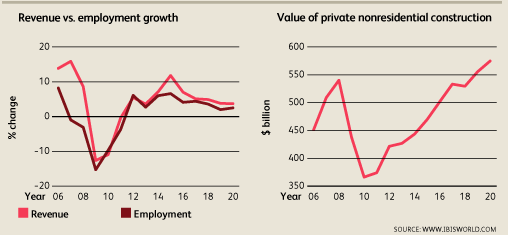

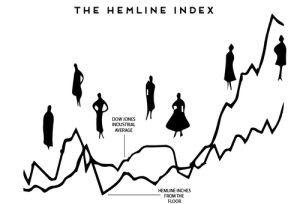

economists closely watch their activity, trying to link it to economic growth or decline.

economists closely watch their activity, trying to link it to economic growth or decline.

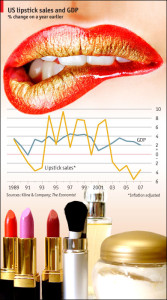

One of the more widely talked about economic indicators tied to women is the lipstick index. Leonard Lauder argued “that during difficult economic times, women will increase purchases of lipstick and makeup and decrease purchases of higher priced goods like shoes and handbags”. There are two major theories that support why women would increase their makeup buying habits in hard economic times. The first of these theories looks at the self-esteem of women and the need to have luxury goods even when unaffordable. Women’s fashion is branded from a desire standpoint not a need standpoint therefore women view items like handbags and shoes as items that increase their self-value. While money may run short women’s opinions of their own self-worth does not diminish at the same rate. This leads to women seeking desire goods that fit their new price point, such as lip stick.

One of the more widely talked about economic indicators tied to women is the lipstick index. Leonard Lauder argued “that during difficult economic times, women will increase purchases of lipstick and makeup and decrease purchases of higher priced goods like shoes and handbags”. There are two major theories that support why women would increase their makeup buying habits in hard economic times. The first of these theories looks at the self-esteem of women and the need to have luxury goods even when unaffordable. Women’s fashion is branded from a desire standpoint not a need standpoint therefore women view items like handbags and shoes as items that increase their self-value. While money may run short women’s opinions of their own self-worth does not diminish at the same rate. This leads to women seeking desire goods that fit their new price point, such as lip stick.

Walk into Badmaash and it becomes instantly clear what the brothers are talking about. The familiar overwhelming buffet-style dishes are replaced with portion sized plates paired with a selection of hand-picked artisan beers. The LCDs blaring Bollywood songs are gone, swapped for a cool, silent Indian classic projected on the large wall. A set of Warhol-like portraits of Mahatma Gandhi wearing coloured aviators lines the wall.

Walk into Badmaash and it becomes instantly clear what the brothers are talking about. The familiar overwhelming buffet-style dishes are replaced with portion sized plates paired with a selection of hand-picked artisan beers. The LCDs blaring Bollywood songs are gone, swapped for a cool, silent Indian classic projected on the large wall. A set of Warhol-like portraits of Mahatma Gandhi wearing coloured aviators lines the wall.