China’s Douyu is one of China’s largest live-streaming sites that focuses on gaming and esports content. By out-fundraising rivals and poaching top streamers, it survived China’s live streaming war in 2016 to become an industry giant.

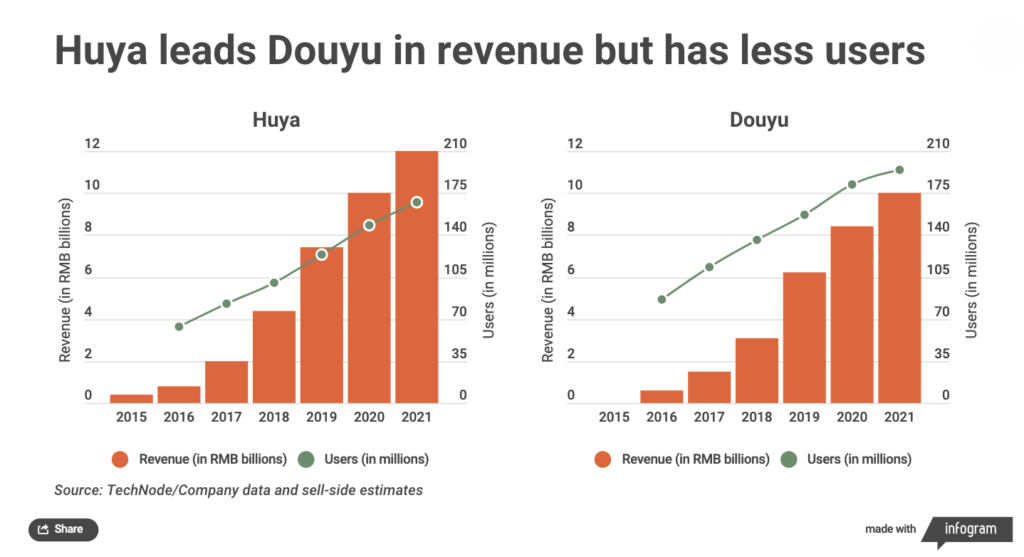

Douyu is the second Twitch-like service backed by Tencent to go public in the United States. The other one is Huya, which signed a deal with Western competitive esports organization Team Liquid, one of the world’s most valuable esports teams according to Forbes.

But Douyu is more focused on the growth in its hometown. “As one of the first game-centric live streaming platforms to make the foray into eSports, we are strategically positioned to benefit from the proliferation of the eSports industry in China,” Douyu said on its corporate profile.

Huya and Douyu control over 60% of the Chinese game streaming industry. And this number is expected to grow even higher with further consolidation. Huya went public in May 2018, while Douyu recently IPO’ed in July 2019, both in the US.

Huya is more than 80% larger than Douyu with a $4.9 billion valuation, and Douyu has a $2.7 billion valuation as of August 26. Moreover, compared to Douyu, Huya has a slightly higher tilt towards game streaming with over 50% revenue derived from gaming, compared to 45% for Douyu.

Last April, Douyu filed with the U.S. Securities and Exchange Commission as it prepares to raise up to $500 million on the NYSE less than a year after its archrival floated on the same stock market.

However, looking at Douyu’s quarterly financial results, it is noticeable that the company’s performance in the third quarter of 2019 is not as good as expected. “The Company expects its total net revenues to be in the range of RMB1,950 million to RMB2,000 million in the third quarter of 2019,” while the real total net revenue increased by 81.3% to RMB1,858.5 million (US$261.0 million) from RMB1,024.8 million in the same period of 2018.

For the third quarter, Douyu’s net loss was RMB165.4 million (US$23.2 million) compared with RMB220.5 million in the same period of 2018, implying a net loss margin of 8.9% compared with 21.5% in the same period of 2018.

However, these streaming platforms also face other challenges like ethical guidelines and piracy concerns. When a gamer live-streamed on Douyu three days before a Nintendo Switch game’s release date, viewers were quick to realize they were watching someone flagrantly play a pirated copy of an unreleased game.

The streamer faced immediate backlash from Nintendo fans. Eventually, Nintendo also appeared to respond. A screenshot of a cease and desist letter said to be from the company started circulating online. The letter was said to be sent to a number of Chinese websites where users were sharing pirated copies of Switch games.

We were unable to verify the authenticity of the letter, but some Chinese websites were quick to respond. Some websites and forums known for hosting pirated games have now stopped allowing users to download Nintendo Switch ROMs.

Nintendo has a complicated relationship with China, which has long been a hotbed of game piracy. This isn’t even the first time a Chinese hacker has publicly flaunted a pirated Nintendo game ahead of its release.

With strong financial support and a large audience base, China is catching up with the world on its eSports and game live streaming services. With its unique duopoly model, each platform needs to find its distinctiveness and has to deal with other concerns along the way.