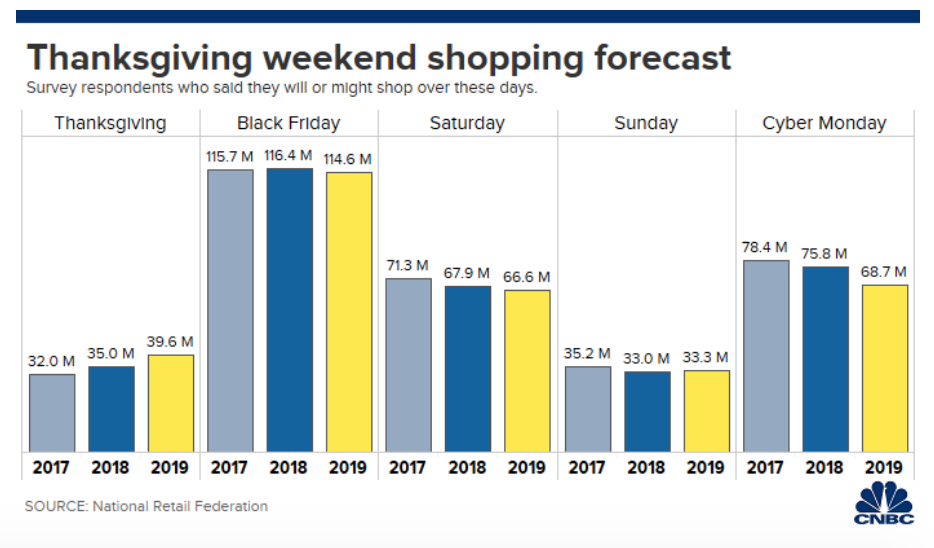

For many, the week surrounding Thanksgiving is filled with eating, drinking, treacherous travel and reconnecting with family. And for millions of Americans, waking up early and traveling far distances to score crazy Black Friday deals is the immediate objective following Turkey Day. While Americans are projected to spend even more money –$29 billion to be exact– on Black Friday this year, Black Friday retail sales are anticipated to take a hit this year. With the popularity of online shopping and Cyber Monday only increasing, consumers are less motivated to actually shop in-store. Now, consumers are browsing, comparing prices and hunting down deals from the comfort of their own home.

In the past, large department stores like Macy’s, Kohl’s and JC Penney held the largest power when it came to retail in the 70’s and 80’s. Around this time, the allure of black friday and retail sales in general came to the foreground. Thus, when it came to Black Friday, these department stores relied on and drew in more dollars than any other retail companies.

Nowadays, however, the reality of the retail industry couldn’t be more black and white. Due to the disruption of Cyber Monday and online shopping in general, large retail chains like Macy’s and Kohl’s are having a hard time drawing shoppers to malls. As a direct result, their sales are in a slump. The model of Black Friday is essentially crazy deals for a limited and short amount of time. However, as Coresight Research CEO Deborah Weinswig stated, “Black Friday no longer represents a narrow window of opportunity in which shoppers have to wait in the cold and sprint into stores to get unmissable deals.” Holiday shopping begins much earlier in the season and now, actually occupies most of the month of November. While Black Friday is still expected to be the busiest shopping day in respects to foot traffic, Cyber Monday is expected to surpass Black Friday sales this year. That being said, Macy’s shares are down 47% this year and Kohl’s shares are down 27%.

While the days of Americans trampling each other in a race to get a deal on a flat screen TV are decreasing, Cyber Monday and online holiday shopping sales, as previously stated, have lucrative projections. This year, online shoppers are expected to spend $143.7 billion in November and December combined, according to Adobe Analytics annual calculations. This is a 14% increase in comparison to last year’s holiday shopping period.

This year, the holiday shopping period is 6 days shorter than normal, seeing as there’s only 22 days between Cyber Monday and Christmas. Alas, Adobe Analytics projects ecommerce sales will exceed $1 billion for for every day of November and December. This will be the first year ever that this is the case. Thanks to online shopping companies like Amazon Prime and “BOPIS” (buy online, pick up in-store) services, online shopping is just that much easier. This year, smartphone purchases are projected to account for 36% of online sales this holiday season. This statistic is up 20% from last year.

With the ability to complete our holiday shopping needs from the 4 inch device that sits in our pockets, the odds continue to stack up against the power of Black Friday retail sales. While Black Friday has yet to occur, these statistics and projections prove that retail shopping finds itself in a very interesting cross road. As large department and retail chains are closing down nationwide, I personally am very interested to see where the future of in-person retail sales lies.