https://drive.google.com/file/d/1DiR9XcQusHQrkY9PqPAkwN4xf1TBt-HI/view?usp=sharing

genesis domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home3/ascjclas/public_html/wp-includes/functions.php on line 6131news domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home3/ascjclas/public_html/wp-includes/functions.php on line 6131https://drive.google.com/file/d/1DiR9XcQusHQrkY9PqPAkwN4xf1TBt-HI/view?usp=sharing

This is probably the most unpleasant job in the world – trash sorter. It is smelly, boring and intense. The job exists because citizens throw all types of garbage into the same bin. Trash trucks take everything in the bin and pour them onto a conveyor belt. The belt rolls with the pulley in front of the recycling workers, who spend days after days watching the belt rolling and sorting them out.

Till 2018, recycling companies still rely on manual labor to categorize materials, since the assembly lines in recycling factories neither produce identical output nor have repeatable processes. According to a study released by the University of Illinois, recycling workers are more than twice as likely to be injured at work as the average worker. Seventeen American recycling workers died on the job from 2011 to 2013.

“I was created to do this job,” said Max, a robotic sorter created by Bulk Handling System (BHS) with the artificial intelligence technology. Fundamentally, Max identifies recyclables in a similar way to a person. A process called “deep learning” runs through hundreds of thousands of images to train neural networks to “think out” the correct identification. Once built these neural networks resemble the architecture of the brain and, when paired with a camera, will correctly identify the items in our recycling stream.

Max is volunteering at just the right time. The dedicated mechanical sorter is widely welcomed, as China’s ban on plastic trash import lends urgency to upgrading the recycling industry in the exporting countries. Now that the world’s biggest trash importer only allows half percent of contamination, the recycling plants need to double or triple sort the product before the shipment. Companies are getting squeezed on a number of levels. Now they are anxiously seeking every possible way to reduce labor cost.

BHS has three sites in the U.S. and three in Europe. Two waste management companies in the U.K., Viridor and Green Recycling, have invested in Max-AI, expecting to upgrade their processing line, according to the companies’ websites.

More companies than just BHS are dedicated to developing smart machines to cater for that need. Moblieye, a vehicle manufacturer, recently designed an electronic trash truck for heavier city distribution and refuse transport operations with gross weights of up to 27 tons.

“Chinese government is allowing a window for imports, but the quality has to be there,” said Brett Johns, Director of Sales, Marketing, and Procurement at City Fibers, a family recycling company in Los Angeles. Johns said that they need robots to help improve quality. “We are looking at the elimination of probably ten to twenty percent of human jobs positions,” he said.

China’s import ban is not the only reason for Max to exist. “Automation has been a trend in the last ten to fifteen years,” Nick Morell said. He is the Recycling Coordinator from Sanitation District of Los Angeles County (LACSD).

According to Morell, the agency currently relies on both mechanical and human sorters to run its processing line. “It will be out of service in next 12 months. As we put in a new mechanical sorting line,” he said, adding that LACSD is about to sign a contract with BHS to optimize their facilities this October. This means the current employed sorters will be soon out of jobs.

Morell said they were temporary labors through contracts, so they would be either reassigned to other facilities or temporarily laid off as “they are not gonna work on the line anymore”.

While sorting trash is unpleasant, it can be worse for people to lose jobs.”This conversation should not be about jobs.”said Peter Raschio in an email. He is the marketing manager of the company. Raschio argued that automation might result in the the loss of sorting position for a future hire, but those positions were not “sustainable, long-term jobs”.

Steve Miller, CEO of BHS, believed that the impact on labors would be positive. He said in an interview that the increased efficiency in assembly line could cut recycling costs and create more jobs at paper mills, plastic recyclers, and other firms that reuse raw materials.

“I would say that green jobs are going away as automation progress,” Morell said on the contrary. He predicted that green jobs in the future would be more about quality control, engineering and processing line. “It would be almost like the mining operation — the way things are ground up and that they use magnet and optical sorters. There’s not a lot of people involved in those process until you are dealing marketing and commodities,” he said.

The newest Recycling Economic Information (REI) released by the environmental protection agency (EPA) shows that the estimated recycling jobs have declined from 2001 to 2016 national wide, including those in iron and steel mills, non-ferrous foundries and glass container manufacturing plants. The number of plastic converters dropped from 178,700 to 30,535 during the 15 years. Firms that reuse raw materials in all categories of scrap commodities, except for rubber, have seen a decreasing demand for recycling workers. Miller’s optimistic outlook might not come true in the short term.

(Professor Dowell Myers, Director of the Population Dynamics Research Group in at the University of Southern California, commenting on automation’s impact on labors)

(Labor union comments, hopefully with anecdotes)

……

Picture living under the threat of attack within the town you were born in. High walls and towers divided the very streets you walk to school, work, or a place to meet with friends. The threat of bombs or the reality of violence plaguing your every step. Imagine growing up, watching four decades of violence tear your city and country apart.

That was what living in Northern Ireland was 20 years ago. The “Troubles” as they are commonly referred to, were fought primarily between opposing paramilitary groups of either protestant unionists or Catholic nationalists in Northern Ireland. Civilians were often caught in crossfire and fell victims to homemade bombs or stray bullets.

An estimated 30,000 people were imprisoned for paramilitary offenses during the troubles and over 100 peace walls, adorned with sectarian messages and barbed wire are still standing in the city of Belfast. Though the people of Northern Ireland would do without more literal and physical walls, there’s a chance there might be a few more added in Northern Ireland.

In 2016, the United Kingdom voted to leave the EU. Some hailed the results of the referendum has a chance for the UK to negotiate trade with Europe on its own terms, while others saw the results has a sign of increased xenophobia and warned that the choice would result in unemployment.

However, the majority of Northern Irish citizens voted to remain in the EU, According to the BBC. And though the U.K. and the European Union have until March 29, 2019 to set trade and border terms for Brexit, the clock is ticking for a solution for Northern Ireland.

The problem starts with an an almost 20 year old pact known as the Good Friday Agreement. It ended sectarian violence and created an open border between the two countries. Because of this, citizens of Northern Ireland have the option for Republican passports. In the days of the hard, militarized border between both countries, the border was “a frontier of milk smugglers, gun runners and frequent clashes between British soldiers and Irish Republican Army cells”, according to the Washington Post. Today, many Irish citizens feel that there is a sense of relative peace.

“This city, this country, is like a woman who has given birth,” said Gerry Lynn, an amateur historian of the city Londonderry, to the New York Times. “All the trauma, the pain and the fighting are over. We’ve come out of the Troubles — out of black and white and into color.”

However, in March of Next year, Northern Ireland will leave the EU with the UK, and it’s brother, the Republic of Ireland, will stay, putting the open border policy between the countries up in question.

In response, the EU has offered that the border between the two countries remain the same, the UK is adamant that changes must be made. Regardless, the U.K. and the European Union have until March 29, 2019 to set trade and border terms for Brexit.

While a hard border could stir up memories of a militarized pass in some, it would also disrupt the “frictionless” trade Northern Ireland is able to benefit with its proximity to an EU country. Still, Northern Ireland’s government has created some friction of its own. It’s government has been in deadlock since January 2017. In affect, they’ve been kept out of Brexit negotiations and Westminster is set to bargain on their behalf.

In July, Trevor Lockhart, Northern Ireland chair of the Confederation of British Industry expressed frustration with the UK government over the issue.

“We find ourselves in a set of circumstances where the solutions that will work for Northern Ireland economically, don’t work politically,” Lockhart told BBC Inside Business. “And, those that work politically, don’t work economically.”

If the UK and the EU don’t reach a set agreement, a “hard brexit” would take place as all trade would be cut from the EU. According to Vox, this could temporarily halt air travel and make for empty supermarkets. It would also reinstate a hard border between Northern Ireland and the Republic of Ireland, throwing 20 years of peace into jeopardy.

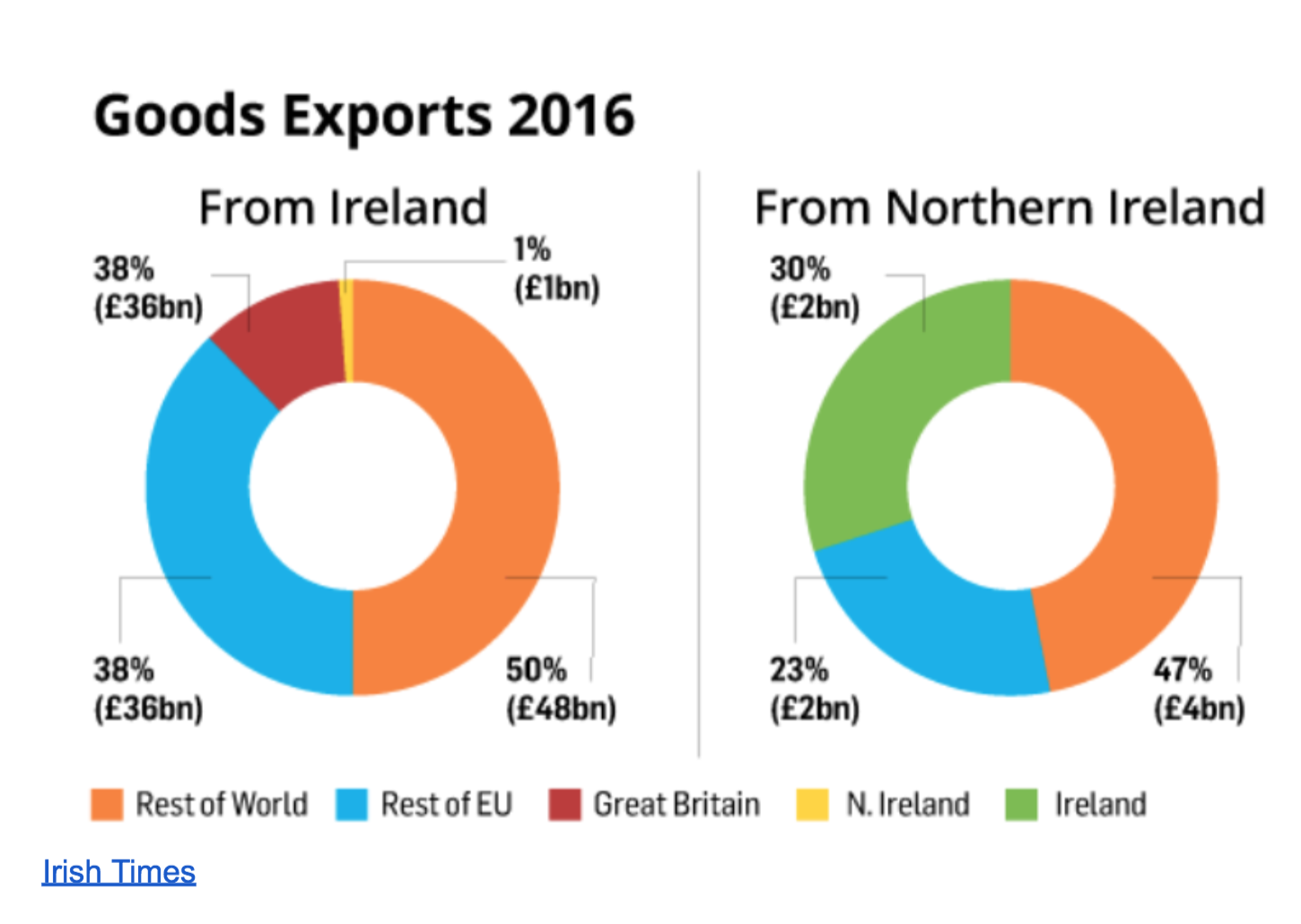

A hard border between the countries could do more than reignite old grudges from the last half of the 20th century. It would bring a halt to the movement of goods, capital, services and people that Northern Irish businesses and workers so heavily rely on. According to the Irish Times, 30 percent of Northern Ireland’s exports or £2 billion were sent to the Republic of Ireland in 2013. Over 50 percent of Northern Irish exports go to the EU.

Republic of Ireland in 2013. Over 50 percent of Northern Irish exports go to the EU.

These exports are largely food products, live animals, machinery and transport equipment. A lot of these jobs are performed by low-skilled migrant workers that receive passage into Northern Ireland through the European Union, according to a report from the Migrant Advisory Committee.

Still, the rest of the U.K. is Northern Ireland’s single largest primary market for external sales. Nonetheless, nearly three-quarters of exports to Ireland come from small businesses with fewer than 50 employees along the border.

Disruption in cross border-traffic has other ramifications as well. Over 177,000 trucks and 250,000 vans that cross the border for trade every month would be subject to customs duties if a hard border was reinstated, according to the Financial Times. This transport does more than bring goods over the border for sale in small shops and supermarkets. Bailey’s Irish Cream, for example, is manufactured from resources from Northern Ireland the Republic of Ireland, and involves over 5,000 border crossings per year, according to the Atlantic Council.

Northern Ireland’s economy continues to experience challenges of its own. Poverty rates in the region are higher than the rest of the U.K. The children of former prisoners can still be barred from from certain jobs while their parents cannot get public sector positions or insurance. In addition, Northern Ireland has received over £470 million dollars from the U.K. for peace programs in communities that are plagued by both by whispers of sectarian struggles and economic hardship.

On October 11, Michel Barnier, the EU’s chief Brexit negotiator announced that Customs and VAT checks, as well as compliance checks will not be performed at the border between Northern Ireland and Ireland, according to the Irish Times.

However, Barnier was unclear as to the nature of system that would be implemented with the Brexit deal.

“There will be administrative procedures that do not exist today for goods travelling to Northern Ireland from the rest of the UK,” said Barnier. “Our challenge is to make sure those procedures are as easy as possible and not too burdensome, in particular for smaller businesses.”

That same day, 21 of Northern Ireland’s leading business organizations released a public letter to Theresa May, demanding that she take note of upcoming labor shortages, as migrant forces will be forced to move south to the Republic of Ireland if the current negotiations are approved.

“Unfortunately, it fails to provide the necessary solutions and we believe it is therefore critical to create an immigration policy with sufficient flexibility to address Northern Ireland’s labour needs,” the letter states.

Are the deadly “Troubles” set to return if a solution is not reached? At this point in the negotiations, it’s hard to tell. However it is important to consider the economic ramifications of repeating one dangerous memento from the past: a hard border.

Sources Note: All works cited have been properly hyperlinked. Ireland map provided by https://www.cso.ie/en/media/csoie/newsevents/documents/census2016profile6-commutinginireland/Cross_Border_Commuters_2016_v2.pdf.

Our global economy is connected through the energy industry. For centuries, nations and firms have fought over and sought the right to acquire “black gold” – oil [Yergin]. However, the production and use of these natural resources emits dangerous carbon into the atmosphere, endangering our planet. These carbon emissions result in a changing climate — through higher temperatures, more heat, and stronger natural disasters such as tropical storms and wildfires. In acknowledging the perilous effects of climate change, the world’s fifth-largest economy – the state of California – is embarking on a goal to transition out of a state of affairs governed by the dominant energy sources (oil, petroleum, natural gas) and towards complete utility of carbon-free clean electricity by 2045.

Signed into law in September by Governor Jerry Brown, the bill sets increasingly greater targets on California’s renewable energy capability, with 50 percent by 2026, 60 percent by 2030, and one hundred percent clean electricity by 2045. California represents the second state to set this goal [Ige, 1]. Many are skeptical of the ability of the state to fully transition to clean electricity by the time 2045 rolls around, or are perturbed by possible high costs of energy bills caused by the transition. These being legitimate causes for concern, there are myriad reasons Californians could accomplish this challenging aspiration. The development of battery storage will play a vital role and its economic viability will determine California’s success at this effort. As Fareed Zakaria writes, “We need to store the energy [produced] for when the sun isn’t shining and the wind isn’t blowing. For that we need battery power on a different scale than we have today.”

As has often been the case in its innovative history, California’s investment and pledge to transition entirely to clean electricity sets an important example for the rest of the world to follow and should help influence the private sector to act. Explains the energy expert Daniel Yergin: “High energy prices, climate change and energy security are converging as the new engine driving the development of clean energy … They are being bolstered by public policy…” [Yergin, 1].

The state has crafted policies that incentivize companies and utilities to spend on enhancing renewable energy strategies and investment in energy storage, which is seen as vital towards reaching the one hundred percent clean energy goal. Although currently natural gas power plants currently makes up a large quantity of California’s energy, the state’s leadership and many companies forecast that declining costs of energy storage will ensure that electricity is much more strongly stored. Following his signature on the one hundred percent clean energy bill, Gov. Jerry Brown recently signed another law that allows the state to allocate “an additional $800 million for energy storage to capture electricity generated by solar panels during daylight hours to help keep the lights on after the sun goes down” [Penn, 1]. This money goes into the state’s Self-Generation Incentive Program, which incentivizes providing support for “distributed energy resources” and “rebates for qualifying distributed energy systems installed on the customer’s side of the utility meter” [CPUC, 1]. Through this initiative, California is essentially creating a market for the utilities to research ways to develop new advanced energy storage systems. The state has increased the program’s funding to over $1 billion. The rebate money is available for energy storage and can be used for residential and commercial systems, including for schools, farms and businesses.

Vox’s energy and climate writer, David Roberts argues that it is imperative to get these new markets right, for they are “better at determining the proper amount and location of storage than” politicians. The state should help furnish “a market that values carbon, capacity, ramping, voltage regulation, and all the other services storage can provide, lower barriers to entry, set up transparent rules, and let profit-seeking companies battle it out” [Roberts, 1].

In many sectors, need drives innovation. California is hoping that its regulation of carbon-emitted energies drives private sector innovation vis-à-vis energy storage and new energy markets. This is especially the case for solar generation and capture, smart meters and smart grids that can store and send out energy when necessary.

“For utilities invested in the right analytics capabilities [in smart meters and the smart grid], they enable data-based analyses, planning, and diagnostics. Smart grids are more efficient and less capital intense, allowing for predictive maintenance and better asset health” [McKinsey, 3].

For example, with smarter grids and meters, the potential for energy arbitrage – storing/selling energy during higher-power times during the day and releasing/buying it during less-peak times – will grow. More powerful sensors, smart grids and energy storage provide new opportunities to develop tailored programs for consumers, which will help them control energy usage, heating, and cooling more sufficiently. This is what California is counting on. According to McKinsey & Co. research, there are a number of energy markets that – through improvements in battery storage – will grow significantly in economic value:

Source: McKinsey & Company research, June 2017

Ultimately, “the industry wants dynamic pricing and hourly rates so that solar-plus-storage owners can respond in real time to the real needs of the grid,” Brad Heavner, California Solar and Storage Association policy director, vouches. With new and more efficient batteries, solar energy can be stored by consumers and offers alternatives to carbon emitting energies.

Southern California Edison (SCE), Pacific Gas and Electric (PG&E) and San Diego Gas and Electric (SDG&E) are the three major California utilities. Despite possible rising energy bills due to these initiatives, an indicator of progress is that the economics of energy storage are becoming more cost-friendly every year. This should be a positive trend for the utilities, who could improve services by “incorporating new distributed energy alternatives”, and consumers alike [McKinsey, 2]. The International Energy Agency reported in 2017 that battery costs have declined significantly every year since 2009 and that, concurrently, battery energy storage is enlarging yearly.

Source: International Energy Agency report, 2017

Moreover, Bain & Company partners Julian Critchlow and Aaron Denman – head of and partner in the firm’s Global Utilities practice – come to the conclusion that “large-scale energy battery storage is reaching an inflection point, advancing from limited experimentation to wide adoption” [Critchlow and Denman, 1]. This inflection point is a necessary incubation for California to accomplish its goals. For utilities, grid-connected batteries and battery storage are integral for “managing peak loads, regulating voltage and frequency, ensuring reliability from renewable generation and creating a more flexible transmission and distribution system” [2]. With California-based energy storage systems working with commercial clients, utilities, and governments and using machine-learning and deep learning to “optimize power generation,” Bain determines that immediate benefits should be seen and additional value will be realized over time.

Winston Churchill once remarked regarding oil that “on no one process … or field must we be dependent” [British Parliament Speech, 1913]. Similarly, today we cannot depend on “one process” of gaining energy — society must aim to discover and utilize more efficient, environmentally-friendly energy tactics. Battery storage will be pivotal in this effort. As battery power and costs rise and fall, respectively, California’s ambitious endeavor to use completely clean electricity should be emulated, and if achieved represent a realistic, necessary path forward on energy policy for the world within a changing climate.

Sources:

Beatty, Jack. “A Capital Life: A biography of John D. Rockefeller traces his rise from threadbare country boy to Standard Oil magnate.” The New York Times, The New York Times, 17 May 1998, www.movies2.nytimes.com/books/98/05/17/reviews/980517.17beattyt.html.

Berke, Jeremy. “There’s New Evidence That Fossil Fuels Are Getting Crushed in the Ongoing Energy Battle against Renewables.” Business Insider, Business Insider, 9 Apr. 2018, www.businessinsider.com/solar-growth-outpaces-coal-oil-fossil-fuels-2018-4.

Critchlow, Julian, and Aaron Denman. “Embracing the Next Energy Revolution: Electricity Storage.” Bain Insights, Bain & Company, 31 Aug. 2018, www.bain.com/insights/embracing-the-next-energy-revolution-electricity-storage/.

Garner, Dwight. “’The Quest,’ by Daniel Yergin – Review.” The New York Times, The New York Times, 20 Sept. 2011, www.nytimes.com/2011/09/21/books/the-quest-by-daniel-yergin-review.html.

Genier, Bethany. “Yergin: Renewables Moving Toward Competitive Role in Energy Markets.” Yergin: Renewables Moving Toward Competitive Role in Energy Markets | IHS Online Newsroom, 5 Mar. 2008, https://news.ihsmarkit.com/press-release/energy/yergin-renewables-moving-toward-competitive-role-energy-markets

Gilbert, Ben. “’It’s the Dumbest Experiment in Human History’: Elon Musk Rails against Fossil Fuel Use and Climate Change.” Business Insider, Business Insider, 8 Sept. 2018, www.businessinsider.com/elon-musk-dumbest-experiment-2018-9.

Government, U.S. “U.S. Energy Information Administration – EIA – Independent Statistics and Analysis.” California – State Energy Profile Analysis – U.S. Energy Information Administration (EIA), https://www.eia.gov/state/analysis.php?sid=CA

Ige, David. “David Y. Ige.” David Y. Ige | PRESS RELEASE: Governor Ige Signs Bill Setting 100 Percent Renewable Energy Goal in Power Sector, 8 June 2015, governor.hawaii.gov/newsroom/press-release-governor-ige-signs-bill-setting-100-percent-renewable-energy-goal-in-power-sector/.

International Energy Agency. “Global EV Outlook 2017.” International Energy Agency, IEA, June 2017, https://www.iea.org/publications/freepublications/publication/GlobalEVOutlook2017.pdf

Nikolewski, Rob. “Can California Really Hit a 100% Renewable Energy Target?” Sandiegouniontribune.com, San Diego Union Tribune, 19 June 2017, www.sandiegouniontribune.com/business/energy-green/sd-fi-california-100percent-20170601-story.html.

Penn, Ivan. “California Lawmakers Set Goal for Carbon-Free Energy by 2045.” The New York Times, The New York Times, 29 Aug. 2018, www.nytimes.com/2018/08/28/business/energy-environment/california-clean-energy.html.

Roberts, David. “California Just Adopted Its Boldest Energy Target Yet: 100% Clean Electricity.” Vox, Vox Media, 10 Sept. 2018, www.vox.com/energy-and-environment/2018/8/31/17799094/california-100-percent-clean-energy-target-brown-de-leon.

Santos, Paulo. “On The Tesla Model 3 Being The Safest Car.” Seeking Alpha, 12 Oct. 2018, seekingalpha.com/article/4211218-tesla-model-3-safest-car.

The Parliamentary Debates (official Report).: House of Commons. By Great Britain. Parliament. House of Commons

Yergin, Daniel. The Prize: the Epic Quest for Oil, Money & Power: with a New Epilogue. Free Press, 2009.

Yergin, Daniel. The Quest: Energy, Security and the Remaking of the Modern World. Penguin Press, 2012.

http://faculty.haas.berkeley.edu/wolfram/papers/aea%20dynamic%20pricing.pdf

https://www.nytimes.com/2011/09/25/books/review/the-quest-by-daniel-yergin-book-review.html

https://sites.hks.harvard.edu/fs/whogan/PES_paper_09_salles_final.pdf

https://www.sciencedirect.com/science/article/pii/S0301421506003545

When the phrase “world domination” is used in reference to a powerful entity, the first image that often comes to mind is a villain in a cartoonish suit who absorbs power as the surrounding world crumbles — sometimes even accompanied by evil-sounding thunder in the background. World domination, however, is not limited to unrealistic individuals who wear masks that shield their true identities from being associated with their heinous crimes. Instead, the modern-day world dominator takes on a more digital form, making their tactics easily accessible to the public by interacting with their followers on a daily basis. As loyal followers build trust in the entity, individuals are more willing to divulge information as the power source grows in influence, teaching the dominator to tactfully increase its followers based on previous behavioral patterns. The cycle repeats until the dominator has created such a large presence that its followers literally cannot go about their day-to-day lives without it but, even worse, don’t really question this codependency.

Yes, Amazon and Facebook are the culprits of world domination — or, at least, they’d like to be.

The digital sphere as the modern world knows it has only been in existence for about two decades but has completely revolutionized the way humanity functions. Twenty years may be an extremely short period relative to all of time, but this small sliver of time has seen unprecedented societal and economic progress that has rewired the way we consume goods, interact with others and even perceive ourselves. This progress will only continue to exponentially grow, and digital companies like Amazon and Facebook will play a vital role in evolving our economic choices alongside forming our digitally-dependent society.

On one hand, the accessibility and connectivity Amazon and Facebook provide have made experiencing life in the 21st century easier than ever before between instant communication with peers and having nearly anything imaginable delivered right to one’s doorstep with the click of a button. As mentioned earlier, however, people unquestionably are becoming increasingly co-dependent on these large digital companies to live their everyday lives and make economic decisions — emphasis on unquestionably. While individual consumers make their lives easier by passively allowing these massive digital entities to become interwoven in their lives, the dominance of Amazon and Facebook on a grander economic scale may prove more dangerous than anticipated.

Primarily, the superiority Amazon has over specific producer markets and the dominance Facebook has over advertising are reminiscent of Standard Oil’s monopoly on oil in the late 19th century. By owning or controlling 90 percent of the U.S. oil refining business, Standard Oil was able to form trusts with other oil companies and drive out competition with others in the same business. Though Standard Oil was able to provide a good quality product at a reasonable, stable price, the company, from the government’s perspective, uncomfortably wielded too much power in one of the nation’s most important industries. Ultimately, the government put antitrust laws into practice, breaking down Standard Oil’s trust and, ideally, preventing further monopolies from forming.

Now in the digital age, the large-scale presence of Amazon and Facebook isn’t as tactile as, say, oil, but that doesn’t mean their potential to monopolize isn’t as — if not more — dangerous. The way consumers interact with these companies may be limited to a screen, but their impact is both felt and seen in the real world.

Amazon, as most any digitally literate citizen knows, is an online retailer that consumers can utilize to buy nearly anything — anything — and have it shipped to their door. As discussed by Jonathan Taplin in his book “Move Fast and Break Things,” Amazon has created a monopsony over certain goods, which is essentially the inverse of a monopoly. A monopsony, according to Taplin, is when a buyer, as opposed to a seller in a monopoly, has control over who can enter a specific market to buy goods, which drives prices down.

“Amazon has a near-monopoly position in the distribution of ebooks,” Taplin writes. “Beyond books, Amazon captures fifty-one cents of every dollar Americans spend in online commerce. It wasn’t supposed to be this way.”

Ironically, in 2014, New York Times opinion writer Paul Krugman published an article titled “Amazon’s Monopsony Is Not O.K.,” where Krugman claimed that “Amazon doesn’t dominate overall online sales, let alone retailing as a whole, and probably never will.” Come 2018, research by eMarketer tells an updated story: Amazon now shares 49.1 percent of retail ecommerce sales, which is nearly 5 percent of the total U.S. retail market online and offline.

Further, Taplin points out that the main consequence of Amazon’s monopsony in the book business forces authors and publishers to work for less money. He details how Amazon is able to practice a form of “rent-seeking” by denying publishers access to its large customer base and extracting excessive “rents” from publishers because the company has driven out seller competition. Arguably, Amazon’s path to digital retail dominance came rapidly and without much question because of the convenience the company brought to consumers. As a result, however, the consequences of Amazon’s presence are only recently being felt and studied.

“Monopsony power has probably always existed in labor markets, but the forces that traditionally counterbalanced monopsony power and boosted worker bargaining power have eroded in recent decades,” writes Alan Krueger of the Princeton Economist.

VIDEO: Here’s Amazon’s impact on the economy

Beyond damaging competition with selling in the book market, Amazon has established other monopsonies that have had disastrous effects for classic physical retailers.

“Amazon has changed the market in many ways. By the end of this week, Sears will file for bankruptcy. That’s a direct result of Amazon. Kmart will file for bankruptcy probably within the next two months. There’s really no place for the old-fashioned retail to exist in a world where Amazon can undercut their prices,” said Taplin in an interview. “Amazon wants to rule the world. It’s simple.”

Facebook is a whole other beast.

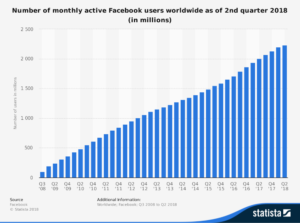

As mentioned, Amazon holds a monopsony over particular retail markets, like ebooks. This makes it harder for other buyers to enter the market because Amazon’s prices are so competitive that any smaller buyer would have a hard time being successfully profitable. Facebook, on the other hand, is the largest social network in the world with over two billion monthly active users or “MUAs.” The platform also owns Instagram and WhatsApp, which each have over a billion MUAs.

Facebook’s increasing MUAs from 2008-2018, according to Statista.

With such a large reach in the social media realm, Facebook has a near monopoly on affinity-side advertising, according to Dan Faltesek’s Medium article “Social Monopsony.” Taplin discusses Facebook’s business model in the same light, noting that the platform centers around selling advertising at a higher rate than comparable internet sites.

“In short, if you are looking to make a large social buy, Facebook is your only option,” writes Faltesek. “The case that Facebook has a near monopoly on in-stream affinity network advertising is fairly clear.”

Why is Facebook’s advertising scheme so successful? It’s simple: Microtargeting.

Microtargeting is a marketing strategy by which a company collects specific information on consumers — where they live, what they like, what their friends like and so forth — and pushes advertising content their way that directly reflects their specific interests. While this can be an effective strategy for marketers, in a world where there is only one buyer of user attention, regulation is necessary, as Faltesek points out.

So where does this leave modern society? For how much longer will we be so codependent on these massive digital entities? Digital enterprise is no longer an experiment — it’s a legitimate business with large impacts on the consumer market and needs to be treated as such. On the security side, in light of data leaks like the Facebook Cambridge Analytica scandal that took place earlier this year, these digital companies have shown that while they have a massive presence, they don’t always have control over where their data goes, which is a major issue that needs to be addressed. Additionally, increasing amounts of people have shown distrust in being so digitally present or have removed themselves completely from social media platforms, so now is a crucial moment that will determine if living digitally dependent lives is sustainable in the long-term.

“Until these companies begin to take responsibility for what’s on their platform, it’s going to be complete chaos and anarchy. This is not healthy for democracy, and I don’t think it’s healthy for humans, as you can tell in terms of what I think about your addiction to your smartphone that it is probably not a good thing. It’s not making you smarter. It’s just making you more distracted,” said Taplin in an interview.

At the end of the day, the digital sphere can change intensely in only a short period of time. While one cannot be certain where certain digital platforms will be in the next two decades, one can know for sure that the digital market is here to stay. Now, it’s just up to consumers to decide how digitally codependent they want to be. The digital sphere may be prominent, but allowing it to have personal dominance is an individual choice.

On July 6th, 2018, the United States declared war on China. This war, however, is not being fought with bombs and guns or by millions of soldiers, but is being fought with tariffs. Trump and Chinese President Xi are engaged in a full-on trade war, and neither side is showing signs of concession.

Trump has never been a big fan of the way Americans have traded with the Chinese. He says that China is profiting too much from U.S farmers without returning the favor.

At the root of Trump’s decision back in early July to tax $34 billion worth of Chinese imports lies his belief that too much manufacturing abroad is hurting domestic industrial efforts. This protectionist philosophy is highly debated by economists and is complicated as it results in both negative and positive effects throughout the economy.

Trump’s policies are not popular with other countries that rely on a stable U.S trade relationship to meet their importing schedule. Engaging in tit-for-tat trade disputes may seem like it will yield results, but in the long-term, it damages crucial relationships that could hurt America’s biggest industries. One big American industry may take a permanent hit—soybeans.

The United States’ biggest export is food, beverage, and feed according to a U.S Commerce report in 2017. Soybeans make up the largest part of that industry, and 60% of them were exported to China last year.

As demonstrated by a case study of the soybean market, the economic impact of tariffs on U.S. exports and a protectionist trade policy may damage the Chinese economy in the short term, but will eventually just push China to find alternative ways to avoid importing such high amounts of this product from America.

China does receive most of its soybeans from the United States, but it also gets them from Brazil. South America may be Xi’s best option if Trump doesn’t step down.

Though Brazil consistently runs out of soybeans at the end of each cycle, it could likely ramp up production efforts if need be. In the last 20 years, the country has increased its soybean production by 266%, whereas the United States’ production has only increased by 63%. However, production costs for Brazilian farmers may end up being too high to keep up with Chinese demand.

Another option for China is for investors to buy and develop land to produce soybeans in Brazil or another country, which would take a few years to fully implement. Then again, if this is a viable option in the long term, it could take away China’s need to rely on American soybean farmers.

President Xi’s Belt and Road Initiative (BRI) is also a key player in reducing reliance on U.S agriculture throughout this trade war. The Initiative is an effort to connect Asia, Africa, and Europe for mutually beneficial economic opportunities. China wants a “belt” of overland corridors and a “road” of shipping lanes between 71 countries. That means the BRI streamlines trade between half of the world’s population and a fourth of the global GDP.

The BRI brings an increased level of economic interaction to China, making it that much easier to locate untapped areas equipped to produce soybeans other than the United States.

If China resorts to any of these options, U.S soybean farmers are going to take a long-term hit. While America can refocus its efforts to shipping out the product to other countries, if China manages to get Brazil to ramp up production levels or invests in agricultural land in other countries, it would lower the need for U.S trade partners to exclusively import soybeans from America.

China is now taking short term measures to deal with Trump’s tariffs. The China Feed Industry Association proposed in September to ration out soybean feed to pigs.

Furthermore, the Xi administration is maintaining a positive attitude by looking to increase domestic soybean production.

“Unilateralism and trade protectionism are rising, forcing us to adopt a self-reliant approach. This is not a bad thing,” Xi said in September.

The Vice Agriculture Minister Han Jun also warned that Trump is playing with fire.

“Many countries have the willingness and they totally have the capacity to take over the market share the U.S. is enjoying in China. If other countries become reliable suppliers for China, it will be very difficult for the U.S. to regain the market,” Han Jun told the Xinhua news agency in August.

Soybean producers in China are already benefiting from the conflict. Yang Guiyin, the sales manager of an agricultural company in the Heilongjiang Province, said that soybean profits are on the rise.

“Our farmers really hope that China will import less soybeans so that domestic soybean production and soybean-related businesses will flourish,” Guiyin told NBC News in July.

The Chinese Government is pushing its domestic agenda even further as it aims to add $1.6 million acres of land to its existing soybean production. It is also subsidizing $190 to $320 per acre instead of the previous $150.

On the other side of the war, the U.S is not taking a visibly huge hit just yet. Soybean producers have been able to maximize productivity this last quarter by exporting to other countries other than China. The profit margins on the products are still diminishing, however.

Some experts believe this will not last.

“I view this as being a surge that will not persist, but it’s huge,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, told the Wall Street Journal in July. “If you’re doing lots [of exports] in absolute terms at a time when normally you wouldn’t be doing very many, then the seasonals will be very favorable.”

Looking ahead, the future of U.S soybean farmers will be determined by conversation between Trump and Xi. The world leaders have planned to meet on several occasions, but due to rising tensions, have not been ready to negotiate quite yet. The White House decided recently to move forward with conversation. Trump and Xi are planning to discuss the escalating situation at the Group of 20 leaders’ summit in Buenos Aires at the end of November.

For the Trump administration, the pressure is on. President Xi purposely targeted the soybean industry because the farmers primarily reside in states that elected Trump to office. China is looking to hit his weak spots. If Trump’s support system loses faith, it could have detrimental effects for republicans come November’s elections.

Iowa, Minnesota, Nebraska, North Dakota, and Indiana are all major soybean producing states and all voted for Trump in 2016.

In any trade war, just like in real wars, people are hurt. Trump stands by his belief that the United States will beat China, but if Xi continues to match Trump’s level of tariffs, it could get very ugly. Americans have no choice but to wait and see if Trump is correct in tweeting that “we win big.”

When Stacey Li heard that her hourly wage would be increased from $10.5 to $15 from her manager, she couldn’t help texting the exciting news to her friends immediately. Walking out of the manager’s office, she rushed to and hugged her friends who were waiting out of the building she worked.

“I was really excited. At first, I thought I got it because I worked hard,” Lee said. “ But I was still very happy after I knew L.A. increased its new minimum wage.”

Stacey Li

Stacey Li

Li, a student worker at USC FMS, received her first increased payroll in August. She said she had more extra money to buy clothes and bags. When asked her opinion of increasing minimum wages, she said: “It’s definitely good to minimum-wage earners, such as me. ” However, is it really good to artificially set an increased mandated minimum wage? Maybe not.

On July 1, the City of Los Angeles increased its minimum wage to $13.25 for large employers who have more than 25 employees, up from $12. Smaller employers with 25 and fewer employees saw a $1.5 increase to $12.

Wages will continue to rise incrementally over the next several years. By 2022, the minimum wage of Los Angeles will be heading toward $15 an hour. California is also heading towards $15, but won’t be there until 2023.

Source: wagesla.lacity.org

In passing the bill of higher wages, the well-intended government hoped that mandated higher wages could help the lowest-paid who are really struggling. However, the effects of increasing minimum wages are still under discussion. Two-side voices to debate about the wage floor have been appearing for decades years.

Early in the 1960s, the economist Milton Friedman pointed that the mandated minimum wage is “a monument to the power of superficial thinking”. He thought the low-paid and the unskilled would be hurt because the mandated minimum-wage law induced employers to dismiss a portion of employees.

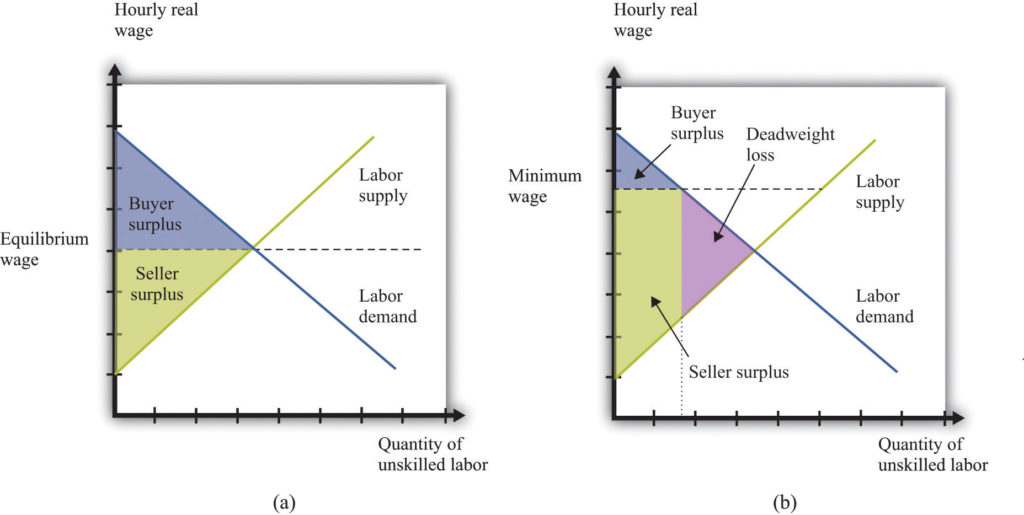

Also, if you learned Introduction to Microeconomics, you would be familiar with a concept: price equilibrium, a center point where supply and demand are lines that cross at the same time. In a totally competitive market, the price equilibrium point is the wage where the number of workers matches the number of jobs at that price. When we artificially set a mandated minimum wage higher than the market-determined spot, the deadweight loss appears. Under the situation, some workers are out of work. All in all, minimum wages create unemployment: While they draw more people into the labor market, they reduce the number of labor companies wish to hire.

Source: The Effects of Minimum Wage

Source: The Effects of Minimum Wage

The Employment Policies Institute published a study in December 2017 about the statistically negative effects of California minimum wage increases on employment growth-particularly in low-wage industries, from 1990 to the present. The study shows that a 10% increase in the minimum wage would lead to a 4.5% reduction in employment in an industry if one-half of its workers earn low-wages. The study also estimates 400,000 jobs will be lost if California minimum wage is increased to $15 in 2022.

How does the higher minimum wage hurt the low-paid and the unskilled? For example, the wage increase of $1.5 an hour in Los Angeles will translate to almost $60,000 in annual costs for a business with 20 minimum-wage employees. Businesses need to find ways to increase sales and generate profits to make up for the costs. When businesses cannot pay the costs with increased sales, they will choose other ways to control costs, for example, eliminate jobs, reduce work hours, or hire higher-skilled employees whose productivity can match their salaries.

For example, one of the recent breaking news would be that Amazon’s decision to raise its minimum wage to $15 apply to more than 250,000 Amazon employees and 100,000 seasonal workers, according to the company. However, in order to control the costs, Amazon also decided to end grants of valuable Amazon shares and monthly attendance and productivity bonuses. Some Amazon employees think their yearly total compensation, on the contrary, will shrink and they may end up making thousands of dollars less a year.

However, the other voice says mandated minimum wages don’t necessarily result in job losses; instead, they have little or no effects on employment. In 2017, two universities studied the effects of Seattle minimum wages and came to two different conclusions. The University of Washinton concluded that Seatle’s minimum wage is costing jobs, while the Univerisity of California, Berkeley pointed it hasn’t cut jobs. The University of California, Berkeley’s study focused on the Seattle food services industry, which is an intense user of minimum wage workers. They found no evidence of job loss in the city’s restaurant industry.

In 2013, Center for Economic and Policy Research released a report “Why Does the Minimum Wage Have No Discernible Effect on Employment?” studied by John Schmitt. The study’s conclusion is that little or no employment effects respond to modest increases in the minimum wage. But this doesn’t mean there is no deadweight loss in setting a mandated minimum wage. The study shows that businesses can make use of adjustments to decrease the effect in employment. These possible adjustments include “higher prices to consumers, reductions in non-wage benefits such as health insurance and retirement plans, reductions in training, and shifts in the composition of employment, improvements in business’s proficiency, cutting the earnings of higher-wage workers, and accepting reduction in profits”. In other words, if consumers, higher-paid employees, and businesses can help to pay the extra costs, the low-paid employment won’t be affected. But why do they have to help to pay?

When we discuss the effects of increasing minimum wages, we don’t only talk about the effects on employment but also on consumers, employees and employers. Based on John Schmitt’s report and Amazon’s actions to increase minimum wages, it’s hard to conclude that a wage hike is a really good thing. True, it can benefit a small portion of low-income employees. However, it a large group of people will suffer losses.

Before the first minimum wage came out, economists had predicted the negative effects of setting mandated minimum wages. Now that the governments already knew the possible consequences, why do they still persist the minimum wages?

One of the possible reasons is inflation. According to the interactive graphic, the buying power of minimum wage peaked in 1968, reaching almost $11, although the absolute minimum wage has been increasing over the past decades. If the governments don’t push the increase in minimum wage, the buying power may go down after taking inflation rate into account.

Source: CNN—Minimum Wage since 1938

Also, instead of considering the long-term suffering consequences brought by the minimum wage, the government may focus more on short-term benefits it can bring to low-income workers: from going hungry to having food. For governments, increasing the minimum wage is an easy way to gain support from people because the action shows their humanitarian. Possibly, when economists consider economic and social progress as a whole, the government pay more attention to the interests of certain groups and individuals only care about themselves. Thus, increasing the minimum wage becomes a correct action.

How Chinese Artificial Intelligence Technologies Have Been Developed to Compete With the U.S. Technologies

During the 1980s and 1990s, Artificial Intelligence (A.I.) had been researched and developed in the United States by research universities including Dartmouth College and Massachusetts Institute of Technology. Gradually, the research of A.I. has transferred from major universities to big tech companies. Its core researching regions have also spread to China.

Culturally, U.S. tends to misunderstand the nature of all China’s technology development, believing that all the high technology-based skills are stolen from the Silicon Valley and duplicated in some Chinese companies.

However, in 2017, Chinese A.I. startups received approximately US $ 6 billion funding around the world, and it was the first time that startups from other countries overtook the U.S. -based A.l. startups. Technology accumulation, cultural differences, government support and Chinese A.I. companies’ relation with Silicon Valley have all contributed to Chinese A.I. companies’ success in funding.

“It is not a coincidence,” said Li Jin, a Chinese software development engineer who works in the Silicon Valley. “It is a new trend.”

Jin is working on the Department of Music in Amazon. Since its popular A.I. assistant Alexa came out, Jin has wondered whether his company would have any interest in getting into the Chinese market.

The Chinese government now provides high-level support for the A.I. industry and implements tech-friendly policies in the tech business. One primary reason is that the success of mobile payment gives the Chinese government confidence that Chinese people have a relatively high acceptance of new technologies.

For example, Jack Ma, the chairman of Alibaba, was the first businessman who recently launched wireless dining in a smart restaurant. Customers can order food via an intelligent interaction by touching the screen. By using facial recognition at the first time, customers’ facial information will be stored into the system. Next time, the restaurant system will remember customers’ face and recommend food they potentially like. At the end of the lunch, people don’t have to pay for something physically, but their bills will be directly taken from their Alipay account. Alipay’s popularity stimulates the implementation of the smart restaurant.

Jin said that this A.I. restaurant implementation case is the combination of facial recognition and Alipay, which was developed by the same company Alibaba. Without the popularity of Alipay, this kind of restaurant won’t work for most of the customers.

Ma called this wireless restaurant “the future of smart restaurants.”

Government Policies and People’s Quick Adoption Are The Key Reasons

The Chinese government is willing to pick the best among the technology companies, giving them enormous advantages to enter the market and protecting them from foreign competition. The technology products of Alibaba, Baidu and Tencent can avoid their foreign competitors including Google, Facebook and Apple, and quickly occupy the Chinese market.

When Silicon Valley companies research similar products or services, it is always forbidden to imitate each other’s business models. However, in China, with the support of the government, a valuable and practical concept usually gets picked by dozens of companies.

Willie Chan, an ASIC design engineer in Silicon Valley, said more companies rush into the A.I industry when the government gives subsidies to any company that claims to have a qualified A.I. product.

One of the challenges faced by the A.I. companies is that A.I. software requires qualified hardware to run it. Because China has developed large hardware technology bases such as the Greater Bay Area in Shenzhen, A.I. companies can easily cooperate with hardware companies by moving to the same area. Generally, different types of technology companies gather at some developed cities in China, which is similar to San Francisco’s Silicon Valley.

Every year, thousands of talented people then all come to these new technology cities. For instance, Shenzhen is one of the well-known hometowns of A.I. companies. Each year, more than six million students come to the Greater Bay Area to search for jobs. Hundreds of companies also recruit talented people all around the world.

Unlike Americans who always question the security and privacy of new technologies, Chinese customers are willing to give innovations a try. The Chinese population’s high adoption rate of the recent high tech helps Chinese A.I. companies to practice their products. For example, China has the largest user population of mobile payment, bike-sharing and ride-hailing apps. Since the sharing culture including Uber and Airbnb entered from the U.S. to the Chinese market, Chinese companies have expanded this trend to more products: shared basketball, shared umbrella, shared mobile and phone chargers.

Potential Threats and Future Opportunities

Chan said that it is very valuable for large American countries such as Google and Facebook to put investments into the A.I. research during the past ten years; meanwhile, the Chinese companies focus more on simple A.I. technologies such as facial recognition and its related apps. Therefore, it is much harder for American countries to test their products by the same amount of people like these Chinese companies do.

Chan said he recently quitted his job on a Chinese A.I. company in Silicon Valley. He said the main purpose of his previous company to have a branch in Silicon Valley is to hire more high-tech talents. Under the culture of job-hopping, his boss believed that he could find talents who had worked for American A.I. companies before.

For Chinese A.I. companies and American A.I. companies, there is no complete block between two countries. Some American A.I. companies have tried to form a partnership with existing businesses in China so that they may better practice their products. On the other hand, in order to further research and develop A.I. technologies, Chinese companies need to participate the ongoing innovations.

Sources:

https://www.information-age.com/silicon-valley-china-next-global-home-tech-123471704/

https://www.information-age.com/shenzhen-next-silicon-valley-123471169/

https://www.technative.io/could-china-win-the-global-artificial-intelligence-race/

https://www.thestar.com.my/news/regional/2018/08/05/chip-labour-robots-replace-waiters-in-china-restaurant/

https://www.yicaiglobal.com/news/jack-ma-savors-wireless-dining-smart-restaurant-co-built-alibaba%E2%80%99s-ant-and-koubei

https://medium.com/syncedreview/chinese-startups-hauled-in-half-of-2017-global-ai-funding-49bd97ef3746

The huge influx of Chinese students into U.S. colleges has opened new opportunities for study abroad agencies – crisis management for students who received expulsions from schools.

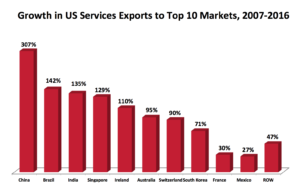

While President Trump relentlessly blamed China for taking away hundreds of thousands of jobs in the country, Chinese students have made a whopping contribution to the U.S. economy over the past decade. As the fasting-growing importer of U.S. services, the exports services to China recorded a jump of 307% from 2007 to 2016, while travel, including education, accounted for $29.9 billion of the export market in 2016, a report from the U.S.-China Business Council showed.

Source: The U.S.-China Business Council

In 2016/17, there were 350,755 Chinese students enrolled in an educational institution in the U.S., about one-third of the international students in the country, according to the Open Doors report published by the Institute of International Education.

Supported by the Bureau of Educational and Cultural Affairs at the U.S. Department of State, Open Doors is a data portal with information about international students studying in the U.S. or American students enrolling in study abroad programs.

As American universities are constantly inundated with Chinese students, a lucrative business opportunity has emerged – education agencies filing college applications for students in China.

Chinese Education Organizations Are on a Rise

Kudos to services delivered by her consultants, Viola Chen, a native Chinese, received her acceptance letter from Boston University in 2013. The RMB 50,000 service, equivalent to more than $7,000, gave Chen a package of 10 college applications. “The price of packages ranged from RMB 50,000 to RMB 200,000, depending on the experience and qualification of the advisors,” Chen said. “I had the cheapest plan,”

The lack of English proficiency and familiarity with American education has made Chinese parents willing to pay for application services worth tens of thousands of dollars. When admission packages arrive at their doors, all those charges pale into insignificance. “They don’t want to risk the opportunity, getting into good schools outweighs the additional service fees.” Chen said.

The booming industry features a one-stop solution for students seeking services pertained to college applications: tutoring classes for SAT and TOEFL tests, internship arrangement, essay editing, application mailing services, visa interview preparation, and meet-and-mingle networking events among students.

As a token of celebration, students attending similar-ranking universities will get the chance to meet at parties organized by the agency prior to the start of school year. “We get the network in China, and expand it in the U.S.,” Chen said.

To meet this mounting demand for college-admissions consulting, a glut of companies in China have hopped on this bandwagon over the past 10 years. However, the growing reliance on agencies has laid bare a serious consequence among this massive population – susceptibility to academic dismissal.

According to a report from WholeRen Education, 5,631 of their students were involved in the process of expulsion from 2013 to March 2018, while poor academic performance and academic dishonesty were the two major causes of dismissal.

“We have around 10 students seeking emergency services or help every day, either through regular channels or social media,” Jennifer Cao, an L.A.-based consultant at WholeRen Education, said.

WholeRen Education is a company headquartered in Pittsburgh, Pa., with operations in eight cities across the U.S., and three in China. To facilitate its business with Chinese students, the majority of its staff are native Mandarin speakers with experience studying in the U.S.

Apart from traditional agency services, the company also carries out a crisis management plan, namely emergency services, for students who are on the verge of getting expelled from schools. It is the pioneering education organization in the U.S. to provide second-chance solutions to academic expulsions, the report said.

“We see the opportunities, students are having problem going through these emergency matters.” Cao said.

The emergency consultation offers a series of services, including advising on how to win an expulsion hearing, ironing out the college transfer process, and providing daily supports to students with mental health issues. Service charge varies from cases to cases. It typically ranges from $1,500 to $4,500, the most expensive package, however, can go up to $50,000 per year.

Cultural Context Behind the Expulsion Story

With the overall surge in Chinese household wealth, sending children abroad is now an honorable move showcasing the family’s socioeconomic status. But the cultural clash between the U.S. and China remained as a major roadblock for Chinese students to perform their ability in the best possible light. It is not true that every child is well-versed enough in an English-speaking environment and the American education system before embarking on their college journey.

“Psychological preparation is a problem, language is another,” Cao said. “Some of them can’t even understand English,”

While there are a host of reasons contributing to the number of dismissal cases, disparity in teaching style appears to be one of the most patent factors. The spoon-feeding education in China made the parent-teacher oversight an important part of learning. With the teacher-led recitation, jam-packed tutoring schedules and strict parental supervision, students excel at academics under the Chinese education system.

Getting adapted to the American teaching style could be nothing but challenging to them. “The story is different here in the U.S.,” Cao said.

When limited guidance and language barriers come into play, these students would easily fall into the trap of skipping school or using ghostwriting services. If they are lucky enough to hide the shenanigans from schools, they could still celebrate college graduation by tossing their caps into the air. But at the same time, Cao said it could pose serious academic threats to those who get caught.

So when it comes to emergency cases, consultants might have to fight daily battles with students over completing their assignments or force them to attend lectures by knocking on their doors. “We are like their parents in the U.S. and help them develop the way right to study.” she said.

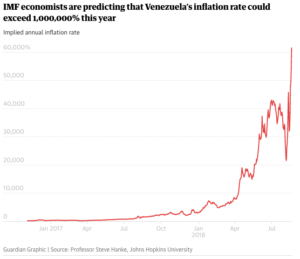

Millions are hungry, ill, and suffering from lack of food and basic necessities such as a police force to patrol the increasing crime in Caracas. In the capital, local residents are constantly rushing to supermarkets and gas stations, waiting in line for hours. Many are even resorting to eating rotten meat. The International Monetary Fund recently declared the lack of stability in the bolivar, predicting Venezuela’s projected inflation rate to be over 1 million percent by the end of 2018. Every day, the foundational pillars of Venezuela’s economy are rapidly changing: the prices of bread, the exchange rate between the US Dollar and the bolivar, and the trust of the Venezuelan people.

How did a prosperous country spiral out of control in less than two decades? It wasn’t always like this. Blessed with the largest oil reserves in the world, Venezuela has had a stable economy based on mostly oil revenue since the 1990s. In fact, they had such immense wealth, with the purchasing power parity (PPP) for GDP per capita was placed just over $16,000 in the 1990s. The economic disaster can be traced back to 1998 when Hugo Chavez was elected President of Venezuela. As he came from a similar background of poverty from the small village of Los Rastrojos in Venezuela, Chavez appealed to the lower-income individuals of Venezuela. After securing these votes, President Chavez was hit with a stroke of luck: a decade-long rise in global oil prices followed his election.

With Chavez in power, Venezuela’s dependence on oil grew— oil accounts for 96% of Venezuela’s exports and over 40% of the government revenue and the rise in global oil prices felt like a jackpot. The flourishing government finances drove Chavez to make a series of economic decisions that tend to be appealing to politicians—good in the short run but disastrous in the long run. Chavez’s socialist regime began to increase spending but as oil revenues declined, they also increased their borrowing. According to the Financial Times, the figure was around $25 billion during 2004 and just last year, the best estimate is around $178 billion. To continue to appeal to the poor, Chavez then spent this new wealth on food subsidies, health care for the poor, and improved education. Although these social programs certainly raised the quality of life for lower-income families, they were unsustainably funded, relying heavily on one major industry—oil. In fact, Chavez did not actively attempt to lay off the dependence Venezuela placed on oil exports. Instead, he zeroed in on welfare programs to the point that his unrestrained spending led to a deficit.

After Chavez died in 2013 and Nicolás Maduro succeeded Chavez as President of Venezuela, the oil prices plummeted in 2014. The U.S. Energy Information Administration states that in June of 2014, crude oil cost $112 per barrel (bbl) and by December, it went down to $59 per barrel. The Venezuelan economy took the hit hard as the GDP shrunk by 30 percent during a four-year span between 2013 and 2017. As Venezuela’s government revenue decreased dramatically, the government slowly realized the gravity of their problem of heavy dependence on one resource. In the past, Venezuela’s wealth and focus on oil exports led them to import more of their food and consumer goods. In 2013, food accounted for 18.41 percent of all of its imports.

President Chavez’s previous overspending on welfare created large fiscal deficits and the economy kept shrinking due to cheap global oil prices. President Maduro decided to simply print more money to sustain the welfare programs and import more food and consumer goods, but that is an extremely short term solution to their problem. Venezuela was trapped: the more bolivars (VEF) it printed to fund imports, the more the currency depreciated. The increase in imports for everyday goods, in combination to years of added regulations from the Venezuelan government (such as price control) and inefficient operations of nationalized businesses, caused domestic production of food and goods to shrink. With greater reliance on the government for the distribution of goods and services, only a few US dollars to spend on imports, and a decrease in welfare funding, there was a sudden scarcity of products within Venezuela. As the bolivar (VEF) became worthless, no one wanted to buy Venezuela’s debt or lend them money. President Maduro tried again to mitigate the bolivar’s decreasing value through various policy attempts that proved to be equally as disastrous; he raised the minimum wage by more than 3,000% and later hacked off 5 zeroes on the bolivar currency. But Venezuela fell short of achieving long term economic stability and these actions only elicited a deeper inflation crisis. Finally, the short term effects of Chavez’s policy to exchange welfare programs for popularity had worn off and the negative long term consequences began to emerge under Maduro.

Under Maduro, the normally subsidized medicine and food were not available to the poor because the government ran out of money and supplies. During this time, around 84 percent of the population identified as poor. To make matters worse, in the midst of this crisis, political corruption permeated the economy. Nicolás Maduro tweaked the political system to ensure that he could take advantage of the nation’s resources by using a complex currency system. While the bolivar became worthless and the demand for a more stable currency such as the US dollar arose, Maduro set the official government exchange rate at 10 bolivars per $1. However, only allies and elite friends of President Maduro could access this special rate, who then imported food and goods and sold them on the black market for a massive profit, to ultimately ensure that Maduro could maintain his power through near total control of goods and the cooperations of his allies. Most Venezuelans had no choice but to turn to the black market to access US dollars with exchange rates in the tens of thousands of bolivars.

Running out of options, Maduro turned to issuing local currency debt to raise money for Venezuela. However, the Trump administration responded by restricting Venezuela from selling their government debt in the US, making it more difficult to access foreign currencies and get out of their inflation. But most ambitious of all, Maduro is currently betting on a new type of currency to solve the economic crisis: the Venezuelan petro. It is an attempt at a virtual currency or cryptocurrency backed by commodities such as oil, gas, gold, and diamonds and intended to supplement the Venezuelan bolivar fuerte (VEF) while aiding in the mission of overcoming US sanctions. On the first pre-sale day, the petro raised $735 million and current prices are $62 for a barrel of oil. The Venezuelan government argues that this revenue could help pay part of the country’s obligations and is hopeful to one day use the petro as a daily currency.

Financial experts from the Washington Post find this ambitious plan incredibly risky. Though they are linked to oil reserves, the initiative can only be a superficial solution as long as the central bank continues to print money to cover government spending, which is what caused the inflation in the first place. More importantly, there is a lack of credibility. Implementing the petro is not the best policy because it circles back to the idea of trust—if no one believes in the cryptocurrency, no one is likely to use it. According to the Washington Post, “few Venezuelans appear to have faith in the fix (the petro), with many expressing broad fears that it may only make the situation worse.”

Often, economics are a self fulfilling prophecy and an economy’s state is rooted in social perceptions and belief. In fact, there is speculation of whether the petro is backed at all, as there is no evidence of active oil drilling or indication which reserves are used to back the currency. At the same time, because social perception influences economic actions, Venezuela is looking to legitimize the petro through active participation in using the petro as currency. An example is Venezuela’s expressed desire to pay for imports from Brazil with the petro. Another way Venezuela is implicitly forcing their citizens to partake in the petro initiative is in processing fees of one of the most important government issued items: the passport. The financial crisis has Venezuelans dwelling in social unrest. In fact, an estimated 2.3 million people have been fleeing the country since Nicolás Maduro’s ascendance to presidency in 2014 and is said to be the biggest migration of people in Latin America’s recent history. With large flocks of people emigrating, Ecuador and others are tightening immigration laws and requiring passports (reported to take up to two years to approve) to restrict access. Venezuela’s mandate that passport fees are to be paid in petro may be an economic policy move, but it is also a political decision from President Maduro. The past policy attempts to fix Venezuela’s economy from both Chavez and Maduro have been vast but short-sighted, yet one thing continues to ring true: in the root of Venezuela’s economic crisis lays political turmoil.

from Brazil with the petro. Another way Venezuela is implicitly forcing their citizens to partake in the petro initiative is in processing fees of one of the most important government issued items: the passport. The financial crisis has Venezuelans dwelling in social unrest. In fact, an estimated 2.3 million people have been fleeing the country since Nicolás Maduro’s ascendance to presidency in 2014 and is said to be the biggest migration of people in Latin America’s recent history. With large flocks of people emigrating, Ecuador and others are tightening immigration laws and requiring passports (reported to take up to two years to approve) to restrict access. Venezuela’s mandate that passport fees are to be paid in petro may be an economic policy move, but it is also a political decision from President Maduro. The past policy attempts to fix Venezuela’s economy from both Chavez and Maduro have been vast but short-sighted, yet one thing continues to ring true: in the root of Venezuela’s economic crisis lays political turmoil.

SOURCES:

https://www.economist.com/the-americas/2018/08/25/a-rude-reception-awaits-many-venezuelans-fleeing-their-country

https://www.reuters.com/article/us-venezuela-economy/venezuelas-annual-inflation-hits-488865-percent-in-september-congress-idUSKCN1MI1Y6

http://go.galegroup.com.libproxy1.usc.edu/ps/i.do?id=GALE%7CA524864014&v=2.1&u=usocal_main&it=r&p=AONE&sw=w

https://www.washingtonpost.com/world/the_americas/maduro-has-a-plan-to-fix-venezuelas-inflation—-which-may-make-things-worse/2018/08/19/7a6ee048-a3bf-11e8-ad6f-080770dcddc2_story.html?noredirect=on&utm_term=.87c509cca661

https://search-proquest-com.libproxy2.usc.edu/docview/398286313?accountid=14749&rfr_id=info%3Axri%2Fsid%3Aprimo

https://www.forbes.com/sites/garthfriesen/2018/08/07/the-path-to-hyperinflation-what-happened-to-venezuela/#4c9a7a3215e4

https://cointelegraph.com/news/venezuela-mandates-passport-fees-must-be-paid-in-controversial-cryptocurrency-petro

https://www.scmp.com/tech/blockchain/article/2167274/want-passport-venezuela-tells-citizens-pay-travel-document-state

https://www.aljazeera.com/news/2018/02/venezuela-petro-cryptocurrency-180219065112440.html

https://www.theguardian.com/world/2018/aug/20/venezuela-bolivars-hyperinflation-banknotes

https://www.imf.org/external/datamapper/PPPPC@WEO/OEMDC/ADVEC/WEOWORLD/VEN?year=2017

https://tradingeconomics.com/venezuela/consumer-price-index-cpi

https://www.cato.org/research/troubled-currencies?tab=venezuela

https://www.economist.com/finance-and-economics/2017/04/06/how-chavez-and-maduro-have-impoverished-venezuela

https://ftalphaville.ft.com/2017/10/03/2194217/how-did-venezuela-get-to-this-point/https://www.eia.gov/todayinenergy/detail.php?id=19451https://www.nytimes.com/interactive/2017/07/16/world/americas/venezuela-shortages.html