Taylor Swift performs on her ‘Speak Now’ tour in Sydney, Australia, in March 2012. (Photo by Eva Rinaldi via Flickr under CC-BY SA 2.0 license).

Last week, Taylor Swift was responsible for one-third of all music sold or streamed in the United States. Her newest album, reputation, on its own sold nearly double the rest of the Billboard 200 combined. And despite releasing only four singles from the album on streaming services, Swift came to dominate those charts as well.

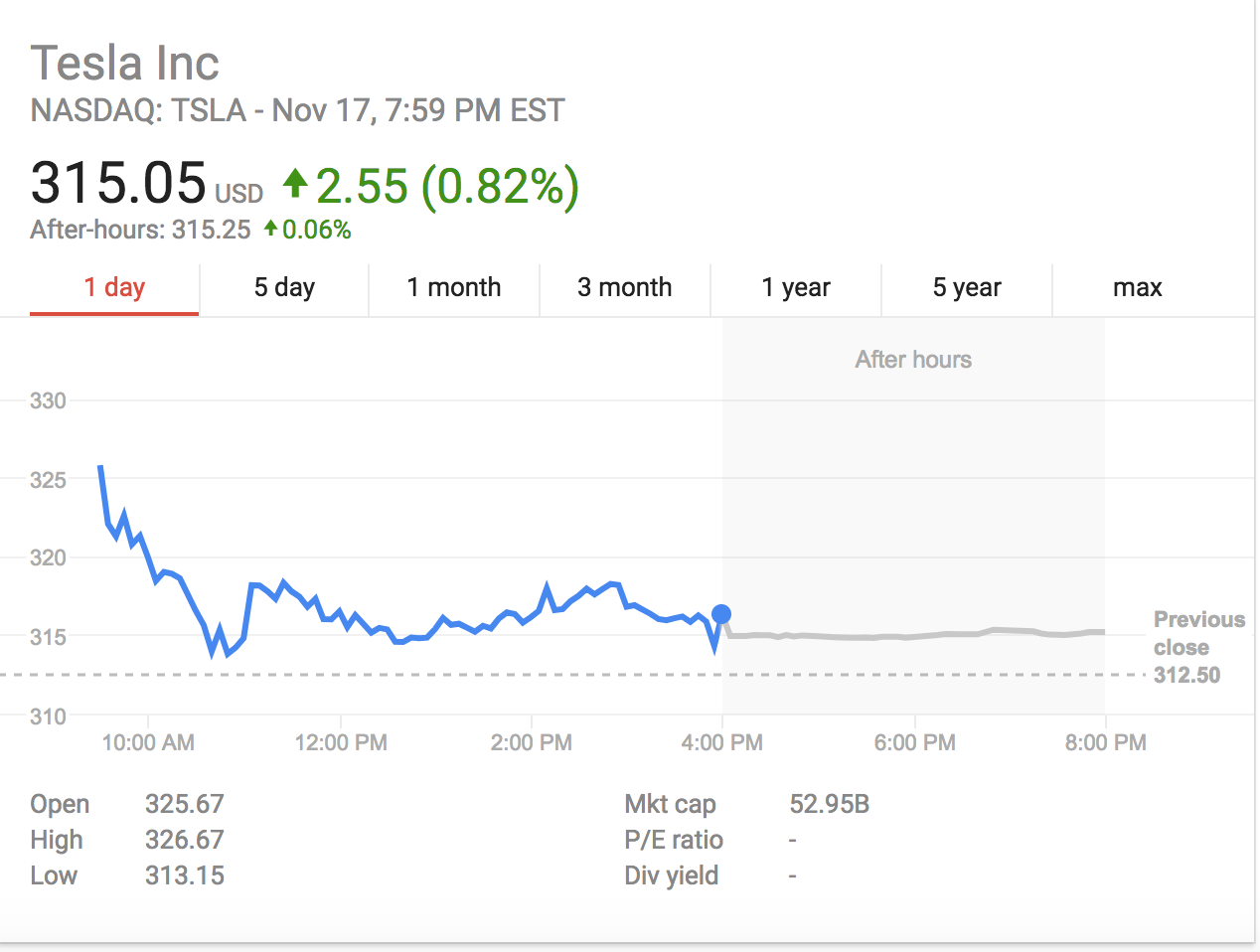

Swift’s choice to withhold access and force listeners to pay for her music has interesting implications for the streaming music industry, which remains unprofitable despite climbing numbers of paying subscribers. The latest numbers peg market-leader Spotify at 60 million subscribers, with second-place Apple Music coming in at 30 million. The growth of these services has been the primary driver of increasing revenue for record companies, whose U.S. revenues grew 11.4 percent in 2016 to reach $7.7 billion, according to industry association RIAA.

But that figure is still only about half of what it was in 1999, before early music streaming services like Napster entered the market, the RIAA said. As music became widely available online, consumers became less willing to pay for it, driving down revenues. The recent uptick in paid subscriptions has yet to make up for more than a decade of declines.

“We’re no longer running up a down escalator,” Warner Music CEO Stu Bergen told The Guardian, “but that doesn’t mean we can relax.”

The major challenge faced by both streaming services and the music industry is the popularity of YouTube, where songs are often available for free (legally or illegally) and revenues sent back to the music industry are miniscule. Spotify contributes an average of about $20 per user to the industry, according to The Guardian, while YouTube sends less than $1 its way. In 2016, that meant just $553 million in total revenue from YouTube compared to $3.9 billion from Spotify. Both these figures are far lower than comparable music sales revenue would be for the same number of listeners.

Throughout her career, Swift has taken a stance against making music widely available online, defending her copyright on YouTube and withholding her releases from streaming services. Her entire catalog was only available to stream for a few months in 2017, until reputation was released to buy but not to stream.

Swift wrote in 2014 that “music is art, and art is important and rare. Important, rare things are valuable. Valuable things should be paid for.”

Free or subscription music can be great for consumers, but it prevents sellers in the marketplace from gauging how much someone values an artist’s creation. In economic terms, Swift’s choice to temporarily withhold her latest album from streaming services and allow interested customers to pay for access enables a kind of price discrimination that can increase efficiency and better match supply and demand. As John Paul Titlow of Fast Company explained:

Many of the people who care most about her music felt compelled to do something that seems rare these days: They bought the album. Others, like me, did nothing.

[…]

And to be sure, many of the diehards who bought a physical copy of Reputation will likely add it to their streaming libraries as well. But by then, Swift will have already smartly extracted maximum value out of the people who care the most. And why shouldn’t she?

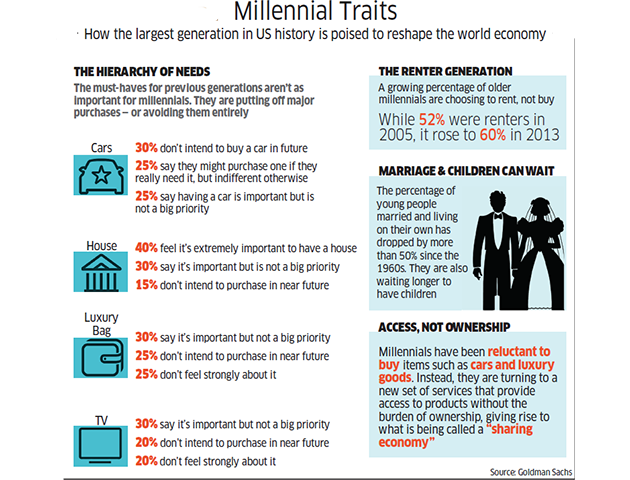

Millennials grew up during a time of major technological advances, globalization and economic disruption. Because of this, they have a very different set of behaviors and experiences.

Millennials grew up during a time of major technological advances, globalization and economic disruption. Because of this, they have a very different set of behaviors and experiences.