Humans do not actually behave according to economists’ thought processes. Classic economics assume that humans are perfectly rational beings, who are all-informed and have infinite calculating abilities. In such a world, where people have concrete preferences and act in isolated events, advertising would not need to exist. This is because people would be certain in their preferences and unable to be swayed by ads.

In 2016, $190 billion was spent on advertising in the United States, so clearly, the real world has a need for advertising. That’s where behavioral economics come into play. Behavioral science–at the intersection of economics and psychology–assumes that people are not rational or capable of making decisions in their best interest (Freakonomics). In reality, most people make decisions using their emotions as the deciding factor either equally as much or more often than they use reason.

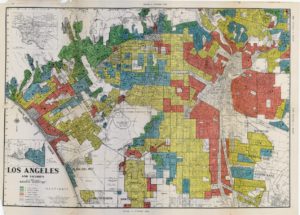

In this world of incomplete information, independent actors (people) must infer from others or situations with more complete information. Their safest bet is often to copy what the people around them are doing. The academic term for this is social norming, which in lay man’s terms means peer pressure.

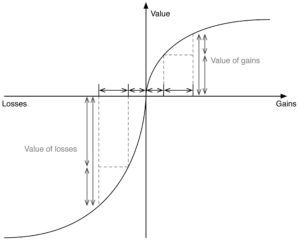

A big reason for this herd mentality is something called loss aversion. Loss aversion is a concept explaining that people experience greater emotion (pain) with loss, than the emotion (pleasure) they experience with gains of proportional size. So in simplified terms, people hate giving stuff up, even if said stuff has little to no value to them. They want to mitigate their losses, and one way of doing this is by making decisions that other people have already made which weren’t catastrophically bad.

Behavioral economics takes into account these factors playing into decisions that real, irrational individuals make. It’s a study of the “codification of behavioral anomalies” which economists establish using empirical evidence (Forbes). Consumers frame their personal economic outcomes as gains and losses, which affects their economic decisions and choices. Behavioral economics examines this framing.

Advertising is an industry that has been using behavioral economics to its advantage long before the area of study was formally established. The industry manipulates the emotions of consumers in a way, changing their preferences, which contrary to standard economics beliefs, are not concrete. Like social norming, people pick well-known brands because they figure they’re less likely to be catastrophically bad than the alternative.

One tactic some advertisers use is the creation of scarcity. Limited edition, limited time only, etc., labeled products construct an artificial scarcity, driving humans to take action. They buy the product right then and there instead of waiting. Companies and advertisers exploit this scarcity bias in consumers as an effort to sell more products.

Advertisers and ad agencies rely on data to help manipulate their audiences. This collection of data calls for a new area of academia–this time in the field of ethics. Where is the line drawn? If voluntary data collection is okay, what about involuntary? How do these ethical issues converge with those of digital data collection as seen by Google, Facebook, etc?

http://adage.com/article/adagestat/advertising-dan-ariely-behavioral-economics-marketing/146001/

https://www.investopedia.com/terms/b/behavioraleconomics.asp?ad=dirN&qo=investopediaSiteSearch&qsrc=0&o=40186

https://www.spectator.co.uk/2017/08/how-sutherlands-law-of-bad-maths-could-solve-nightmare-train-commutes/