Last year, Nike brought back their Air Cortez sneaker in the White/Varsity Royal-Varsity Red color scheme– the very same style Tom Hanks was seen donning in the 1994 movie Forrest Gump. Producing this shoe is incredibly labor-intensive– its leather stitching, exposed padding on the nylon tongue, and crisp white laces have undoubtedly been produced in one of hundreds of Nike’s manufacturing plants outside of the United States. However, a significant portion of what consumers pay for when purchasing shoes like the “Forrest Gump sneaker” go not only towards manufacturing costs, wages, and shipping, but also tariffs and shoe taxes. Unbeknownst to many, outdated shoe tariffs have been contributing to the rising costs of shoes and have led to many Americans, like Forrest Gump, running their shoes into the ground.

Last year, Nike brought back their Air Cortez sneaker in the White/Varsity Royal-Varsity Red color scheme– the very same style Tom Hanks was seen donning in the 1994 movie Forrest Gump. Producing this shoe is incredibly labor-intensive– its leather stitching, exposed padding on the nylon tongue, and crisp white laces have undoubtedly been produced in one of hundreds of Nike’s manufacturing plants outside of the United States. However, a significant portion of what consumers pay for when purchasing shoes like the “Forrest Gump sneaker” go not only towards manufacturing costs, wages, and shipping, but also tariffs and shoe taxes. Unbeknownst to many, outdated shoe tariffs have been contributing to the rising costs of shoes and have led to many Americans, like Forrest Gump, running their shoes into the ground.

With a globalized economy and companies increasingly outsourcing plants to take advantage of cheaper labor, brands produced in the United States have difficulty competing with low prices. In order to counter the low costs of the textiles and apparel imports, the United States government has imposed tariffs of up to 67.5 percent compared to an average 1.4 percent on most other goods to protect the United States’ dwindling domestic manufacturing supply chain (The Hill). However, with only one percent of shoes manufactured in the United States, American consumers could be the ones suffering the burden through unnecessarily high costs of shoes.

The shoe tariff was created in 1930, when the United States boasted a large domestic footwear manufacturing base (The Hill) that needed protection from foreign companies. Back then, footwear manufacturing was even more labor intensive than it is now, with each stitch handmade and leather meticulously done. Numerous European craftsmen brought with them knowledge and credibility in the art of shoemaking, which helped the United States manufacturing base flourish. Since the rapid globalization of the shoe industry, cheaper labor across seas made manufacturing in the United States less practical. Today, European shoemakers are not competing with the United States for shoe manufacturing, but counterfeits and cheaper goods from countries like Vietnam and China.

Generally, imposing high tariffs are meant as a supportive measure for the domestic manufacturing market. Raising prices of incoming goods keeps prices competitive for imports and domestic products, thereby encouraging United States consumers to continue supporting the United States economy on a local level. In the United States, over 99 percent of shoes are imported, mostly from Asia (Wall Street Journal). However, these tariffs still exist to protect the remaining one percent, whilst most Americans cannot name one American shoe companies manufactured in the United States.

An example of a company benefitting from the high tariffs is New Balance, an American sneaker company, and one of the last to continue manufacturing in the United States. Even New Balance, however, says that it is struggling to keep manufacturing in the United States. Though Robert DeMartini, CEO of New Balance, insists on keeping manufacturing in the United States, stating that New Balance’s U.S. plants are “twice as effective” as Asian plants, and that “we learned a lot because we had to in order to survive” (Wall Street Journal), the company is still facing difficulties to keep work at home. Manufacturing in the United States costs 25 to 35 percent more than to manufacture abroad in Asia (Daily News), and a majority of New Balance’s shoes have parts manufactured outside of the United States. In fact, the company manufactures two-thirds of its shoes across waters and relies heavily on machinery in order to keep costs low. Though the main argument for maintaining the high shoe tariffs is to keep manufacturing jobs at home, are they simply supporting jobs that we can no longer afford to keep in the United States?

Nike is one company protesting the high tariffs. Nike claims that current money going towards tariffs and taxes could go towards research and development advancing sustainability and innovation. The company argues that lowering tariffs can actually increase manufacturing jobs in the United States by allowing the company to develop advanced manufacturing methods that would make keeping jobs in the U.S. more practical. However, many Americans are skeptical of Nike’s promises to create jobs if tariffs are cut, especially as the company continues to move jobs overseas. Lori Wallach, the director of Public Citizen’s Global Trade Watch, is one skeptic. She says, “Nike’s job creation claim mimics the broken job creation promises that multinational corporations have used to push for past controversial trade pacts, only to turn around and offshore U.S. jobs after the pacts took effect” (NPR). Though Nike is viewed as having the financial and political backing to end shoe tariffs in the United States, the reality is that many Americans would rather trust a company like New Balance on an issue concerning American jobs due to its positive association of being made by Americans, for Americans.

The 99 percent of shoes manufactured abroad pay a significant portion of their budget towards shoe taxes, which in turn ups the prices of shoes for unsuspecting Americans. Shoe tariffs are enforced based on shoe classification, which are assigned in a complicated process based on the shoe material, function, target gender, size, construction, and value. Generally, shoes that are more likely to have been produced through cheap, foreign labor have a higher tariff imposed. These shoe tariffs range from zero percent for men’s golf shoes, to 84 percent for cheap sandals and are implemented by volume, per shoe (Harmonized Tariff Schedule). Annually, these shoe tariffs provide an additional 2.7 billion dollars for Congress (NPR). Because most Americans purchase 7.3 pairs of shoes annually each regardless of age, the estimated 2.4 billion dollars that Americans could be saving according to industry analysis could be going towards other household expenses.

The 99 percent of shoes manufactured abroad pay a significant portion of their budget towards shoe taxes, which in turn ups the prices of shoes for unsuspecting Americans. Shoe tariffs are enforced based on shoe classification, which are assigned in a complicated process based on the shoe material, function, target gender, size, construction, and value. Generally, shoes that are more likely to have been produced through cheap, foreign labor have a higher tariff imposed. These shoe tariffs range from zero percent for men’s golf shoes, to 84 percent for cheap sandals and are implemented by volume, per shoe (Harmonized Tariff Schedule). Annually, these shoe tariffs provide an additional 2.7 billion dollars for Congress (NPR). Because most Americans purchase 7.3 pairs of shoes annually each regardless of age, the estimated 2.4 billion dollars that Americans could be saving according to industry analysis could be going towards other household expenses.

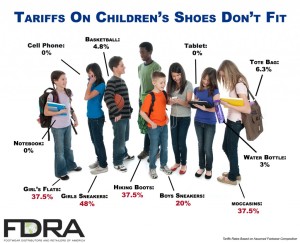

Due to the fact that shoe tariffs disproportionately affect prices on the cheapest shoes to manufacture — children’s shoes and low-cost-to-produce sneakers, the Americans hit hardest by shoe tariffs are often those who cannot afford to pay the extra costs. According to Economist Bryan Riley, shoe tariffs increase costs of the cheapest shoes by about one-third. For example, if shoe tariffs were removed on a $10 shoe, they would be reduced by $3. This in turn impacts how families living paycheck-to-paycheck end up spending money in other household necessities like groceries. Purchasing goods and services to support their children and their family’s health are affected unnecessarily.

Though the 1930s shoe tariffs were intended to protect the United States shoe manufacturing industry, the tariff is now outdated as American manufacturing work has since traveled overseas. Americans are left paying the costs of keeping a slim number of manufacturing jobs at home. Most Americans are unaware of the shoe tariffs, and with companies like Nike and New Balance arguing both sides of whether or not to keep them, Americans who are informed are decidedly split on the issue. As tariffs come to the forefront of politics, it will be interesting to see whether or not Americans decide to kick the tariffs costing them so much.

Sources:

https://hts.usitc.gov/?search_txt=shoes&query=shoes

http://sneakerfactory.net/sneakers/2015/02/importing-shoes-hts-shoe-import-duty-shoe-tariffs/

http://www.usalovelist.com/american-made-shoes-ultimate-source-list/http://www.aei.org/publication/the-us-has-imposed-protective-shoe-tariffs-on-americans-for-decades-even-with-no-domestic-shoe-industry-to-protect/

http://www.npr.org/sections/itsallpolitics/2015/05/08/405196569/would-lower-shoe-tariffs-actually-encourage-american-jobs

http://www.wsj.com/articles/SB10001424127887323764804578312461184782312

http://money.usnews.com/money/personal-finance/articles/2011/10/28/how-consumers-and-communities-can-benefit-from-buying-local

http://www.usnews.com/opinion/blogs/economic-intelligence/2012/09/21/the-wasteful-culture-of-forever-21-hm-and-fast-fashion

http://www.forbes.com/sites/danikenson/2013/07/23/textile-protectionism-in-the-trans-pacific-partnership/#275d91d593a8

http://www.wsj.com/articles/SB10001424127887324735104578123523795505336

http://hypebeast.com/2016/7/nike-classic-cortez-og-forrest-gump

Leave a Reply

You must be logged in to post a comment.