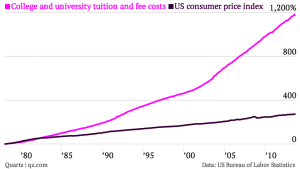

Every year the cost of tuition goes higher and higher and yet I have personally never understood why tuition is high as it is (USC). My mama always told me to get the bang out of the buck and always figured that his made the most absolute sense, –so shouldn’t universities, institutions handling millions of dollars, be doing the same? Maybe that’s just the uneducated and confused, yet hopeful and concerned citizen talking in me. But, man wouldn’t that be nice.

Take my school for example. We have a cafeteria, two libraries, five parking lots, 23,653 employees, million dollar club fund raisers, $35 million donation from Dr. Dre –etc.. Now some of those things listed do make a profit and some don’t, but regardless I believe that USC has all the possibility and even responsibility to utilize these things in a way that runs the school as efficiently as possible. Obviously USC has to pay the 23,653 employees so they pay those who work for the school and allow them to feed their families, pay the bills etc.. Or maybe, NOT.

Featherbedding. It’s a word I just learned today. It means having more employees than needed. Without a doubt, this school has killed a lot of birds (). But it’s not just employees –it’s facilities, programs and organizations that are funded by the university. Who gives the university $40,000 each year? Me, damn it. Am I being crass? Well, I’m sorry if I feel that my money should be used more efficiently to provide me with a return more comparable to what the leaders of the institutions are receiving. The leaders are people who I refer to as the teachers, the administration, USG, counselors, –the utmost needed people to protect and serve the ideals of an efficient institution.

The thing here is Jerry, that man Nikias, President of USC, takes home at least a million dollars and that’s where I’d like to be, see? That’s why I’m paying this school (Sallie Mae* actually) and I will not feel apologetic for not willing to pay for services, programs and organizations that I have no interest in and provide no benefit. Would you do that? See the problem here, is USC along with many other schools have become less transparent in connecting tuition (investment) to returns. Tuition now includes payment for school concerts, construction, celebrity appearances etc.. And frankly, I could care less for all of that, but god allows for differences and so I’m sure there are people who love seeing Jason Derulo and Diplo, which is … fine. But tuition, like any other transaction, should only be to pay for the service—the education, and all those who service directly to provide it.

If you’re getting the picture Jerry, what I’m wondering is, why can’t universities do away with all of that and simplify their financial obligations towards a way that makes everyone happy? Happy means lower tuition, more savings –oh, I do pray that’s what Walmart had in mind.

“Tuition is expensive, school is hectic and the future is a blurring. So let’s simplify the picture and look at it one frame at a time.”

– Willis Parker

Sallie Mae* – A formerly government sponsored enterprise that that assists in the furthering of college debt