In a medical emergency, dial 9-1-1 – it is ingrained into every American’s head from childhood. What is only realized after you call 9-1-1 and the ambulance takes you to the hospital is the hefty bill that comes with it. But what are we supposed to do in a state of emergency, not call an ambulance?

As medicine advances, more patients are being treated effectively and more lives are being saved. However, the costs associated with these advances are astronomical, and many Americans don’t even know how much they are paying for healthcare. Similar to the habit of calling an ambulance, most people don’t immediately start thinking about cost and start questioning their course of treatment – they just want to get better. This is one of the root causes of the healthcare crisis in the United States. Patients trust their doctors, and they should. However, they are increasingly being steered in more expensive directions because of new technologies and increased healthcare costs across the nation.

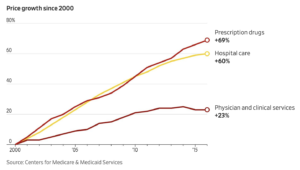

Of course, the healthcare crisis in the United States is multi-faceted. It involves the question of who has access to healthcare, health insurance costs, political interest, lobbying power, mergers and more. Often the topic of healthcare gets so complicated that people don’t even know what their opinions are or how to address the issue. But one thing is extremely clear, healthcare costs are rising and it is directly affecting Americans. According to The Wall Street Journal, the United States spends more per capita on health care than any other developed nation. Soon, the U.S. will spend almost 20 percent of its GDP on health. This is not because Americans are buying more healthcare overall, but because what they are buying is becoming increasingly more expensive. Health insurance costs and out-of-pocket prices are increasing. For a healthy individual, this is likely just increased costs associate with annual visits to a general physician. Although significant, this doesn’t have dramatic impacts on individuals and families. However, for individuals with life-threatening diseases, disabilities or cancer, these costs become a huge burden. As seen in the chart below, the price of prescription drugs due to pre-existing conditions and hospital care expenses have grown exponentially since 2000. Physician and clinical service prices have increased as well, but more moderately.

When looking at specific individuals plagued by horrible circumstances of health, it is easy to see how these increased prices have become a problem. For example, according to the American Diabetes Association, the total costs of diagnosed diabetes in 2017 was $327 billion, increasing by $82 billion since 2012. For a Type One Diabetic who is insulin dependent, many of these costs are associated with the insulin they must purchase in order to survive. When grouping together Type One and Type Two Diabetics, the largest components of expense are hospital impatient care (30 percent) and prescription medications to treat complications of diabetes (30 percent). These dramatic numbers are a trend seen among life-long diseases that require many doctor appointments, occasional hospital visits and a lot of medication.

A Duke study published last year, where 300 cancer patients were surveyed, revealed the financial distress a cancer diagnosis causes a household. On average, cancer patients in this study were spending 11 percent of their household income on their cancer treatments. Those who reported the most financial trouble were spending more than 30 percent of their household income on their care, even though more than 60 percent of the people surveyed were covered by private insurance. These expenses are not the first thing someone things about when they receive their diagnosis, but for many, they are very difficult to ignore and that has an impact on their health. An associate professor, oncologist and member at the Duke Cancer Institute, S. Yousuf Zafar, says, “The financial toxicity of cancer treatments is impacting patients’ ability to pay for care, and is likely impacting how well they do.” Zafar says during the recession ten years ago she started noticing patients asking for less expensive treatments and wanting to cut back on the frequency of their treatments. This is a trend that has continued even as the economy has recovered – even in privately insured patients.

Although the United States is constantly making medical advances with treatments that can dramatically increase an individual’s quality of life and life expectancy, the economic burdens are holding a lot of patients back from embracing these new technologies.

A new, advanced diabetes technology, the Dexcom G6, continuously monitors glucose levels in a revolutionary way. With insurance, most patients have to pay an out-of-pocket cost of $349 for a box of three sensors that last ten days each. That is about twelve boxes a year, for a total of over $4,000 a year spent on Dexcom supplies.

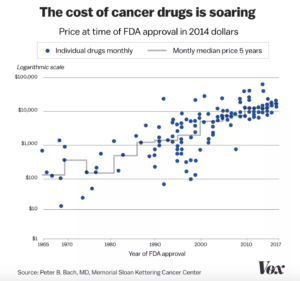

Revolutionary drugs are now also being created to treat cancer. Recently, James P. Allison and Tasuku Honjo were just awarded a Nobel Prize for their research on cancer immunotherapies. Immunotherapy treatments are seen as a beacon of hope for many people with cancers such as melanoma, lymphoma, lung, kidney and bladder cancers. It is amazing. However, when these treatments are unaffordable to most, they are not being utilized to their full potential. Ezekiel Emanuel, a professor at University of Pennsylvania’s Perelman School of Medicine, says, “What we’ve seen over the last two decades is the cost of cancer drugs go through the roof. Every year, the introductory price seems higher and higher and higher.”

According to Forbes, the cost of cancer drugs has increased from $50,000 per patient in the mid-1990s to $250,000 today – four times the median U.S. household annual income. A treatment of $850,000 for a single patient is not unheard of with immunotherapy. Not only does this mean people can’t access these medications, it means they are unsustainable in the U.S. health system as a whole. However, still, the U.S. government plans to increase its budget towards medical research for the third consecutive year.

The thought of not calling 9-1-1 because of the cost of an ambulance ride seems absurd. But people with life threatening conditions are now forced to consider limiting or withdrawing treatments and care that could have extraordinary impacts on their health conditions.

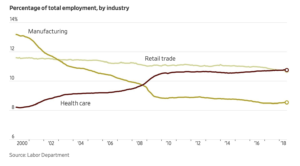

With a health system that has become unsustainable, how can the United States maintain a healthy, long-living country? The answer may be to look at preventative care, which will cost less in the long-term. Former head of the Centers for Medicare and Medicaid Services under President Obama, Dr. Donald Berwick, notes,” We put far more into hospital care than we do keeping people from having to be in the hospital.” However, with this idea lies another problem. Going back to the almost 20 percent of the nation’s GDP being within the healthcare sector, it is evident how the significantly the industry contributes to the country’s economy. While much of this has to do with spending, another – fairly large – part of this has to do with the employment the health care industry has brought Americans. In December 2017, the health care industry surpassed the retail industry as the country’s largest employer. It surpassed the manufacturing sector in 2008.

This points to the vast amount of power there is in the industry, which makes it such a tough issue to tackle. Healthcare is a complicated issue, and there is no easy answer. However, it is unfair to ignore the many Americans who are burdened with these costs, when they are already being burdened by a life-altering medical condition.