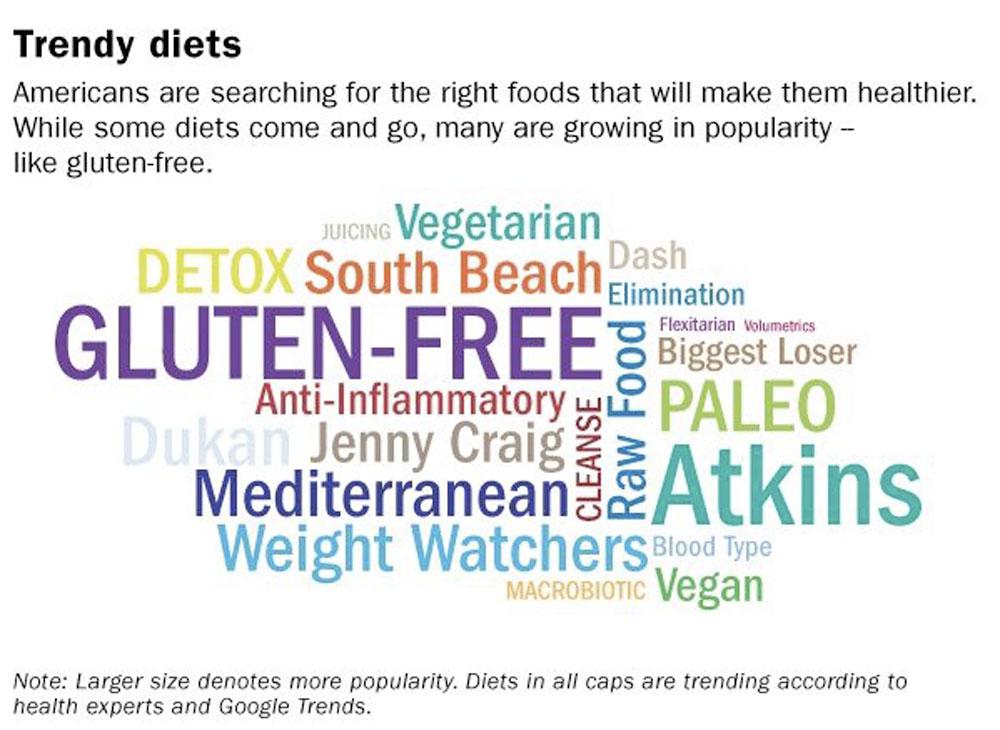

It’s a protein, it’s found in plants, and it’s the most hated ingredient in the food industry right now. No, it is not sugar that leads to a high risk of diabetes, and it is not sodium that is linked to prevailing rates of heart disease – it’s gluten. Absurd at it seems, gluten has become public enemy number one, and is getting kicked out of households across the country. Because of media outlets spreading news of gluten like wildfire, gluten has been transformed from an ordinary ingredient to the culprit of a variety of health issues. The consequence of this has grown an anti-gluten passion into a multibillion-dollar market.

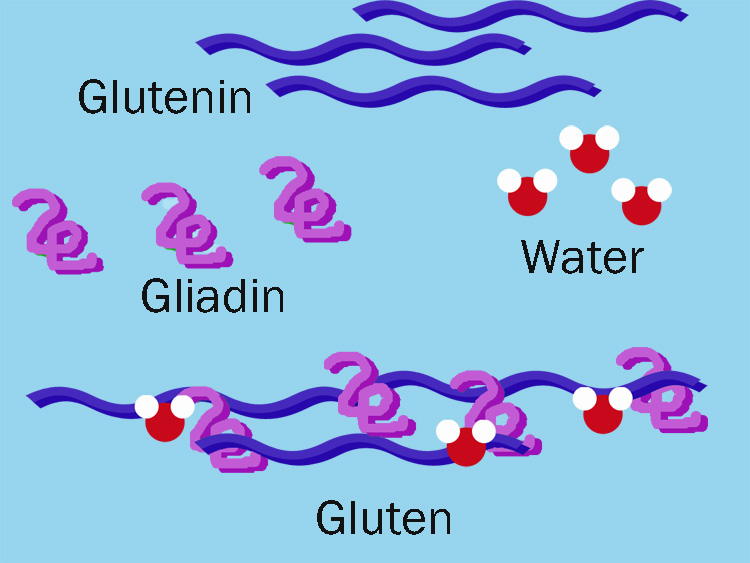

Found in wheat, barley, rye, and a couple other grass-grown grains, gluten is formed when two molecules (glutenin and gliadin) are conjoined during the germination cycle of a plant. The bond of these two molecules allow for elasticity in food products, an element that is essential for cooks to create desirable cuisine for their customers. Gluten can be manipulated to form different textures for food; however, it is essential to keep in mind the origin of this protein molecule.

A depiction of the gluten forming process. (Source: http://pieinthewoods.files.wordpress.com/2012/11/gluten.jpg)

The beginning of the gluten-free tale came about in 2011 when Peter Gibson, a professor of gastroenterology, published a double-blind research study indicating the detrimental affects gluten has on an individual’s health. When his subjects did not eat gluten, their health improved. When gluten was added into their diet, they immediately reported pain and other gastrointestinal issues. As astonishing as the results seemed, it was noted that all thirty-four-test subjects had irritable-bowel syndrome – but the public overlooked this defining detail.

This study raised the awareness of a “gluten anxiety” phenomenon, initiating a new group of people to develop an interest in the topic. To add fuel to the fire, two books about the malicious acts of gluten were released not too long after Gibson’s study was published in the American Journal of Gastroenterology. William Davis penned “Wheat Belly” in 2011, and David Perlmutter followed suit with his book “Grain Brain: The Surprising Truth About Wheat, Carbs, and Sugar – Your Brain’s Silent Killer.”

Celebrity endorsement of the gluten-free movement further pushed along the awareness of this new trend. With the likes of Oprah, Gwenyth Paltrow, and other influential leaders in the social media realm, the notion to ditch gluten slowly crept into the minds of individuals from all different age groups. Soon, this newfound awareness of gluten warped into a trendy diet, initiating the demand for gluten-free food. The magnitude of the gluten free market has astonished both doctors and investors alike, whom are both struggling to keep up with the changing landscape for ditching gluten.

The market value for gluten free products provides evidence for the growing mass of consumers that are vying for gluten free food. With a $10.5 billion dollar price tag in 2013, a 48% increase is expected for gluten free products, leading to a $15 billion dollar estimated market by 2016. Investors have picked up on this development, hoping to get their own piece of the gluten free pie. In 2011, Smart Balance, an investor in small food companies, turned their attention to Glutino. With a price tag of $66.3 million, Smart Balance purchased this gluten-free baking operation.

A year later, the same investment group acquired another gluten-free establishment called “Udi’s” that was about twice the price. It seems the investment paid off, as sales for these two gluten free establishments are up 50%. The Chief Executive of these companies, Stephen Hughes, explained the motive of his purchases in an interview with the New York Times. “Three years ago, we could have bought a Greek Yogurt Company, but instead, we bought Glutino…we think this is a trend with long legs because there is some insulation from the big players- it’s hard to produce gluten free.” Hughes brings up a valid issue with this booming market – and that is the ability to honestly produce a gluten free product.

Glutino’s approach at marketing its gluten free food at a local convention. (Source:https://c1.staticflickr.com/9/8093/8592803563_aa7851d752_z.jpg)

The Food and Drug Administration (FDA) was prompted to take action with the labeling of gluten-free foods when just about any company could slap on a label indicating it was free from the feared food product. Years ago, the primary reason companies would make gluten free food was for the population with Celiac’s disease – an autoimmune disorder that produced a dangerous enzyme in the body to make up for the lack of being able to digest gluten. The smallest bit of gluten can set off this chain of response for a Celiac’s patient. The importance of correctly labeled food is vital, and their trust in food companies could potentially be a life-or-death matter.

Deception amongst companies who mislabeled their food “gluten-free” became a highlighted issue for the Celiac community; however, the new boom in this market was not looking to attract this group of consumers. The driving force of this market is the population with a self diagnosed gluten intolerance – where believing they were eating gluten free was “good enough.” The FDA cracked down on many inaccurate claims of foods supposedly having gluten-free ingredients.

Surprisingly, the FDA set a gluten limit of 20 parts per million. It is controversial whether or not this is a low enough limit, but this was not the only discrepancy. The FDA requires food products to declare any possibility of cross contamination with wheat, nuts, dairy, and soy; however, gluten is not yet included on this list. A company may not be able to have a “gluten-free” label on their product, but they still do not have to report any possible added gluten.

The barrier the FDA inflicted upon the gluten-free market put a dent on the pace of growing food products, but this did not negatively impact the social influence of eating gluten-free. Almost 30% of Americans reported they wanted to reduce or eliminate their intake of gluten last year, shedding light on the public opinion of pursuing this type of diet. It became a norm for an overwhelming amount of people who jumped on the “gluten-free bandwagon” to diagnose themselves as having non-celiac gluten sensitivity. Conveniently, this type of diagnosis does not involve the approval of a specialist; people have simply taken it upon themselves to play the role of health care provider.

Beyond this, other health care providers are beginning to play along with the gluten-free blaming game. In an interview with the New Yorker, Peter H. R. Green, the director of the celiac-disease center at Columbia University medical school talked about the impact of this growing issue. “A life coach is now prescribing a gluten-free diet. So do podiatrists, chiropractors, even psychiatrists…we are now seeing more and more cases of orthorexia nervosa. First, they come off gluten. Then corn. Then soy. Then Tomatoes. Then milk. After a while, they don’t have anything left to eat…”

This withdrawal of eating that Peter Green refers to highlights the hidden foundation of a fad diet – taking away an element of food that is supposedly “bad.” The point of the diet is to stop eating a harmful ingredient for his or her body, but this is not the same mindset for the patrons of the self-diagnosed gluten-free clan. Losing weight is the main marketing strategy for gluten free food, and the individuals are more concentrated on how many pounds they have lost since (supposedly) giving up gluten. Yet another trick the gluten-free market has cooked up is keeping up this notion of associating “gluten free” to being healthy, no matter the food product. The industry attempts to cater their food items to people who want an exact replacement of the food they ate, just without gluten. Without this pesky ingredient, their once junk food has instantly become healthy. Unfortunately, this is usually the opposite case. Green stated, “Often, gluten-free versions of traditional wheat-based foods are actually junk food…our patients have jumped on this bandwagon and largely left the medical community wondering what the hell is going on.”

The bona fide gluten-free customer is treasured by grocery stores; they spend about $100 per grocery trip compared to $33 for the average consumer. It does not pose as a coincidence that the individuals who are diagnosing themselves as gluten intolerant are also able to afford this price hike. Stores like Whole Foods and Trader Joe’s specialize in supplying large supplies of gluten-free foods, knowing their clientele will purchase it. Trader Joes even joked to sell “Gluten Free Greeting Cards” at a surprisingly low cost of 99 cents each. This notion that the gluten-free lifestyle is aimed at the middle to upper class adds to the hyped up culture of the diet.

To successfully sell gluten-free food to a consumer base with money, it is necessary to “know your audience.” The farmer’s market every Wednesday at the University of Southern California attracts vendors who wish to sell their goods to its students. This is where the “CaveGirl Cupboard” first caught my eye – an all-natural bakery that creates treats with ingredients you can pronounce. They also pride themselves on being gluten-free, non-GMO, low-carb, soy free, dairy free, grain free (and the list goes on). Leia Blanco, one of the founding partners of the company had some time to talk about the vision of the CaveGirl Cupboard, and the success they have found in the Los Angeles area. When asked about the production of their food, Leia made it clear that they bake the products themself.

“At CaveGirl, we make the items in our own kitchens and buy our own ingredients to ensure there are no cross-contamination issues we have to worry about.”

Leia noted that they stick to a gluten-free diet, and she has already lost a significant amount of weight from this. She does not have a medically diagnosed gluten allergy herself; however, she insists that she has more energy because of ditching gluten. When I asked about her customer base and how many of them had Celiac’s disease, she hesitated, and said, “Most of our customers love our cookies and other food because it is delicious and fits with their diet. I do not know how many specifically are medically allergic to gluten, but I do not think it is too many.”

CaveGirl Cupboard tables at different farmers markets around Los Angeles, and has built a significant following since their start in 2013. It seems that they have started their company in the appropriate location to flourish in this industry, as their prices seemed a bit steep. “We keep our prices competitive with other products like ours, we know there are customers out there who do not mind paying more for baked goods they can trust.”

CaveGirl Cupboard markets their product to reach out to the stereotypical self-diagnosed gluten free customer, which has brought them success in this industry. As I walked away with a box of four poker-chip sized cookies for five dollars, it dawned on me how much potential companies like this have with prices like that.

The opinion of social media on the topic of gluten has taken a turn for the comedic side. Talk show hosts have taken advantage of the ridiculous growth for gluten free products and services – such as gluten free dog food, gluten free dating services, and the sudden onset of banning gluten from households. A popular show on Comedy Central, “South Park,” illustrated this humor during a recent episode by comparing it to the anxiety of Ebola.

With a firm group of believers in the gluten-free trend, this industry is only expected to continue to grow. Although the endless misconceptions about gluten have doctors shaking their heads, the consumers that can afford this lifestyle are supposedly feeling all sorts of positive effects. Although these same customers believe they can have their gluten free cake and eat it too, the reality is that it is still a cake – and the long-term benefits are not going to pan out.

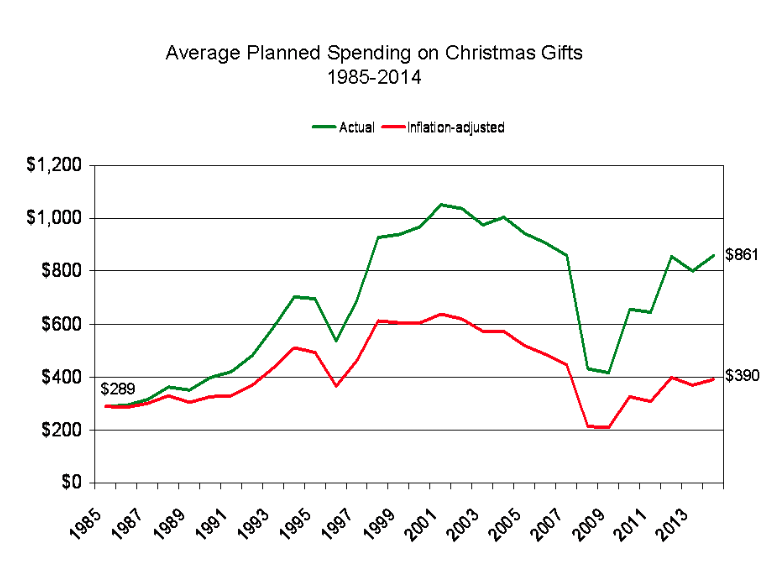

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an