Rosemary Anderson owes the federal government $152,000 due to accumulated student debt. Hundreds of thousands of students find themselves in similar straits. However, it is her age, 57, that leads to an alarmed reaction.

When the Great Recession plagued the nation in 2008, unemployment spread quickly throughout the middle-age workforce. In 2010, approximately 3.9 million individuals aged 35 and older were pursuing a degree, a 20% increase from 2006. Pursuing a college degree as an older adult became more common as the few jobs available were increasingly competitive to acquire. The payoff for going back to school was not clear for everyone in this cohort, and the repercussions of this have spilled into saving for retirement.

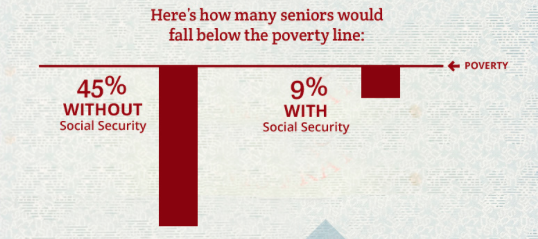

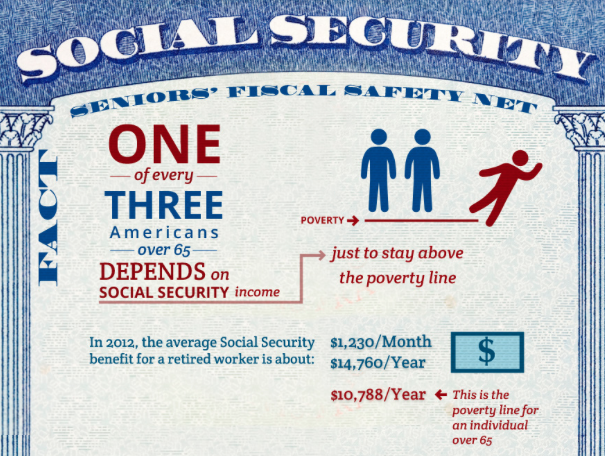

Social Security, a government entitlement program, would typically serve as the safety net for a person with diminished financial resources in later years. One of the purposes of Social Security is to assist older Americans with the transition from a working salary to retirement. Approximately 45% of people 48 to 64 will not have enough money saved to cover basic needs once in retirement. This translates into a disproportionate part of the population depending on Social Security as their major money lifeline.

Unfortunately, this option is starting to fade for people like Rosemary. She went back to school for her bachelor’s degree at the age of 37, and a master’s degree at the age of 44. Rosemary has been able to put off loan payments because of claiming unemployment and sorting through a divorce, but this period is soon to end. Beginning April of 2015, she is mandated to pay $699 a month for the next 24 years (until she is 81) – or else she will default on her loans. With a $3,400 monthly income and a $2,200 mortgage payment, if she were to pay her student loans, this would leave her with $500 a month to live on. With car payments, utilities, and other bills still to pay, the security of old age is quickly slipping away from Rosemary’s grasp.

In 1995, the Higher Education Technical Amendments Act was approved to remove any time limits the federal government had to collect money from student loan borrowers. A year later the Debt Collection Improvement Act passed, allowing the federal government to garnish Social Security checks in order to collect this debt. Once a monthly Social Security check drops to the value of $750, the government cannot collect more money until the subsequent month. The Supreme Court upheld these provisions in 2005. This monthly value is below the poverty line, likely due to the fact that it has not been adjusted for inflation since 1998.

Rosemary could start receiving Social Security payments in as little as four years, but because of the debt that hangs over her, relying on these checks is unrealistic. If she were to retire, her reduced monthly Social Security check would only cover about a third of her mortgage payment. With health implications already a concern, the amount of time she has left to remain employable is questionable. With no source of income to look upon in later years, her future options appear to be bleak.

According to Rosemary, “I incurred this debt to improve my life, but the debt has become my undoing.”

Although statistics show that a college degree leads to an overall higher salary than those with only a high school diploma, it is important to consider how many viable working years are left to pay off school loans. Adult students are also less likely to receive private scholarships that help alleviate the burden of student loans. The aid most available to the older students consists of Perkins Loans and Stafford Loans – both administered through the federal government.

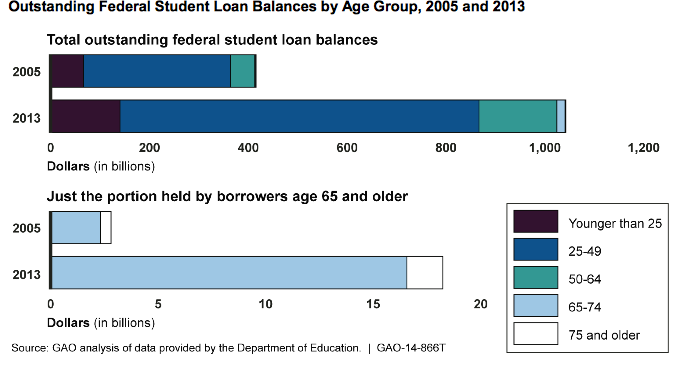

According to a report from the Government Accountability Office, the aggregate federal student loan debt in 2005 was approximately $400 billion. By 2013, this number more than doubled as it reached $1 trillion dollars. The current population aged 65 and older account for $18.2 billion of the total student debt (compared to $2.8 billion in 2005).

The amount of student debt is projected to grow, even with the recovery gaining traction. A visible growth in employment during the recovery has been in the low-paying job sector. Since the height of the recession, many high and middle-wage occupations have been replaced with positions available in lower-wage industries. This shift in job openings did not create a favorable environment for the middle-aged population with new degrees. The consequence of this has become a battle with unpaid student loans and a low salary, ultimately leaving these individuals in a crippled financial state.

With the economy still in a delicate state, the growing amount of people who are caught in this financial predicament are negatively impacting the future growth of the recovery. Because of unpaid student loans, from January to August of this year alone, 115,00 Social Security checks were garnished from the federal government.

Senator Elizabeth Warren introduced a bill early in 2014 to allow individuals in this predicament to refinance their loans, consequently alleviating some of the financial distress; however, the bill was blocked in June.

As Rosemary sees it, “If I had taken out a loan with a loan shark, I would have been better off.”

On September 10, 2014, Rosemary shared her personal story at the United States Senate Special Committee on Aging in hopes of reaching out to lawmakers to take action upon this occurrence.

In an interview with columnist Rodney Brooks, Senator Bill Nelson, chairman of the U.S. Senate Special Committee on Aging, emphasized the importance of Rosemary Anderson’s situation that has become all too familiar nowadays.

When questioned about the magnitude of this issue, Nelson said, “Some may think of student loan debt as just a young person’s problem. But increasingly that’s not the case. Right now, student loan debt among seniors is fairly small, but it’s growing quickly and much faster than other age groups.” As for the reason the aging population is facing large amounts of debt, the Senator indicated, “Many of these folks are going back to school later in life, but are then unable to find jobs that will allow them to pay off their debt before they hit their retirement years.”

Because of the Senate Committee meeting, the Senator wants to push forward new legislation to protect Social Security checks. He intends to index the $750 reduced check payment for inflation to prevent the aging population dependent on Social Security checks from poverty.

Aaron Hagedorn, clinical assistant professor at the USC Leonard Davis School of Gerontology, explained the repercussions of an absent savings to depend upon in later years.

Aaron first highlighted the idea that the population is severely unaware of how much money an individual would need to save for a comfortable retirement.

“If you make about $100,000 per year and your mortgage and other various payments are dependent upon this fixed income, then for a 20 year retirement (assuming a person will be alive for 20 more years), you would need to have at least $2 million saved.” Aaron laughed after this statement, bringing to light that the nature of planning ahead of this magnitude is not common, and simply not realistic nowadays with the amount of debt the population incurs. Aaron exclaimed, “For most of the population, planning for retirement is not possible. Even if an older person stashes away a bit of money hoping it is enough to cover them in old age, with increasing interest rates, the value of their already small savings decreases as time continues.”

Aaron emphasized the importance of Social Security in retirement, and how necessary this money is to keep up with not only the increasing health issues that transpire in old age, but also to simply keep food on the table.

“Getting another loan on top of already built up student loans is not an option for these people, and this is truly an issue that needs to be addressed, but unfortunately, the future does not look certain for them,” Aaron lamented.

An attorney at the National Consumer Law Center, Deanne Loonin, proposed to forgive debt for seniors such as Rosemary Anderson who cannot sustain a minimal standard of living, as they are the most vulnerable debt-holders of the population. Because there is no limit for the government to collect student debt, Deanne summarized the situation in terms that reflects the realistic nature of the issue:

“In human terms, that means, literally, that it follows them to their graves.”

Leave a Reply

You must be logged in to post a comment.