Oil markets are positioned for yet another wild ride; with academic and Wall Street analysts predicting price increases of anywhere ranging from $40 to $70 per barrel by the end of the year, oil is looking far more handsome to investors. Over the last two and a half years, the industry experienced its deepest downturn since the 1990s. As the old saying goes, “history always repeats itself.” When using the past as a guide, after every oil bust comes a significant recovery, if not a market boom. With external factors like increased electronic car production and the Organization of the Petroleum Exporting Countries, known as OPEC, fast at work, one question remains: just how long will this upswing last?

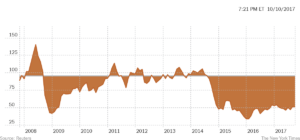

According to macrotrends, as of October 10th, the price of West Texas Intermediate (WTI) crude oil was $49.17 per barrel. “It looks as though the market started to get convinced that the rebalancing is actually happening,” Tamas Varga, an analyst at PVM Oil Associates Ltd. Said in a note during late September of this year.

Even after oil prices recovered from below $30 per barrel in early 2016 to $50 per barrel by the end of that year, The New York Times reported that Executives believe it will be many years before oil returns to a comfortable and prosperous $90 or $100 per barrel, which was essentially the norm for the industry until the price greatly collapsed in late 2014. However, analysts still remain hopeful that oil prices will sit above $60 per barrel by the end of this year.

Following a drumbeat of bullish data in September, which included the International Energy Agency’s upward revision to its demand outlook, crude oil prices were lifted, returning the U.S. to bull-market territory. The Wall Street Journal reported that this serves as the sixth bull market for the crude industry in four years and the first since February of this year.

Investors have gained new confidence that OPEC will continue to cut production and its efforts will help to bring oil’s supply and demand into balance, thus increasing prices. Other factors, like Iraqi Kurdistan’s independence referendum, have played an influential role in boosting prices. After Turkish President, Recep Tayyip Erogan, made a camouflaged threat to close the pipeline which allows for Kurdish oil to reach the global market, crude prices perked up in response. Political and economic upheaval in major oil-producing countries like Venezuela could cause a major price spike as well.

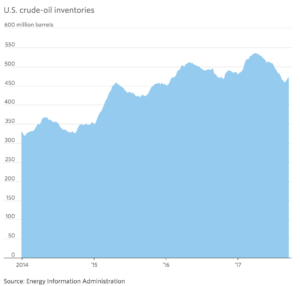

In the wake of Hurricane Harvey, U.S. oil rebounded as U.S. refineries came back online. Due to the storm’s immense power and widespread devastation, U.S. oil supply became more limited, causing an increase in the prices per barrel.

Global demand for oil has also been strong in recent months. In early September of this year, the International Energy Agency (IEA) raised its prediction for demand growth throughout 2017 and expects an increase of at least 1.6 million barrels each day. Additionally, Forbes reported that the “Energy Information Administration showed that motor gasoline product supplies rose 0.6 percent on a year on year basis.” With the IEA confirming rising growth outside the U.S. and the EIA confirming the rise in U.S. demand for petroleum product, “oil markets will move back into contango, and there is really nothing stopping a move in U.S. crude to $60/barrel.”

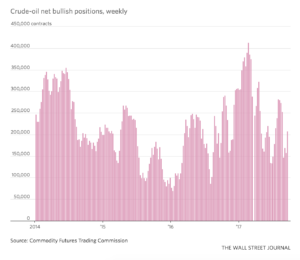

Despite outspoken investor confidence in a continued upswing in crude oil prices, some more speculative investors and hedge funds remain bearish when placing bets on U.S. crude oil. Donald Morton, a Senior Vice President on the energy trading desk at the Connecticut-based Investment Bank Herbert J. Sims & Co., told the Wall Street Journal, “The short sellers haven’t capitulated yet. Those bears who are entrenched remain entrenched – they’re not convinced this is over.”

In early 2017, data from the Commodity Futures Trading Commission showed the bullish bets outnumber bearish ones by more than 11 to one, but according to more recent data, that number has shifted to less than three to one.

So, who benefits from this resurgence in oil prices? Oil companies, their employees and shareholders all walk away as winners when oil and gasoline prices rise. U.S. producers are likely to lock in higher prices for future outputs to maximize their profit. Michael Tran, the director of energy strategy at RBC Capital Markets, regarded this producer mentality as something that has previously capped rallies and worked against OPEC’s pricing efforts.

Producing states, including Alaska, Louisiana, North Dakota, Oklahoma and Texas benefit from residual employment and tax revenue increases. The higher crude prices equate to increased activity in the oil fields, which aids local businesses including construction firms that build housing, truck dealerships, and mom-and-pop services companies.

Nigeria, Russia, Saudi Arabia and Venezuela are all major crude oil producing countries that have been pressed financially in recent years. For the Saudis, higher oil prices hold an additional benefit as its state oil company, Saudi Aramco, becomes more valuable for the initial public offering (IPO) planned to roll out later this year.

Lastly, there is a potential benefit for the environment. With increasing oil and gasoline prices, consumers are encouraged to buy smaller, more fuel-efficient vehicles and limit driving. While this is a good sign for mother nature, consumers of gasoline, heating oil and diesel fuel walk away from the oil pricing increase as losers. Additionally, retail outlets, hotels, and restaurants can take a hit when consumers have less disposable income in response to increased pricing.

With OPEC members producing nearly 40 percent of the global oil supply, the group, when united, serves as a tremendous force in dictating oil prices. In response to their recent efforts, current oil and gasoline prices are more or less in balance, which The New York Times suggests positive economic news for all parties affected by the industry.

As excitement continues to circulate around the direction of oil prices, it seems as though no one has bothered to consider impending potential threats to the crude oil industry.

“It’s going to be huge,” overjoyed oil industry experts exclaimed as Donald J. Trump was elected as the U.S.’ 45th President. Trump is outspoken about his support of industry efforts to build more pipelines, including the Keystone XL, a pipeline that would open up more federal lands and Deepwater prospects for drilling, and successfully deliver Canadian heavy oil to refineries located near the Gulf of Mexico. He has also stated he would like to lower regulatory burdens on the industry, which was made apparent through his lack of sympathy for the international Paris climate accord, which set out to lower global dependence on fossil fuels.

If enacted, all the aforementioned policies would increase natural gas and oil supplies on domestic and international markets, which in theory sounds great, right? Well, this would actually lower gas prices, which would hush the joyous industry expert’s tune.

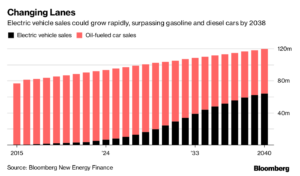

Trump’s presidency isn’t the only threat facing the oil industry. Automakers have been pushing to produce more electronic cars.

10 years ago, Apple Inc. released a surge of innovation (does the name iPhone ring a bell?) that completely capsized the mobile phone industry. With some assistance from ride-hailing services like Uber and Lyft, and new self-driving technology, Bloomberg Technology stated that Electric cars could be on the cusp of pulling the same fast one on “Big Oil.”

David Eyton, the head of technology at the London-based oil giant BP Plc, stated in an interview, “Electric cars on their own may not add up to much, but when you add in car sharing (and) ride pooling, the numbers can get significantly greater.” Fewer people driving cars indicates less demand for oil. If the already diminishing vehicle numbers on the road are replaced by electronic vehicles, the demand for oil will greatly reduce, causing a huge drop in price and supply will likely continue to increase or stay the same.

Tim Harford, the economist behind a BBC radio series and book on historic innovations that disrupted the economy pointed out that instead of electric motors gradually replacing the current norm of internal combustion engines within the model, there’s likely going to be “some degree of systemic change,” adding, “(improvements in technology) are a lot more complicated (than perceived).”

Moral of the story? Yes, crude oil prices are rising at a promising rate; however, one must always remember that all good things do come to an end.

Works Cited

Collins, Jim. “Rising Demand Will Continue To Drive The Rally In Crude Oil Prices.” Forbes, Forbes Magazine, 27 Sept. 2017, www.forbes.com/sites/jimcollins/2017/09/27/rising-demand-will-continue-to-drive-the-rally-in-crude-oil-prices/#2f2a309c2749.

“Commodities: Latest Crude Oil Price & Chart.” NASDAQ.com, www.nasdaq.com/markets/crude-oil.aspx.

Krauss, Clifford. “Oil Prices: What to Make of the Volatility.” The New York Times, The New York Times, 15 May 2017, www.nytimes.com/interactive/2017/business/energy-environment/oil-prices.html?_r=0.

Saefong, Myra P., and Mark DeCambre. “Oil Prices Settle at a More than 1-Week High.” MarketWatch, MarketWatch, 10 Oct. 2017, www.marketwatch.com/story/oil-aims-for-first-2-session-gain-since-late-september-as-saudis-cut-crude-exports-2017-10-10.

Salvaterra, Neanda, and Alison Sider. “Oil Prices Mixed Ahead of Crude Market Data.” The Wall Street Journal, Dow Jones & Company, 9 Oct. 2017, www.wsj.com/articles/oil-prices-yo-yo-ahead-of-crude-market-data-1507546791.

Shankleman, Jess, and Hayley Warren. “How Electric Cars Can Create the Biggest Disruption Since the IPhone.” Bloomberg.com, Bloomberg, 21 Sept. 2017, www.bloomberg.com/news/articles/2017-09-21/how-electric-cars-can-create-the-biggest-disruption-since-iphone?utm_medium=email&utm_source=newsletter&utm_term=170925&utm_campaign=ritholtz.

Leave a Reply

You must be logged in to post a comment.