Trade: the transfer of ownership of goods and/or services from one entity to another.

A slow-down in trade seems improbable at a time when the United States seems to rely more and more each year on cheaper Asian and European manufacturing processes; however, this is no longer the case.

What happened?

Back in late-August/early-September, the Hanjin Shipping Company filed for bankruptcy in South Korea, forcing many of their ships to be stuck at sea. To show how much damage this filing can make, Hanjin Shipping Company is one of the world’s top ten largest shipping container carriers in respect to capacity. The company transports over 100 million tons of cargo every year across the globe.

In order to show the extent to which Hanjin’s influence on world trade exists, the total value of the United States’ imports and exports fell by more than $200 billion last year. According to Binyamin Appelbaum’s article in The New York Times, this marks “the first time since World War II that trade with other nations had declined during a period of economic growth.”

Interestingly enough, Hanjin filed for bankruptcy in the U.S.’s bankruptcy court in Newark, New Jersey. By doing so, Hanjin would be allowed to dock its boats, without any cargo and equipment being taken as collateral by creditors.

Other Impacts on World Trade

The downfall of China in the ranks of world trade has created an incredible loss in supply of goods coming overseas. As opposed to the 1990s when seemingly everything that was bought said, “Made in China”, today there is a decrease of 25% of these goods. China has begun to produce more of what its people consume, and they are consuming more of what they make. This has forced a shrinkage in the number of exports they are shelling out and the number of imports they are bringing in. With smaller trade volume in and out of China, the entire world will feel the lingering effects.

What Hanjin Means to South Korea

Most recently, as reflected by Hanjin Shipping Company’s stock price, South Korea’s government has created an industry rescue plan. As a result, the stock closed up 24.8% from the end of the weekend. This is all speculation and reports that ever since the company’s financial collapse in late August, Seoul, the nation’s capital, has tried to get the shipping company back on track at an earlier time than expected. Also on October 31, 2016, Hanjin received five bids for its United States-Asia business. The shipping industry is so important to South Korea that the government’s goal is to create a state-backed ship financing company, that will help to improve the health of the current situation. There is a need for shipping in and out of Asia, and South Korea sees a promising future as long as there are new vessels, upgraded machinery, and intelligent executives at the helm of these firms.

The Shipping Industry and the Market

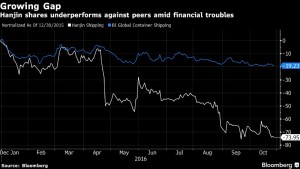

As of December 30, 2015, Hanjin has

amassed a 73.95% loss in its shares, compared to the industry’s loss of 19.23% year-to-date (YTD). Hanjin was responsible for seven percent market share on the Asia-U.S. trade in the first six months of 2016. Although a 7% market share may not seem like a lot, trade between the United States and Asian continent has exported $286 Billion and imported $641.4 Billion.

With hopes to turn things around, we should see a buyout of some of Hanjin’s shipping duties and equipment within the next couple of months.

Sources:

http://www.nytimes.com/2016/10/31/upshot/a-little-noticed-fact-about-trade-its-no-longer-rising.html

https://www.census.gov/foreign-trade/balance/c0016.htm

http://asia.nikkei.com/Business/Companies/Hanjin-Shipping-stock-soars-on-Seoul-s-industry-rescue-plan

http://www.reuters.com/article/us-hanjin-shipping-debt-idUSKBN12U0Z9?il=0

Leave a Reply

You must be logged in to post a comment.