Millennials are the largest generation in America’s history with over 92 million people and coined as the “renter generation.” With this influx of people, more Millennials are staying home and if they leave, they are renting not buying houses. So what components make up the Millennial generation and what does this mean for the housing market?

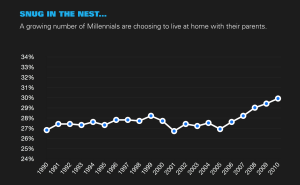

Let’s break down the Millennials and see what makes them stay home longer and why. From 2005 to 2010 there has been a three percent increase in Millennials living at home. Some of them graduated during the recession and the housing crash and their perspectives have shifted. Pew Research cites that they are more burdened with student debt than any other generation but are excited about their financial futures. They want to be mobile, save money and start the large life decisions at a later age than previous generations. For example, Millennials are waiting to get married. The median marriage age was 30 in 2010. Often times, this means that buying a house and starting a family is also a priority later in life. However, buying a house isn’t the only thing Millennials are putting off.

Image from Goldman Sachs

Car ownership and purchasing high-ticket luxury goods have also slowed. With the enhancements of technology such as Uber and rideshare programs, there is less of a need to buy cars. Millennials believe that if they can rent something or use a service, they can save more money.

Sharing not owning is the tagline for this generation. Over 60 percent of all Millennials are interested in renting over owning—this applies to all goods and services from clothing, music and homes. This type of “sharing economy” has caused companies like Rent the Runway, Spotify and Airbnb to rise to success. Seen as yet another opportunity to save, renting is clearly the answer for everything for this generation. Not only does it give them an opportunity to try new things, but they are also not tied to those items and have more freedom in the future. This is the key to why they rent— it allows for more mobility.

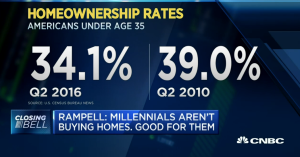

With all the new technology in place, mounting student debt and a need for freedom, it’s no wonder the housing market is seeing a loss. According to a new report, home ownership has fallen since the financial crisis in 2009 with a huge drop in the Millennial generation alone. Homeownership has drastically dropped since 2004. More recently, CNBC stated that home ownership rates for Americans under 35 have dropped from 39 percent in 2010 to 34.1 percent in 2016. This could be bleak for the future of housing because peak home buying years are 25 to 45-years-old. However, the mere size of the generation and aspirations to settle down at a later date could mean a delay in the surge of housing.

Image from CNBC

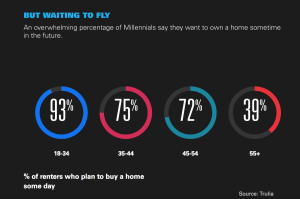

Many wonder if Millennials are a renter generation, will they ever buy a house? Right now, it’s unclear. According to a study by Trulia, 93 percent of Millennials are interested in purchasing a home some day. With a premium on freedom, they want to live in trendy cities where home are often out of reach financially. So where do we go from here? Financial institutions need to work with Millennials and engage them in the importance of saving money. Banks also need to talk about the importance of credit and work to make mortgages more accessible to younger borrowers who might have a smaller credit history. Hopefully one day they will invest in a home but for right now, the number of Millennials will only rise.

Image from Goldman Sachs

Leave a Reply

You must be logged in to post a comment.