When thinking about the economy and the spending habits of Americans, the floral industry came to my mind because it is a product that Americans shift from feeling obligated to buy (for holidays, special occasions like weddings or funerals) or buy on a whim, and this interested me. Gifting a bouquet of flowers may just seem like a kind gesture, but the state of the floral industry can be an economic indicator.

Although the floral industry is a growing industry now (its total retail sales in the U.S. in 2015 was $31.3 billion, it’s highest sales yet) it’s growth and movement typically mirrors the economy. From this list of floral sales over the years, it is revealed that when the recession hit, the sales fell by $1.4 billion. Since the recession, the floral industry has been able to recover and grow by $2.4 billion in sales. This is $1.3 billion more than the industry’s previous peak in sales before the recession.

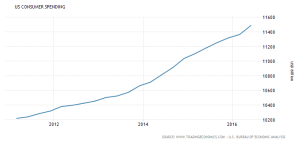

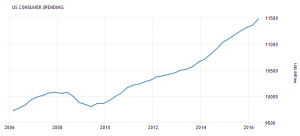

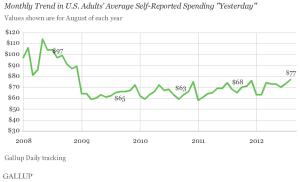

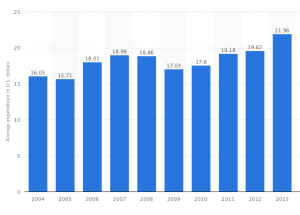

From my research, I have found that the floral industry’s state moves alongside the economy’s state, or in other words, the floral industry is in correlation with the U.S. economy. As U.S. consumer spending increases overall, floral sales increase. The average U.S. consumer spending monthly average in September in 2008 before the stock market crashed and the recession began, was $97. From then on after that number fell down to being in the $60-$70 from 2009-2012. Now in 2016, that consumer spending is back to an average of $90 a month. An interesting finding though is that the floral sales biggest time of growth in 2012 was much more extreme than the growth of consumer spending, and the sales have continued at this rate. The alignment of U.S. consumption and floral sales yearly are further depicted in the charts attached.

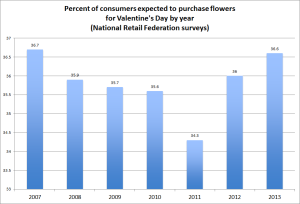

When consumers have more money Buying flowers to give to someone as a thoughtful gesture or buying flowers for yourself to enjoy can be thought of as being frivolous, this is because the flowers are bound to die shortly after purchasing and are just to be looked at. to spend, and they already typically purchase flowers, they will buy fancier and more expensive flowers. When the floral industry is doing well the economy is as well. But, you can also tell that Americans have less readily available money when they stop spending on floral gifts for loved ones. If floral sales during one of the big bouquet gifting holidays, such as Valentine’s Day or Mother’s Day, isn’t at a similar rate to previous years, this can show that the economy isn’t doing well. This is because people do not have the money to spend on flowers on days that they traditionally buy flowers on. Or those sales can be down because people are buying less expensive flowers than they typically would when the economy is well. The types of flowers being bought and the amount of flowers being bought by consumers can show the economy’s state of being. This makes sense for the floral industry especially since it is a luxury business; people will not buy luxury goods when they think they need to save money or are not financially comfortable.

An interesting note about the floral industry is that demand for flowers has not changed much over time even when the industry has gone through many changes, besides during times of economic instability. The floral industry shifted when America went from an agricultural society to an industrial society. The farming of flowers in the floral market shifted from being grown in the United States to being grown elsewhere and are now imported. Even more recently, the floral industry for the producer took a toll when the 1991 Andean Trade Preference Act was enacted. This act was to motivate South American countries from being involved in drug trafficking to being a part of legal industries, such as growing flowers. This continued to take away from the dwindling amount of flower farms in the U.S. because it has made it more difficult for them to compete with the prices of the South American-grown flowers; now 70% of retail flowers in the U.S. are grown in Colombia. Even local flower farms and retailers have attempted to start movements for consumers to buy locally grown flowers but it has not picked up and the amount of floral imports for American floral companies and retailers has remained.

Like the stable demand for florals, predictions of the floral industry in the future includes the continued growth of the industry due to the shift from Baby Boomers’s spending habits on florals and luxury good to the Millennial’s spending habits for on these goods. From the Retail Feedback Group survey in September 2015, Baby Boomers are more likely than other generations to purchase flowers once a week or every two weeks whereas Millennials buy flowers less often and spend more. As Millennials continue to grow up they will be spending more on florals for events such as weddings, parties, work events and funerals than any generation has before. These occasions are better business for the flower industry, and they will increase alongside the economy’s continued recovery from the recession, since the amount of these events decreased during that time. If the floral industry’s correlation with the economy continues as it has been and if this prediction is correct, the economy can be predicted to grow as well.

https://safnow.org/floral-industry-members-look-ahead-to-2016-with-some-hesitation/

http://www.pma.com/content/articles/2015/11/floral-consumer-trends

https://smartasset.com/insights/the-economics-of-flowers

http://www.aboutflowers.com/about-the-flower-industry/industry-overview.html

http://superfloralretailing.com/january2010/StateIndustry.html

http://www.bls.gov/oes/current/oes271023.htm

https://safnow.org/new-study-provides-insights-three-generations-flower-buyers/

Leave a Reply

You must be logged in to post a comment.