A peek into the Eurozone does not bring a smile on an onlooker’s face. Despite its third bailout in five years, Greece’s economic problems remain largely prevalent. Within that period, its economy has shrunk by a quarter, and its unemployment rate currently sits above 25%. The problem, however, spans throughout the region. At present, 18 million people across the Eurozone are unemployed. This equates to 11.1% of the workforce. Additionally, government debt burdens are fairly high: 130% of GDP in Italy and Portugal, and above 100% in Belgium and Cyprus. To compound their misery, most of the European economies are predicted to grow by less than 2% for the coming year (IMF forecast). The Eurozone is in a crisis. The ongoing troubles in Europe point to the difficulty in creating and more importantly sustaining a common monetary union, and a common policy to adhere to the needs of individual countries (unless you are Germany). The failure of the Euro to live on its promise of a successful monetary union has threatened the implementation of monetary alignment in regions across the globe.

Despite the above warnings, South of Europe, the East African Community (EAC) is working towards a common monetary union with the notion of introducing a common currency for the entire region. While the challenges of macroeconomic convergence and loss of national sovereignty, not forgetting the failure of Euro, act as barriers, the EAC has taken positive steps towards this ambitious goal. While continuing to work towards fiscal convergence, the EAC has made progress through harmonization of financial, social and institutional laws and regulations. Although a monetary union is a work in process, the member states can definitely rejoice over the advantages that such a union will bring to the region in the future. With increased stability and investment being the primary positive outcomes. “Yes, the risks are evident, but the progress and benefits are even more apparent. The EAC’s decision to introduce the East African Monetary Union (EAMU) is certainly bound to be a successful endeavor,” Mr. Wayne Sandolhtz, Professor of International Relations, USC.

The Community’s Work

The EAC is a regional intergovernmental organization of five East African countries. Initiated in 1999 by Kenya, Tanzania and Uganda, the community welcomed two new members in 2007: Burundi and Rwanda. “The community was established with the intention of encouraging strong economic and political relationships within the economies in the region,” Mr. Sandolhtz. Since its induction, the EAC has worked towards this goal. Introduction of the Customs Union (2005) mitigated tariff and non-tariff barriers to trade, promoting intra-regional trade, and harmonizing standards for goods produced in East Africa. Moving a step further, the EAC initiated the Common Market (2010) to encourage free movement of capital and labor across the region. As a result, the region profited from economical development through increased investments, cross listing of stocks and joint infrastructure development projects, most notably the Arusha-Namanga-Athi River Road, which covers Tanzania, Kenya and Uganda. The countries have also joined hands to move towards social alignment. Standardization of university fees for citizens, implementation of cross-border disease control programs, and harmonization of procedures for granting work permits have encouraged movement of people to achieve labor efficiency in the region. Additionally, the countries share criminal intelligence and surveillance to combat cross-border crime.

The EAC functions as a community to work towards collective social and political progress. But more importantly, it is an economic union. In addition, the EAC hosts four of the emerging economies of Africa: Rwanda, Kenya, Uganda and Tanzania. Hence there is a collective need to work towards economic growth through regional integration and implementation of a common currency. Therefore, on November of 2013, the EAC announced its decision to introduce EAMU and the East African Shilling by the year 2024. “East African community is now fully embarked on enormous, ambitious and transformational initiatives for our people,” Uhuru Kenyatta, Kenya’s president.

Plausible Future Gains

Before delving into the feasibility of such an enterprising act, one must understand the reasoning behind the EAC’s decision to introduce a common currency. Surely, the future gains should be greater than the risks and costs associated with building a union.

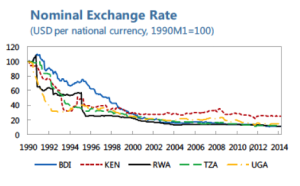

For more than two decades, the currencies of the five individual economies have remained  unstable. “Besides experiencing poor economic growth, the East African region remains a conflict zone; hence the exchange rate fluctuation,” Mr. Sandolhtz. “Introduction of a single currency will eliminate the volatility experienced by individual currencies, bringing in a more stable currency.” More importantly, for past 25 years the currencies have devalued against the dollar. Implementing a single stable currency will also mean a stronger currency. A single currency will serve to eliminate transaction cost and quicken cross-border payments. The reduced cost of operations will lead to a direct increase in businesses transacted in the region. Besides, a single currency will ensure that prices across the region are fairly represented.

unstable. “Besides experiencing poor economic growth, the East African region remains a conflict zone; hence the exchange rate fluctuation,” Mr. Sandolhtz. “Introduction of a single currency will eliminate the volatility experienced by individual currencies, bringing in a more stable currency.” More importantly, for past 25 years the currencies have devalued against the dollar. Implementing a single stable currency will also mean a stronger currency. A single currency will serve to eliminate transaction cost and quicken cross-border payments. The reduced cost of operations will lead to a direct increase in businesses transacted in the region. Besides, a single currency will ensure that prices across the region are fairly represented.

Reduction in the cost of business supplants the Common Market incentive to increase flow of capital and people within the region. With movement across the region financially feasible and affordable, there will be increased mobility of people within the region. As a result people can move across the region in search for better job and educational opportunities. Consequently, people will have increased access to resources, and benefit from reduced costs of mobility. This will aid in the efficient allocation of labor throughout the region. Adding to the benefits from increased movement of capital in the region, the EAC will also attract foreign investors through reduced cost of business and currency stability. Besides representing the growing economies of Africa, the EAC boasts oil through Uganda and Kenya, with 250 trillion cubic feet of oil discovered in the Indian Ocean. Additionally, the realization of 30 trillion cubic feet of natural gas reserves in Tanzania will also guarantee influx of foreign capital.

Tourism is most likely going to experience a boom in the coming years. In addition to already initiated joint infrastructure projects, the EAC has introduced a single tourist visa for East Africa. This will supplant the policy to apply a common currency across the region to ease the movement and expenditure of tourists. Both, improved infrastructure through influx of capital and ease of operation will encourage greater international tourism for the region.

Towards Monetary And Fiscal Convergence

Understanding the advantages of a common currency does not make this a success story. It is just partial progress. The real challenge lies in implementing and maintaining policies that cater to the requirements for a establishing a successful monetary union.

A proposed move for the EAMU goes beyond a piece of paper. In theory, the idea seems to work. But executing the required policies to achieve fiscal and monetary alignments requires great commitment. That being said, the heads of state have already implemented a protocol towards attaining common policies, which is to be followed by 2021, three years before the introduction of the currency.

The heads of state have already begun introducing common laws and regulations to aid the implementation a common monetary policy. The EAC has achieved an integrated banking and financial system, and established an integrated payment system. This not only encourages business activities within the region, but also eases the introduction of a common currency. The protocol sets the target for fiscal deficit to be 3% of the GDP (including grant) in all the economies of the region. Although this target is set for 2021, all five economies, since 2004, have maintained the required criteria.

One barrier in the EAC’s progress towards monetary convergence is the required willingness of economies to loose unilateral control over instruments such as the exchange rate policy, which are crucial in dealing with specific macroeconomic shocks. Seceding this privilege to the EAMU will not only lead to loss of national sovereignty but will also mean that individual economies must surrender an important tool of economic adjustment. However, the perks of increased investment and job opportunities have garnered great public support and political will. Thus, it’s likely to eliminate the above-mentioned problems.

Achieving A Suitable Economic Structure

In addition to aligning their policies, members of the EAC must sustain an ideal economic structure, which is feasible for implementation for a common monetary union. The suitable structure entails macroeconomic convergence through common income and inflation targets, similarity in proportion of sectors as a percentage of GDP, and diversified products. These alignments are important, as a similar structure ensures that the countries have similar economic shocks, making a common policy an effective solution.

Real GDP growth averaged about 6 percent for the region during 2009–14, with individual country growth rates in the range of 4 % (Burundi) to 7 % (Rwanda and Tanzania). Currently, the economies inflation rates vary greatly, with the average price level ranging from 3.3% in Rwanda to 8.3% in Tanzania. Although there is a substantial gap, the protocol has set a common inflation rate of 5%, which must be achieved by 2021. Given that the economies are growing, it will be a difficult task to sustain an inflation rate as low as 5%. Hence, the protocol could renew its definition of inflation relative to the best performing member, which is Kenya. Although this may not be in the best interest of the other economies, it is a pill they musty swallow for a better health. Nevertheless, the countries’ alignment in terms with income and inflation remains a positive.

Each of the five economies has a similar sector allocation towards revenue. The agricultural sector accounts for 23 to 35 percent of the economy in all five countries. Coffee and tea are major exports for Burundi, Kenya, Rwanda, and Uganda. While Tanzania exports mostly gold, tobacco, and coffee, Kenya exports horticultural products as well. An almost similar revenue model points to the fact that these economies are most likely to be affected by similar economic shocks, be it internal or external. Hence a common monetary policy would serve as a universal solution.

Countries with a diverse set of products are more likely to survive economic shocks or hardships. Dependence on a range of products ensures that the country does not rely on a single product to generate its revenue, making it a stable economy. A similar ideology is followed in East Africa, where countries are working towards diversifying their revenue sources. The more stable the EAC is, the more likely it is to hold a monetary union. The implementation of the Common Market has gone a long way in encouraging this ideology. Free movement of goods, labor and capital, coupled with minimal barriers to trade has brought in variety of goods and labor in each region. This has spread each country’s horizon beyond agriculture, towards manufacturing, mining and construction. The discovery of oil in Uganda and Kenya, and natural reserves in Tanzania will further help the cause.

Progress So Far

Potential Risk

Recent natural resource discoveries in Kenya, Tanzania, and Uganda will eventually lead to an increase in export of oil and natural gas from these regions, contributing to higher export values and lower external deficits in the future. Export concentration in these countries is also expected to rise, and the balance of trade dynamics would move in the opposite direction to their neighbours, Burundi and Rwanda, who are largely importers of oil. This may pose challenges on dealing with asymmetric shocks within the monetary union. For example, during periods of lower global oil and gas prices, Kenya, Tanzania, and Uganda would favour pushing for looser monetary policy and lower interest rates compared to Burundi and Rwanda.

At Europe’s Expense

The EAC can certainly imbibe valuable knowledge from the EU, which is not to be like the EU. “The EU was considered as model for a monetary union, especially Africa, but the recent years have gone a long way in disproving that assumption,” Mr. Sandolhtz. Nevertheless, the EAC can implement the positives and discard the negatives at the EU’s expense.

The Werner Plan envisaged the creation of a European monetary union. This was to be achieved in stages, with each step encouraging member nations to establish patterns of coordination towards macroeconomic convergence in order to facilitate convergence of national currencies and reap other cooperative advantages (greater intra-regional trade). This plan served as a blueprint for the EAC in its establishment of the EAMU. “The ceiling conditions of 3% government budget deficit and public debt up to 60% of GDP mentioned in the EAMU protocol mimic those stated in the Werner Plan,” Mr. Sandolhtz.

Among the several problems responsible for the failure of the EU, the most significant one is that its economies are in different growth stages. This has been one of the problems

underlying the Euro from the beginning, with the core countries having quite different economic conditions and cycles to those peripheral countries such as Portugal, Ireland, Greece and Spain, which are now suffering the impact of a monetary policy, which was inappropriate for the prevailing conditions. The EAC, however, learning from the failure of the EU has decided to make the entire region function within a certain economic band. The protocols ensure that by 2021, the economies have achieved macroeconomic convergence, and are working in unison with one another. Besides all the economies are expected are in the development phase. Hence fast forward 10 years, the EAC will have been successful in achieving a similar growth cycle for all its members.

Shilling’s Success Story

No doubt, the EAC has opted for a tough assignment. Currently, the entire region benefits from economic and social progress. The Customs Union and the Common Market continue to serve the goal of regional integration. With progress already taking place, the EAC’s decision to introduce a common currency comes as an added advantage, supplanting the existing growth potential within the region. Countries are likely to benefit from closer integration, increase in intra-regional trade, price harmonization, reduced cost of business, increase in foreign investment, and increased efficiency through improved allocation of labor and capital. The EAC, following the Werner Plan, has set an agenda to introduce the East African Shilling by 2024, but first it must bring the five economies at level with regards to fiscal and structural alignment. The signs of progress are already visible. Given its advantages and feasibility, the Shilling could turn out to be a success story replacing its predecessor, the Euro, as a successful model for a monetary union. Perhaps, the potential success can draw the economies of South Sudan and Somalia towards the EAC, resulting in increased benefits through further integration. Perhaps, this success can ignite Africa’s ultimate goal of a common currency for the entire continent.