How does a company like Tesla Motors, which sells only 50,000 vehicles a year, a number which is deemed as microscopic when compared to much larger companies such as BMW, which sells over a million number of cars in a single year, be a multi billion dollar company?

With the increasing number of Tesla products out in the public right now, it will come as no surprise that the company is doing very well financially in the past few years. There was a significant increase in revenue between 2012 and 2013, increasing by 487% and then again from 2013 to 2014, increasing by 59.9%. Out of the $3,198,356,000 of revenue collected in 2014, $3,192,723,000 was gained from automotive sale alone.

The sudden increase in revenue in 2013 caused the stock price for Tesla to skyrocket and almost reach its peak in the mid of 2014. Although the stock market price decreased in 2015, the stock market price for the company is predicted to increase when the new Model X and Model 3 are released in the next 2 years.

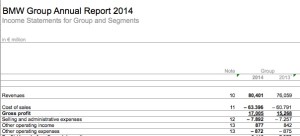

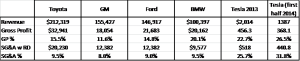

Although Tesla Motors has shown a promising number of revenue for a company that was founded a little over 10 years ago, its numbers are like a drop in the ocean as compared to the numbers produced by its competitors across the board. Take BMW, for example, which is like Tesla Motors, is a company that manufactures luxury vehicles. BMW made a total of US $87,363,726,600 in revenue in 2014, that’s 27 times more than what Tesla made in the same year. The main reason for this is because of the far more diverse vehicle models that BMW has available for purchase as compared to Tesla, which currently only has 1 model, the Model S, available for purchase.

Thus, as compared to BMW, Tesla will need to grow exponentially. It’s hard to imagine this sort of growth happening any time soon, regardless of Tesla’s product offerings as BMW has a total of 25 different models versus Tesla, which currently offers 1 model of vehicle available for consumers. Even when both the Model X and Model 3 are released for the public eventually, that would round up Tesla’s model line-up to a grand total of 3, which is not at all a number sufficient enough for the company to beat out its competitors.

With such a significant difference in the amount of revenue that the two companies are making, one might think that the market capital of BMW would be much greater than that of Tesla. However, that is not the case at all. Tesla has a market capital that is only half the amount of the market capital of BMW. That is pretty impressive for a company that is making 27 times less in revenue than its competitor. In fact, it is even much more impressive that a considerably small company like Tesla is able to reach a billion dollars in market capital, considering the fact that the company only produces about 30,000 vehicles a year.

Tesla Motors Inc., founded in 2003 by Martin Eberhard and Marc Tarpenning, is an American company that focuses on designing and manufacturing electric cars. Tesla Motors is the first public American Car Company since Ford Motors became public in 1956. The company has led the revolution by mass-producing the first line of all-electric vehicles in the world. Elon Musk joined Eberhard and Tarpenning in 2004, where he contributed $ 7.5 million to help fund the company.

Musk went on to become the Chairman of Tesla’s Board of Directors. Tesla was founded, in Musk’s own words, “to accelerate the advent of electric cars”. Every model designed, every vehicle manufactured had to be more than competitive; it had to be flawless. A single defect could set the electric movement back decades, as it had been in the past. Musk played a very active role within the company and oversaw the design and manufacture of Tesla’s first production vehicle, the Tesla Roadster.

The Tesla Roadster is an all-electric sports car that was the first highway-capable all-electric vehicle for sale in the United States. General production of the car began on March 2008. On June 29, 2010, Tesla launched its initial public offering on the NASDAQ, which raised $226 million for the company, selling 13.3 million shares of stock. By the end of 2011, Tesla stopped selling Roadster models in the United States, to focus on the launch of its newer, more defined Model S electric sedan. While not necessarily revolutionary, the Roadster was instrumental in establishing the Tesla brand.

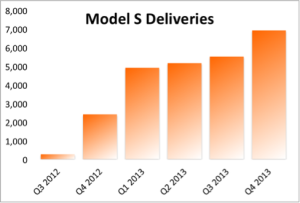

The past few years have been looking pretty good for the company. The highly anticipated Model S, an all-electric, 4 door luxury lift-back sedan was released in 2012, saw global sales that totaled to 22,500 vehicles in the year 2013, selling a whooping 6.900 vehicles in the fourth quarter of that year, pushing the year-sale beyond the company’s target.

Most recently, Tesla Motors just announced new additions to the Tesla Family by introducing the Model X, a four door, seven-seater car that will be out for release in 2016 and the Model 3, the first affordable electric car that Tesla will produce will be released in 2017. Due to the different features and capabilities that all 3 cars have individually, the 3 vehicles have enough differentiating features from each other to prevent intercompany sales cannibalization despite all 3 of them being a high performance electric luxury vehicle.

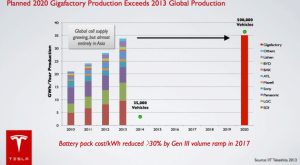

In addition, Tesla Motors broke ground on the Gigafactory in 2014 in Nevada, which is expected to begin cell production in 2017. The Gigafactory, which would greatly increase battery production and reduce its manufacturing cost is expected to reach full capacity by 2020, and produce more lithium ion batteries annually than were produced worldwide in 2013.

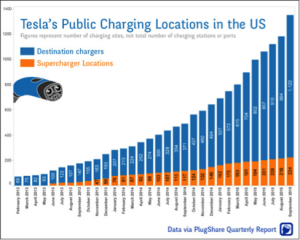

There is also an increasing number of Superchargers that are available in the United States right now. The Supercharger, which is a high-powered facility where Tesla drivers can get free electricity to extend their range while traveling much like gas stations for electric vehicles, grew over 200% in the United States between the year 2014 and 2015. The company added 958 Supercharger and destination charger locations throughout the country, which bring the total to 1,346. 90% of the US population is within 175 miles of a Supercharging location, close enough to get access to the countrywide charging network.

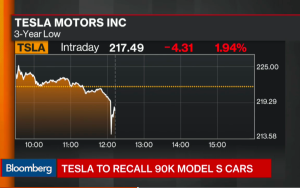

In the contrary, much like any other successful company in the business, there have been setbacks that Tesla Motors has faced as a company. For instance, a month ago on November 2015, Tesla Motors announced that they were conducting a voluntary recall of all the 90,000 Model S cars due to a single report in Europe of a front seat belt not being properly connected. The shares for Tesla Motors fell immediately after the issue was reported, it slid 1.9% to $217.49 on the same day, a 3-year low for the company.

Another major issue that Tesla faces is probably the fact that, as mentioned before, the company is not able to sell as much cars as its competitors. In an interview with Automotive News, Musk revealed that he “wants the company’s estimated 2013 U.S. volume of 20,000 units to soar to 250,000 and to 500,000 globally by the end of the decade.” However, it is easier being said than done as Tesla’s established rivals, companies such as Audi and BMW have begun offering capable electric vehicles of their own, hence Tesla will not be the only choice for long-range zero-emission transportation in the future. With the introduction of the all-electric luxury vehicles such as the i8 and the E-Tron models released by BMW and Audi respectively, Tesla will no longer have the electric vehicle market to themselves in the near future. Therefore, with a new range of selections for the consumers to choose from, it is very unlikely that Tesla is able to sell 500,000 vehicles globally by 2020 despite Musk’s vision.

So back to the original question: how did Tesla become a multi billionaire company as compared to other companies that produce cars in much greater volume?

To start, we have to take into account that the valuation of an automotive company is based on scale. This means that the company has to operate the business by allocating and optimizing resources to drive the greatest results and volume across market segments. Companies that scale have operating leverage, which means they can grow revenue with minimal or no increase in operating costs.

To add on, the automotive industry is also a capital-intensive business. These automotive companies require substantial amount of capital for the production of their vehicles. This is because the automotive companies require high value investments in capital assets, such as the materials needed to manufacture a car.

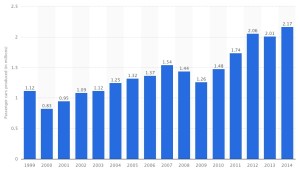

With big automotive companies such as BMW, which produces an average of 2 million cars over the past few years, the marginal cost to make a few extra vehicles will not be as high as the marginal cost it would take for Tesla Motors to do the same thing.

Hence, with the minimal marginal and operating cost despite the increase in the number of cars available for purchase, it is no wonder that a company like BMW is as successful as it is. Moreover, considering the fact that the price for a BMW vehicle ranges from $30,000 to $80,000, and the gross profit for the company in the year 2014 was $17 billion, it is no surprise that BMW, a company that was found almost a hundred years ago has a market cap of over $60 billion.

In contrast to BMW, Tesla produces only 30,000 vehicles on average for the past few years. Therefore, based on the difference in the number of quantity of cars produced by both companies alone, it is fair to conclude that the marginal cost to make extra vehicles for Tesla is larger than that of BMW. However, despite the statistics showing net loss for the company, the unprofitable company has a market capitalization of $31 billion, as mentioned previously.

Well this is because Tesla Motors is unlike any other automotive company out there in the market right now. There are a few factors that Tesla Motors possesses that make it stand out from its competitors, and hence leading investors to assign so much value to the company.

Tesla has a larger gross profit margin as compared to its competitors in the present, and it is very likely to continue to increase in the future with the completion of the Gigafactory.

When Tesla’s gross profit and revenues are compared to 4 other traditional automakers, Tesla’s gross profit percentage exceeded that for the other car manufacturers with 22.7%. Moreover, since the cost of goods sold per vehicle will most likely drop as production volume increases, Tesla’ gross profit will continue to increase and extend its gain over the likes of BMW.

In addition to that, when the new Tesla Gigafactory is completed in 2017, the cost of the battery pack will be reduced by 30%, which will further increase the profitability of Tesla Motors in the near future. Tesla’s battery packs are routinely estimated to be a good tier cheaper than other EV batteries, all thanks to Tesla’s continual improvement of the battery packs. Tesla’s constant work to improve its batteries is one side of the cost-cutting calculus, but another important side is simply scale. Scaling up production results in greater manufacturing efficiencies, manufacturing improvements, and cost reductions. Tesla is scaling up its production big-time via the Gigafactory, and no competitor is showing that anything similar is in the works.

Apart from the Gigafactory, Superchargers and high profit margin, the main difference Tesla Motors has that gives it a competitive edge from other companies is probably the unique way the company operates. Tesla has shown repeatedly that it cares more about providing the customer with good service, a good product, and honesty than making a little more money off of them. For example, Tesla sells vehicles directly to the public through its own stores and the Internet, rather than relying on dealerships like traditional automakers. This makes the experience of purchasing Tesla’s products more intimate and personal as compared to buying your vehicle through a dealership. That kind of reputation for integrity and morality is something long lacking in the automobile industry, and there’s no doubt that customers have found it to be very refreshing and desirable. If Tesla keeps it up, it’s going to gain more and more brand loyalists and hence increasing the company’s number of investors.

In conclusion, Tesla is only just beginning its outstanding journey as the revolutionary multi-billion dollar company that will change the way people look at Electrical Vehicles. Its innovative vehicles and operations will continue to redefine standards across the automotive industry and Tesla will probably be a name that one will hear a lot more of in the near future.

Sources:

http://cleantechnica.com/2015/11/25/tesla-superchargers-grow-200-in-usa-in-1-year/

http://www.economywatch.com/world-industries/capital-intensive.html

http://www.encyclopedia.com/topic/automobile_industry.aspx

http://evobsession.com/tesla-competitive-advantage-5-big-ones/

http://www.latimes.com/business/la-fi-hy-musk-subsidies-20150531-story.html

http://www.reuters.com/article/us-teslamotors-cash-insight-idUSKCN0QE0DC20150810#D938UoHbViWob8l8.97

http://www.fool.com/investing/general/2014/02/05/7-reasons-i-invested-in-tesla-motors-inc.aspx

Leave a Reply

You must be logged in to post a comment.