Fashion sometimes can be a relentless cycle in which the trends of earlier generations are set to return with both their original charm accompanied with a modern twist. However, just as we are now seeing the billowing bellbottoms of the 70s reemerge back on our fashion runways so is another forgotten treasure belonging to a different trade: vinyl records.

Vinyl records and turntables can be spotted at retailers such as Target or Best Buy to Urban Outfitters. No longer do vinyl enthusiasts have to search far and wide for an indie music retailer to purchase a copy of their favorite record.

The cyclical path that fashion takes may seem rational for the respective industry because there are only a limited number of ways a pair of denim jeans can be redesigned. However, technological advancements within this past decade alone that has in turn revolutionized the music industry.

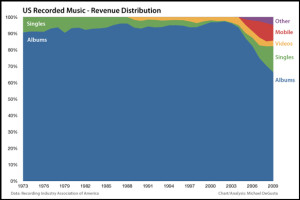

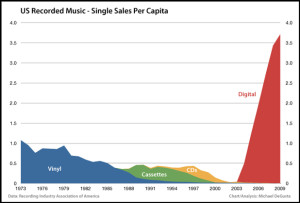

Vinyl records pioneered the at-home listening experience and remained on top for nearly 50 years after being introduced in 1898 by RCA Victor. Yet, it was assumed that vinyl was a long forgotten medium by mainstream consumers as it fell from cultural popularity in the 1960s alongside the introduction of cassettes. But it was MP3s and MP3 players, such as Apple’s IPod and Microsoft’s Zune, which ultimately superseded CDs.

Undoubtedly; MP3s transformed the music industry and drove the business towards the digital realm, whereas vinyl became an ancient relic that remained exclusive to only a small niche of individuals whom were deemed vinyl collectors.

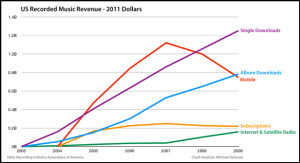

MP3s paved the way for sites and services that provide digital downloads and streaming like Apple Music and Spotify. The music industry’s growth rate would depict a steady growth pattern up until the turn of century when services such as Napsters’ peer-to-peer online file sharing service were launched in 1999. Services such as Napster hit the music industry hard as it made it easy to obtain music illegally.

But digital media has produced both positive and negative outcomes for the music industry. Digital tracks and streaming have allowed artists to expand and grow by easing the ability for music to be shared at a greater volume and speed than ever before. However, digital media sharing services have also facilitated piracy within the music industry and have subsequently caused an excessive loss of revenue for the business. The institute for Policy Innovations, which utilizes the RIMS II mathematical model maintained by the U.S. Bureau of Economic Analysis (BEA) to obtain statistics of the total amount of losses generated by piracy, has reported that universal music piracy causes approximately $12.5 billion of financial losses every year.

While piracy remains a looming issue that artists and record companies continue to combat, it has also affected the U.S. job market. The institute for Policy Innovations has also reported that piracy cuts 71,060 U.S. domestic jobs and creates a loss of $2.7 billion in workers’ total earnings. The illegal act also causes a loss of $422 million dollars in tax revenues annually.

Unfortunately, the digital age has made purchasing music less than necessary. Digital and physical album sales have declined tremendously in recent years. After selling approximately 165 million CDs in 2013, the total number of album sales has dropped 14 percent to 140 million by the end of 2014 according to Rolling Stone. Furthermore, digital sales through platforms, such as ITunes, have fallen 9.4 percent as reported by its 2014 sales figures (Kreps, Rolling Stone)

Audience measurement company Nielsen Music, which records album and song sales and streams, has disclosed that mass market and chain music stores, such as FYE, have reported that their total music sales have declined roughly 20 percent by the end of 2014.

But piracy and physical music sales have not been the only reason why the music industry is experiencing a decline. Business Insider has reported that the recording industry and artists make the majority of their income from album sales. Therefore, with services such ITunes, listeners can pick and choose which songs from an album they want instead of purchasing the entire album.

Another factor that would contribute to the weakening music industry would be the consumer’s shift in mentality of music ownership. Many listeners would rather access songs through sites such as YouTube or subscription services like Spotify than actually owning the file. Access to music has become more significant than owning the actual song (Blabbermouth.net).

“Music fans continue to consume music through on-demand streaming services at record levels, helping to offset some of the weakness that we see in sales,” said David Bakula, Nielsen’s Senior Vice President of Industry Insights (Kreps, Rolling Stone). “The continued expansion of digital music consumption is encouraging, as is the continued record setting growth that we are seeing in vinyl LP sales.”

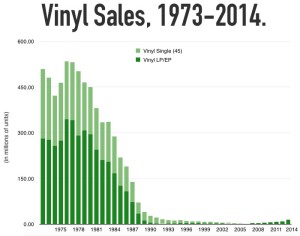

The demand and popularity of vinyl has become an exciting music industry trend for artists and record companies. The 12-inch record sold roughly 9.2 million units in 2014, the highest amount of units sold in decades. Vinyl’s 2014 sales figure is over a 50 percent increase above its 2013 numbers, a trend in the vinyl market for nearly the past four years (Kreps, Rolling Stone). A decade ago vinyl sales accounted for only 0.2 percent of the total number of albums sold, but record sales now make up roughly six percent of all physical music sales.

Traditional record stores are quickly reemerging in the United States in response to the demand of vinyl, and vinyl record pressing plants have seen a significant spike in record orders and production overall. New vinyl pressing factories have also began appearing alongside the few plants that have sustained business since golden age of the vinyl era. It is estimated that smaller sized pressing plants are producing and receiving orders for at least 450,000 units per year, whereas larger factories are turning out around 7 million annually reported the New York Times.

The owner of Quality Record Pressings in Salina, Kansas, Chad Kassem, launched his own vinyl record-pressing factory in 2011 after he grew tired of waiting for his primary supplier to receive and complete his orders. Kassem’s business utilizes four presses in total and manufactures approximately 900,000 discs annually (NY Times).

“We’ve always had more work than we could do,” Mr. Kassem said. “When we had one press, we had enough orders for two. When we had two, we had enough orders for four. We never spent a dollar on advertising, but we’ve been busy from the day we opened” (NY Times).

Musicians have also recognized the new opportunities that the vinyl industry provides. The number of vinyl reissues, such as albums by the Beatles and the Rolling Stones, has grown in recent years. And many new musicians have begun providing vinyl discs as an alternative option alongside digital albums and CDs.

Jack White of the White Stripes released a solo album in 2014 entitled Lazaretto, which set a vinyl sales record. White’s latest album sold 40,000 vinyl units its first week and 87,000 by the end of the year.

In total, 2014 emerged as the greatest sales year for vinyl records in decades. While vinyl may not pose to be the savior of the music industry, the resurgence of vinyl could not have come at a better time. While the music industry has been on a continuing decline as as a result of piracy, album sales and the shift ownership mentality, it will be interesting to see how the new vinyl wave impacts the music industry and sales overall.

Sources:

http://www.businessinsider.com/these-charts-explain-the-real-death-of-the-music-industry-2011-2

http://www.wsj.com/articles/pay-tvs-new-worry-shaving-the-cord-1412899121

http://www.experian.com/blogs/marketing-forward/2015/03/06/one-million-households-became-cord-cutters-last-year/

Leave a Reply

You must be logged in to post a comment.