March madness made be over but the madness surrounding the NCAA has anything but cooled down.

Ever since Shabazz Napier made a public statement about him going to sleep hungry on more than one occasion, questions began circulating about the treatment of athletes and the rules placed by the NCAA.

More important that was the question about who actually does all the work and who reaps the benefits?

The exploitation of college players and their companion organization is an evergreen story.

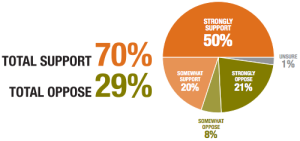

But what is interesting here is the way in which the NCAA reacted to players like Napier attempting to unionize in order to receive better aid for not just playing at a competitive level but also winning for the organization as well; an organization that is a non-profit.

Mark Emmert, NCAA President, is obviously against players unionizing.” The notion of using a union employee model to address the challenges that do exist in intercollegiate athletics is something that strikes most people as a grossly inappropriate solution to the problems. It would blow up everything about the collegiate model of athletics,” he stated in an ESPN article.

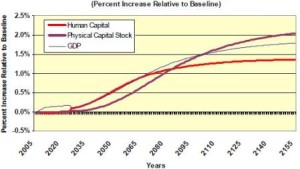

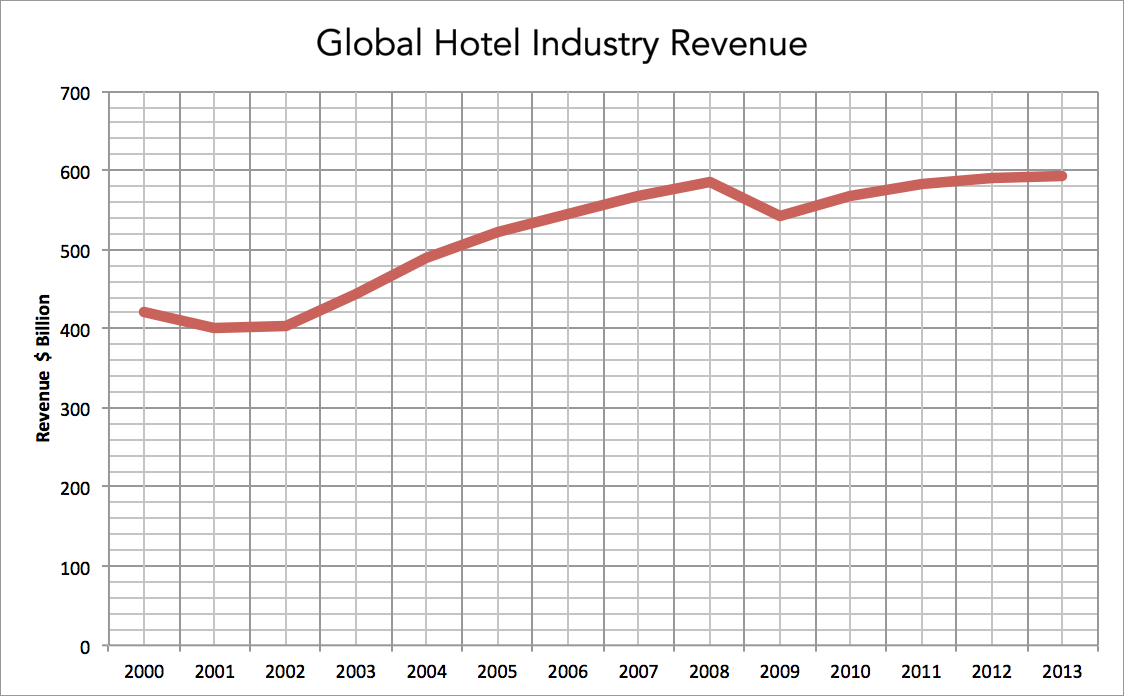

Grossly inappropriate, especially considering the NCAA made somewhere along the lines of $750 billion in revenue from broadcasting contracts alone.

And how much of that goes to the athletes?

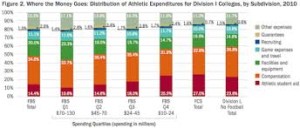

As the chart shows, not as much as they should.

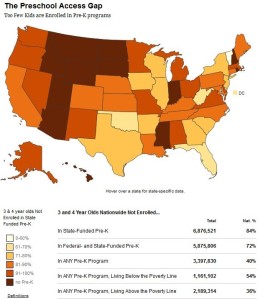

But there are many more issues that come into this student athlete conversation.

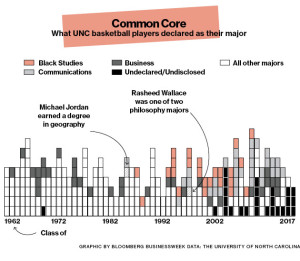

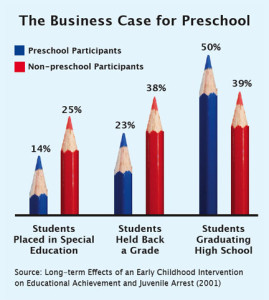

1) The fact that most colleges don’t even take academics as seriously for athletes as they should.

2) The long line of racial disparities when it comes to the graduation rates from white student-athletes compared to black student athletes. It was recently reported that student-athletes at Columbia had a graduation rate of 85% compared to the overall school’s rate of 95% (even more disparity is seen with female athletes but that is another issue).

What is clear here is that there is an even distribution of wealth when it comes to student-athletes. Should they get paid? Do they deserve to considering they win the championships?

As Greg Johnson wrote in an op-ed article, “student athletes do not need salaries or monthly paychecks, even though the NCAA runs just like any other professional sports league. They should simply be allowed to operate within the free market like anyone else in America.”